Answered step by step

Verified Expert Solution

Question

1 Approved Answer

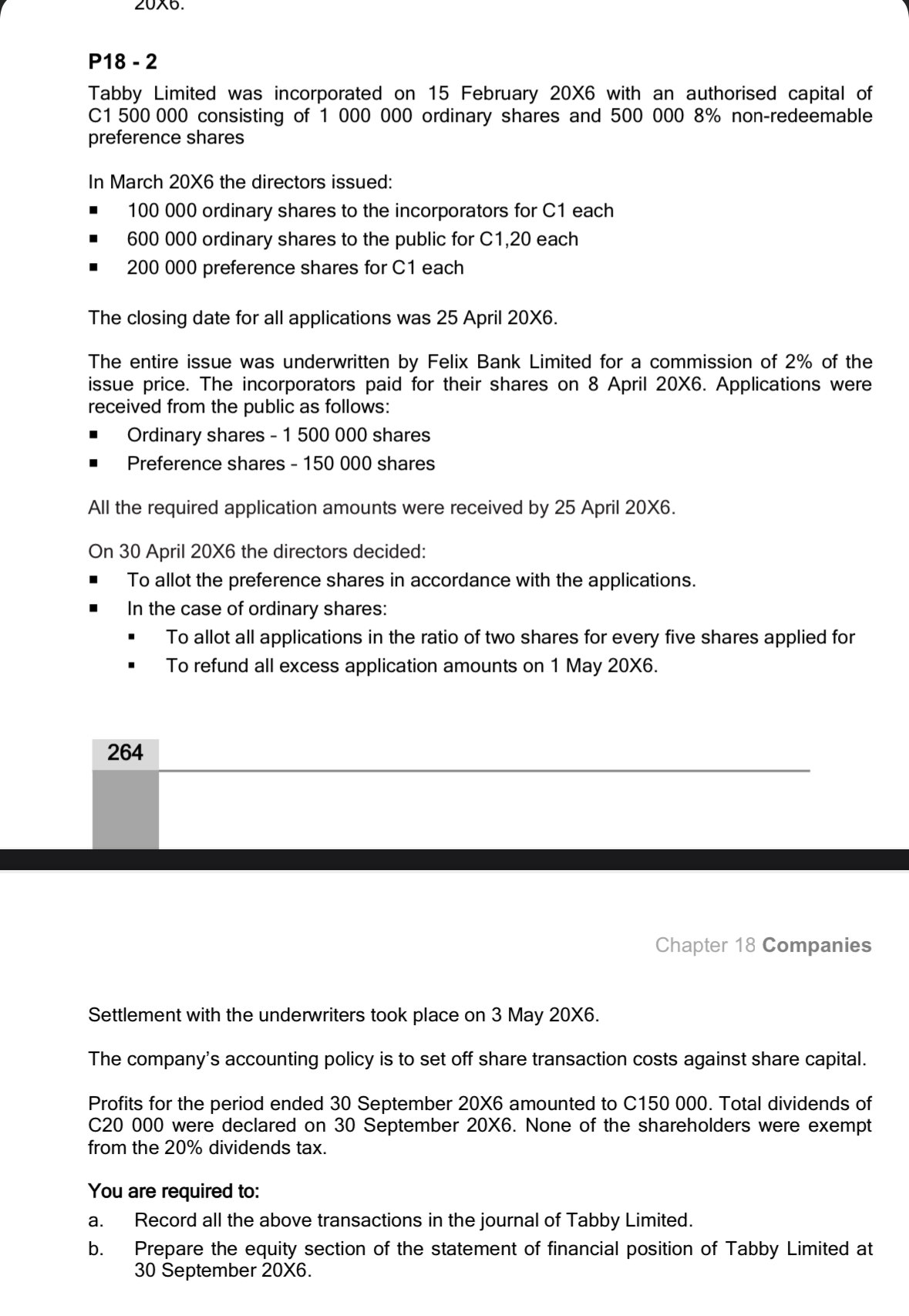

P 1 8 - 2 Tabby Limited was incorporated on 1 5 February 2 0 X 6 with an authorised capital of C 1 5

P

Tabby Limited was incorporated on February X with an authorised capital of

C consisting of ordinary shares and nonredeemable

preference shares

In March X the directors issued:

ordinary shares to the incorporators for C each

ordinary shares to the public for each

preference shares for C each

The closing date for all applications was April X

The entire issue was underwritten by Felix Bank Limited for a commission of of the

issue price. The incorporators paid for their shares on April X Applications were

received from the public as follows:

Ordinary shares shares

Preference shares shares

All the required application amounts were received by April X

On April X the directors decided:

To allot the preference shares in accordance with the applications.

In the case of ordinary shares:

To allot all applications in the ratio of two shares for every five shares applied for

To refund all excess application amounts on May X

Settlement with the underwriters took place on May X

The company's accounting policy is to set off share transaction costs against share capital.

Profits for the period ended September X amounted to C Total dividends of

C were declared on September X None of the shareholders were exempt

from the dividends tax.

You are required to:

a Record all the above transactions in the journal of Tabby Limited.

b Prepare the equity section of the statement of financial position of Tabby Limited at

September X

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started