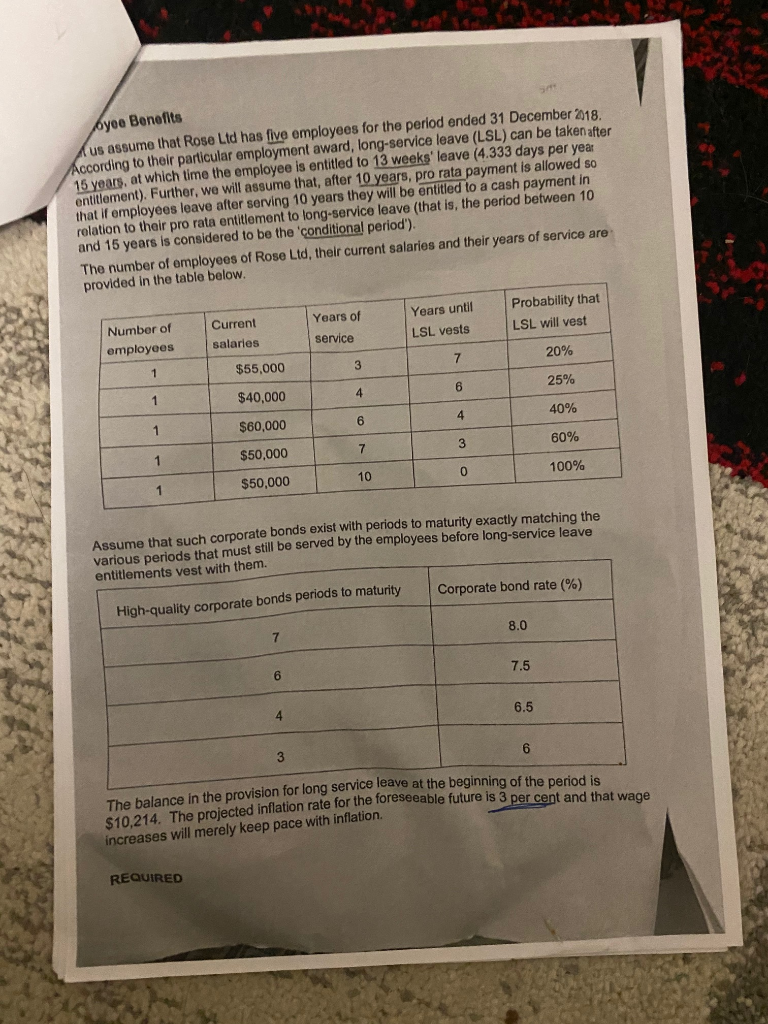

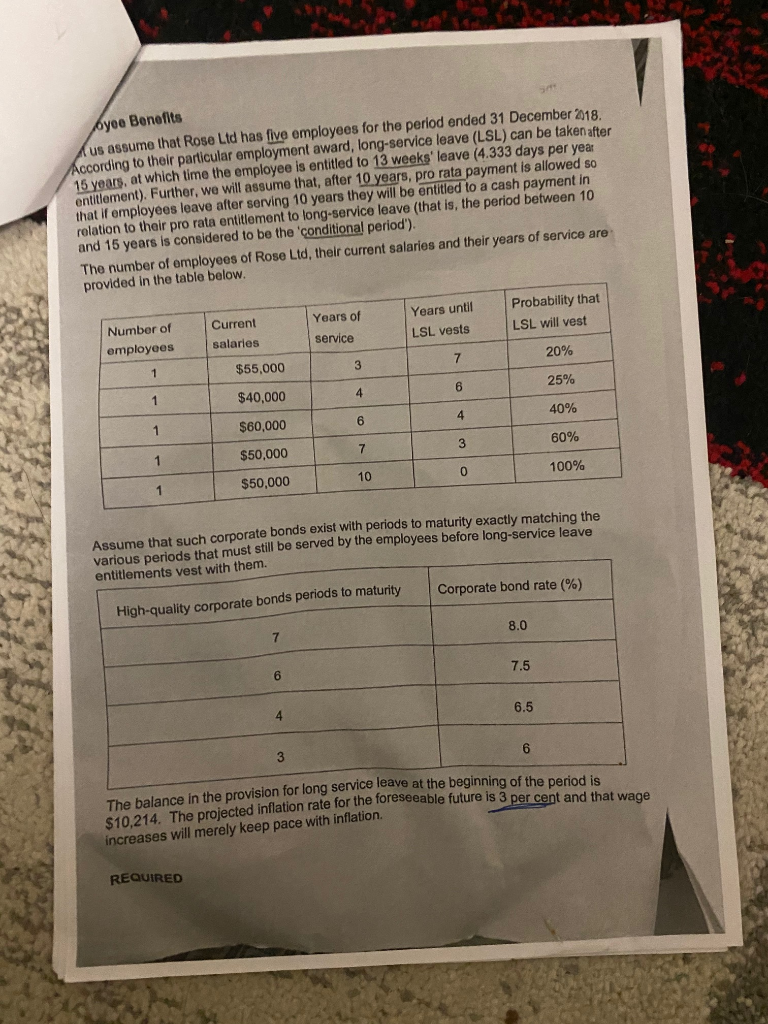

oyee Benefits Kus assume that Rose Ltd has five employees for the period ended 31 December 2018 According to their particular employment award, long-service leave (LSL) can be taken after 15 years, at which time the employee is entitled to 13 weeks' leave (4.333 days per year entitlement). Further, we will assume that, after 10 years, pro rata payment is allowed 50 that if employees leave after serving 10 years they will be entitled to a cash payment in relation to their pro rata entitlement to long-service leave (that is, the period between 10 and 15 years is considered to be the conditional period"). The number of employees of Rose Ltd, their current salarios and their years of service are provided in the table below. Number of employees Current salaries $55,000 Years of service Years until LSL vests Probability that LSL will vest 20% 1 $40,000 25% $60,000 6 40% $50,000 60% 3 o . $50,000 10 I 100% Assume that such corporate bonds exist with penods to maturity exactly matching the various periods that must still be served by the employees before long-Service leave entitlements vest with them. High-quality corporate bonds penods to maturity arporate bonds periods to maturity Corporate bond rate (%) 8.0 7.5 6.5 The balance in the provision for long service leave at the beginning of the period is $10.214. The projected inflation rate for the foreseeable future is 3 ate for the foreseeable future is 3 per cent and that wage increases will merely keep pace with inflation REQUIRED oyee Benefits Kus assume that Rose Ltd has five employees for the period ended 31 December 2018 According to their particular employment award, long-service leave (LSL) can be taken after 15 years, at which time the employee is entitled to 13 weeks' leave (4.333 days per year entitlement). Further, we will assume that, after 10 years, pro rata payment is allowed 50 that if employees leave after serving 10 years they will be entitled to a cash payment in relation to their pro rata entitlement to long-service leave (that is, the period between 10 and 15 years is considered to be the conditional period"). The number of employees of Rose Ltd, their current salarios and their years of service are provided in the table below. Number of employees Current salaries $55,000 Years of service Years until LSL vests Probability that LSL will vest 20% 1 $40,000 25% $60,000 6 40% $50,000 60% 3 o . $50,000 10 I 100% Assume that such corporate bonds exist with penods to maturity exactly matching the various periods that must still be served by the employees before long-Service leave entitlements vest with them. High-quality corporate bonds penods to maturity arporate bonds periods to maturity Corporate bond rate (%) 8.0 7.5 6.5 The balance in the provision for long service leave at the beginning of the period is $10.214. The projected inflation rate for the foreseeable future is 3 ate for the foreseeable future is 3 per cent and that wage increases will merely keep pace with inflation REQUIRED