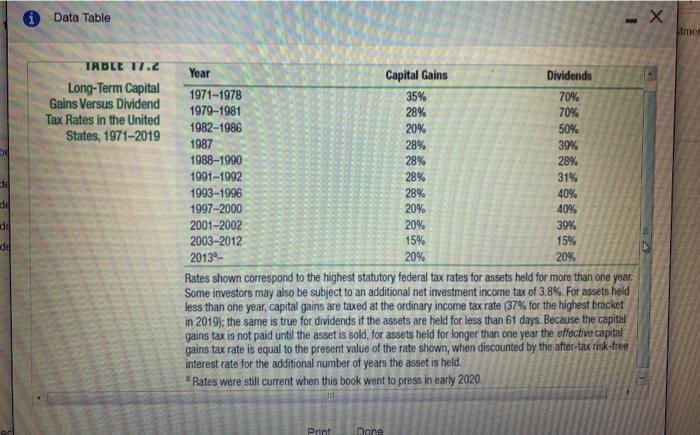

P 17-10 (similar to) Question Help You purchased CSH stock for $4 and it is now selling for $45 The company has announced that it plans a $11 special dividend a. Assuming 2016 tax rates of 15% on dividends and capital gains, if you sell the stock or wait and receive the dividend will you have different after tax income b. If the capital gains tax rate is 10% and the dividend tax rate is 12%, what's the difference between the two options in parta? a. Assuming 2016 tax rates of 15% on dividends and capital gains, if you sell the stock or wat and receive the dividond, will you have different attrix income? (Select from the dropdown menu) Assuming 2016 tax rates aro 15% on capital gain and 15% on dividends, if you sell the stock or wait and receive the dividend you have different after tax income will will not *** UIE. of 20 pts P 17-11 (similar to) Question Help Using Table 172 for each of the following years, state whether dividends were tax disadvantaged or not for individual investors with a one year investment Horizon a, 1985 b. 1980 C. 1085 d. 1919 e. 2005 1.2008 (Select the best choice below) A. Dividends were tax disadvantaged for the years 1989, 1995 and 2005 B. Dividends were tax disadvantaged for the years 1985, 1995 and 1999 OC. Dividends were tax disadvantaged for the years 1985 1989 and 1999 OD. Dividends were tax disadvantaged for the years 1985, 1995 and 2005 i Data Table - x mer 70% TABLE 17.2 Long-Term Capital Gains Versus Dividend Tax Rates in the United States, 1971-2019 28% 20% dd Year Capital Gains Dividends 1971-1978 35% 1979-1981 70% 1982-1986 50% 1987 28% 39% 1988-1990 28% 28% 1991-1992 28% 31% 1993-1996 28% 40% 1997-2000 20% 40% 2001-2002 20% 39% 2003-2012 15% 15% 2013 20% 20% Rates shown correspond to the highest statutory federal tax rates for assets held for more than one year Some investors may also be subject to an additional net investment income tax of 3.8%. For assets held less than one year, capital gains are taxed at the ordinary income tax rate (37% for the highest bracket in 2019); the same is true for dividends if the assets are held for less than 61 days. Because the capital gains tax is not paid until the asset is sold, for assets held for longer than one year the effective capital gains tax rate is equal to the present value of the rate shown, when discounted by the after-tax risk-free interest rate for the additional number of years the asset is held. Rates were still current when this book went to press in early 2020 de Print Dane