Answered step by step

Verified Expert Solution

Question

1 Approved Answer

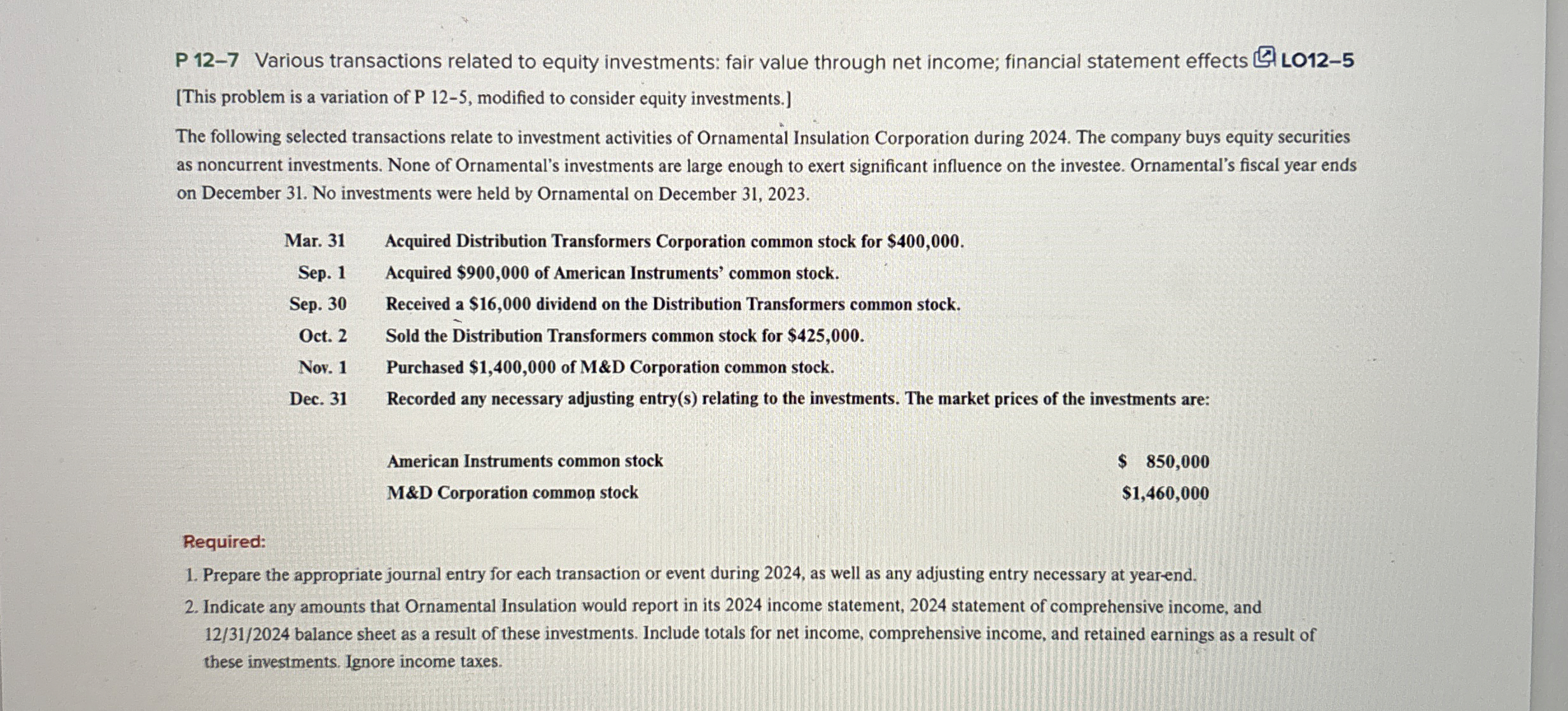

P 1 2 - 7 Various transactions related to equity investments: fair value through net income; financial statement effects S LO 1 2 - 5

P Various transactions related to equity investments: fair value through net income; financial statement effects LO

This problem is a variation of modified to consider equity investments.

The following selected transactions relate to investment activities of Ornamental Insulation Corporation during The company buys equity securities as noncurrent investments. None of Ornamental's investments are large enough to exert significant influence on the investee. Ornamental's fiscal year ends on December No investments were held by Ornamental on December

Mar. Acquired Distribution Transformers Corporation common stock for $

Sep. Acquired $ of American Instruments' common stock.

Sep. Received a $ dividend on the Distribution Transformers common stock.

Oct. Sold the Distribution Transformers common stock for $

Nov. Purchased $ of M&D Corporation common stock.

Dec. Recorded any necessary adjusting entrys relating to the investments. The market prices of the investments are:

American Instruments common stock

M&D Corporation common stock $

$

Required:

Prepare the appropriate journal entry for each transaction or event during as well as any adjusting entry necessary at yearend.

Indicate any amounts that Ornamental Insulation would report in its income statement, statement of comprehensive income, and balance sheet as a result of these investments. Include totals for net income, comprehensive income, and retained earnings as a result of these investments. Ignore income taxes.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started