Answered step by step

Verified Expert Solution

Question

1 Approved Answer

p . 2 3 - 2 4 # 2 0 Assessing Motives for International Business Fort Worth, Inc., specializes in manufacturing some basic parts for

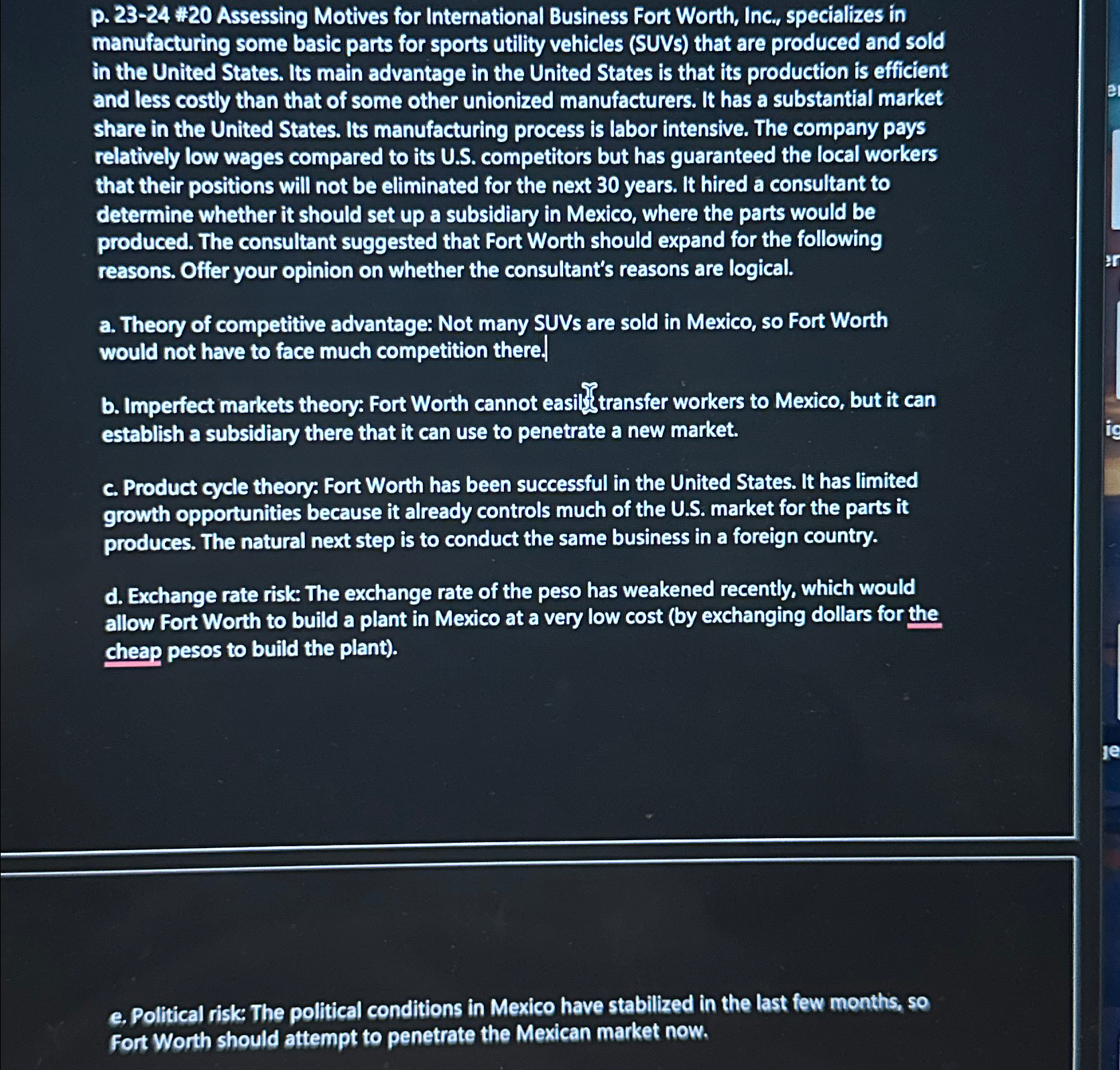

p # Assessing Motives for International Business Fort Worth, Inc., specializes in manufacturing some basic parts for sports utility vehicles SUVS that are produced and sold in the United States. Its main advantage in the United States is that its production is efficient and less costly than that of some other unionized manufacturers. It has a substantial market share in the United States. Its manufacturing process is labor intensive. The company pays relatively low wages compared to its US competitors but has guaranteed the local workers that their positions will not be eliminated for the next years. It hired a consultant to determine whether it should set up a subsidiary in Mexico, where the parts would be produced. The consultant suggested that Fort Worth should expand for the following reasons. Offer your opinion on whether the consultant's reasons are logical

a Theory of competitive advantage: Not many SUVs are sold in Mexico, so Fort Worth would not have to face much competition there.

b Imperfect markets theory: Fort Worth cannot easil Stransfer workers to Mexico, but it can establish a subsidiary there that it can use to penetrate a new market.

c Product cycle theory: Fort Worth has been successful in the United States. It has limited growth opportunities because it already controls much of the US market for the parts it produces. The natural next step is to conduct the same business in a foreign country.

d Exchange rate risk: The exchange rate of the peso has weakened recently, which would allow Fort Worth to build a plant in Mexico at a very low cost by exchanging dollars for the cheap pesos to build the plant

e Political risk: The political conditions in Mexico have stabilized in the last few months, so Fort Worth should attempt to penetrate the Mexican market now.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started