Answered step by step

Verified Expert Solution

Question

1 Approved Answer

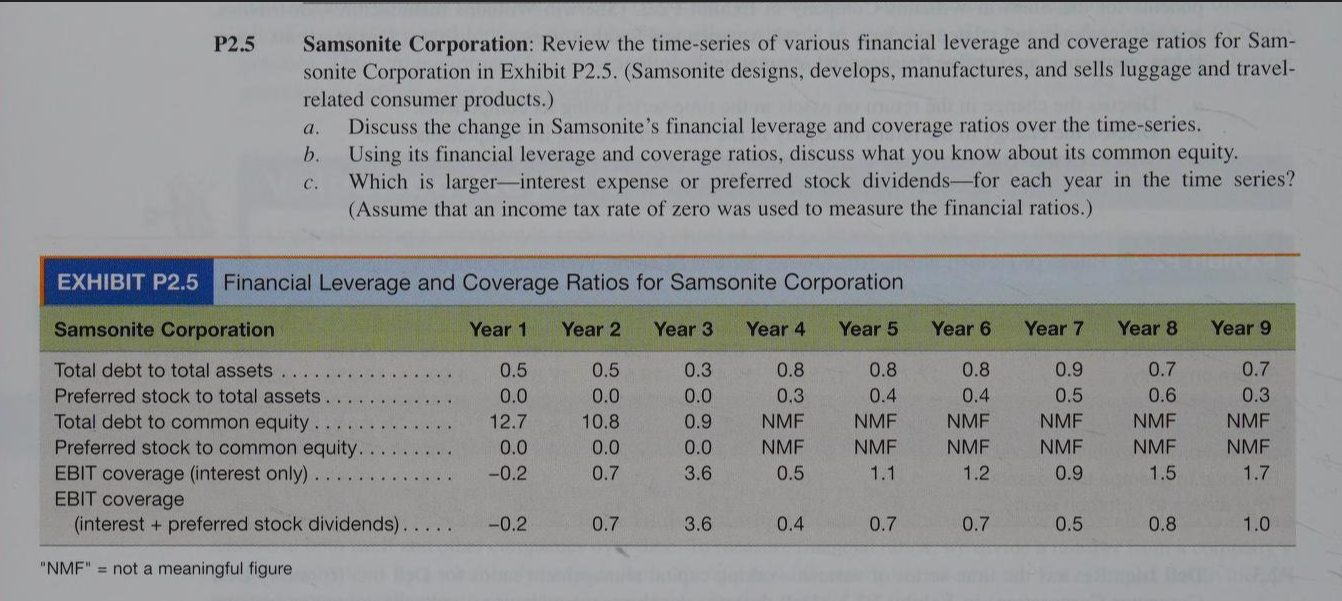

P 2 . 5 Samsonite Corporation: Review the time - series of various financial leverage and coverage ratios for Sam - P 2 . 5

P Samsonite Corporation: Review the timeseries of various financial leverage and coverage ratios for Sam P Samsonite Corporation: Review the timeseries of various financial leverage and coverage ratios for Sam

sonite Corporation in Exhibit PSamsonite designs, develops, manufactures, and sells luggage and travel

related consumer products.

a Discuss the change in Samsonite's financial leverage and coverage ratios over the timeseries.

b Using its financial leverage and coverage ratios, discuss what you know about its common equity.

c Which is largerinterest expense or preferred stock dividendsfor each year in the time series?

Assume that an income tax rate of zero was used to measure the financial ratios.

NMF not a meaningful figure

sonite Corporation in Exhibit PSamsonite designs, develops, manufactures, and sells luggage and travel

related consumer products.

a Discuss the change in Samsonite's financial leverage and coverage ratios over the timeseries.

b Using its financial leverage and coverage ratios, discuss what you know about its common equity.

c Which is largerinterest expense or preferred stock dividendsfor each year in the time series?

Assume that an income tax rate of zero was used to measure the financial ratios.

NMF not a meaningful figure

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started