Answered step by step

Verified Expert Solution

Question

1 Approved Answer

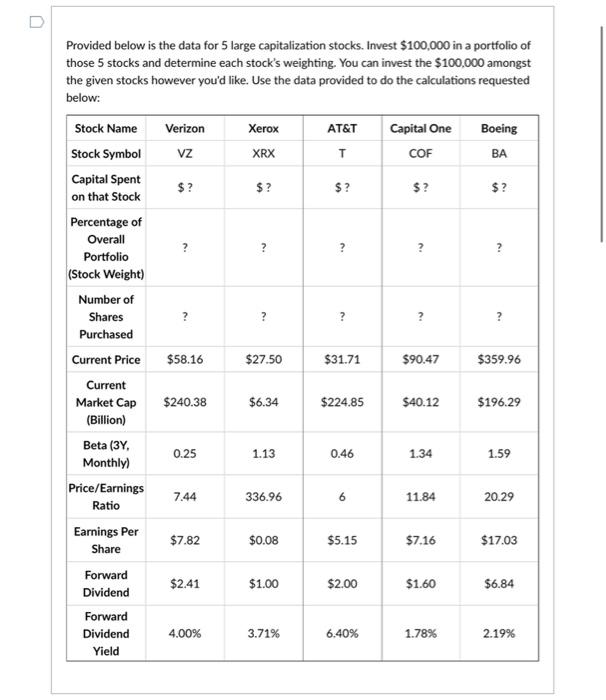

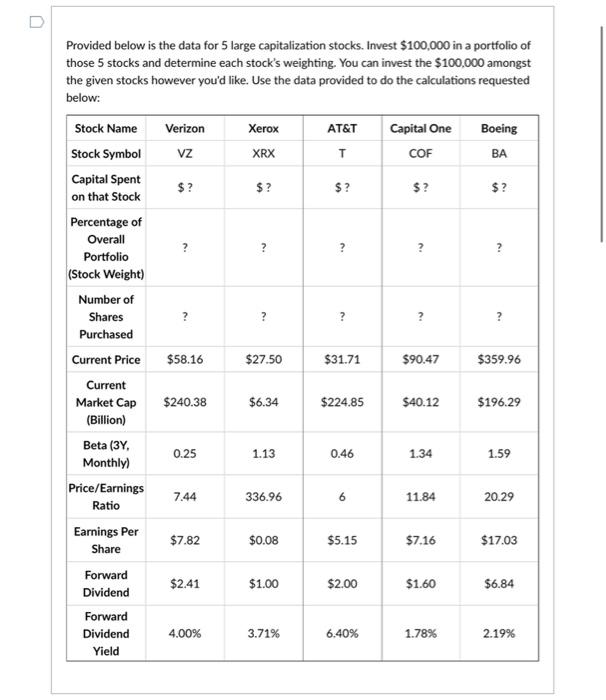

p 0 Provided below is the data for 5 large capitalization stocks. Invest $100,000 in a portfolio of those 5 stocks and determine each stock's

p

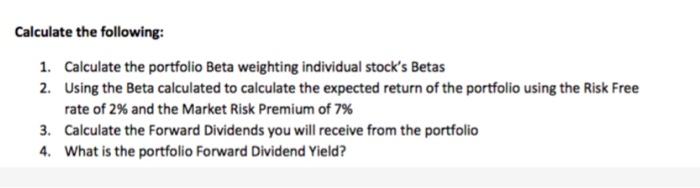

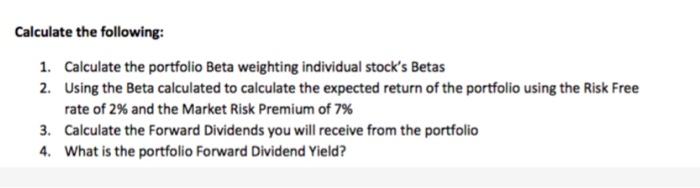

0 Provided below is the data for 5 large capitalization stocks. Invest $100,000 in a portfolio of those 5 stocks and determine each stock's weighting. You can invest the $100,000 amongst the given stocks however you'd like. Use the data provided to do the calculations requested below: Xerox Boeing Verizon VZ AT&T Capital One COF XRX BA $? $? $? $? $? ? ? ? ? ? ? ? 2 ? ? ? ? $58.16 $27.50 $31.71 $90.47 $359.96 Stock Name Stock Symbol Capital Spent on that Stock Percentage of Overall Portfolio (Stock Weight) Number of Shares Purchased Current Price Current Market Cap (Billion) Beta (3Y, Monthly) Price/Earnings Ratio Earnings Per Share Forward Dividend Forward Dividend Yield $240.38 $6.34 $224.85 $40.12 $196.29 0.25 1.13 0.46 1.34 1.59 7.44 336.96 6 11.84 20.29 $7.82 $0.08 $5.15 $7.16 $17.03 $2.41 $1.00 $2.00 $1.60 $6.84 4.00% 3.71% 6.40% 1.78% 2.19% Calculate the following: 1. Calculate the portfolio Beta weighting individual stock's Betas 2. Using the Beta calculated to calculate the expected return of the portfolio using the Risk Free rate of 2% and the Market Risk Premium of 7% 3. Calculate the Forward Dividends you will receive from the portfolio 4. What is the portfolio Forward Dividend Yield

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started