Question

P 12-5 Foreign currencydenominated receivables and payablesmultiple years Sho of New York is an international dealer in jewelry and engages in numerous import and export

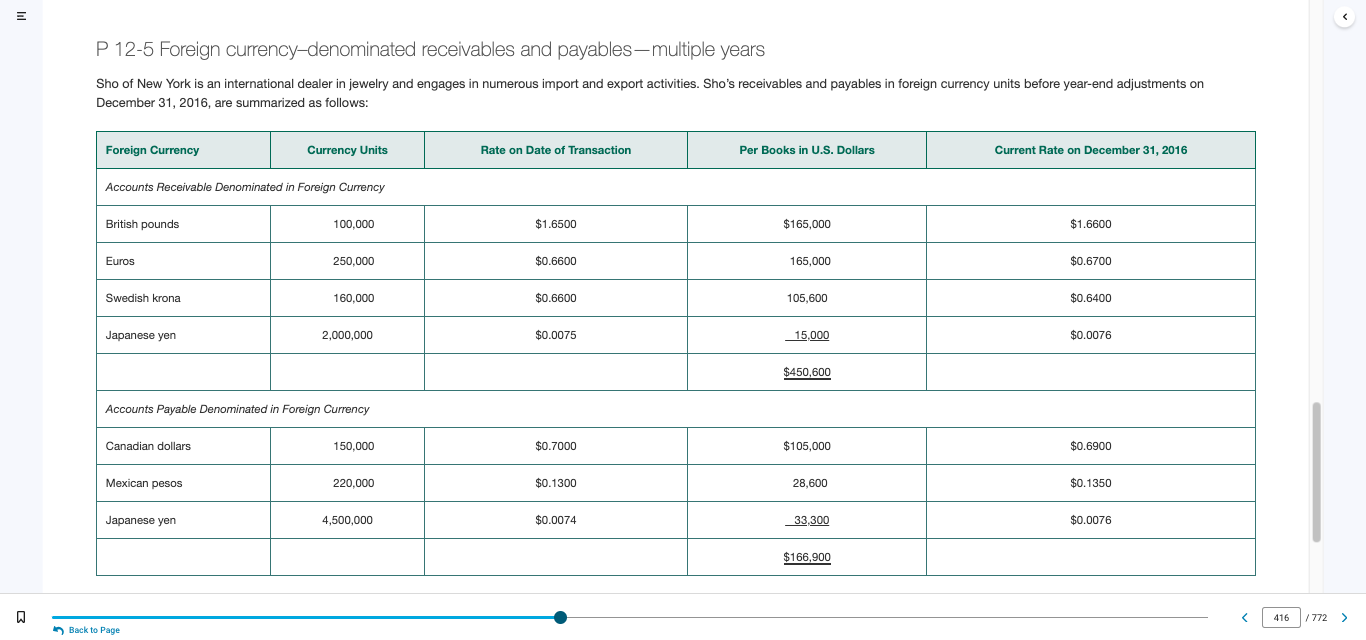

P 12-5 Foreign currencydenominated receivables and payablesmultiple years

Sho of New York is an international dealer in jewelry and engages in numerous import and export activities. Shos receivables and payables in foreign currency units before year-end adjustments on December 31, 2016, are summarized as follows:

Required

1. Determine the amount at which the receivables and payables should be reported in Shos December 31, 2016, balance sheet.

2. Calculate individual gains and losses on each of the receivables and payables and the net exchange gain that should appear in Shos 2016 income statement.

3. When the sale occurs, assume that Sho wants to hedge its exposure to amounts denominated in euros. Should it buy or sell euros for future delivery? In what amount or amounts?

Thank you!!

P 12-5 Foreign currency-denominated receivables and payables-multiple years Sho of New York is an international dealer in jewelry and engages in numerous import and export activities. Sho's receivables and payables in foreign currency units before year-end adjustments on December 31,2016 , are summarized as followsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started