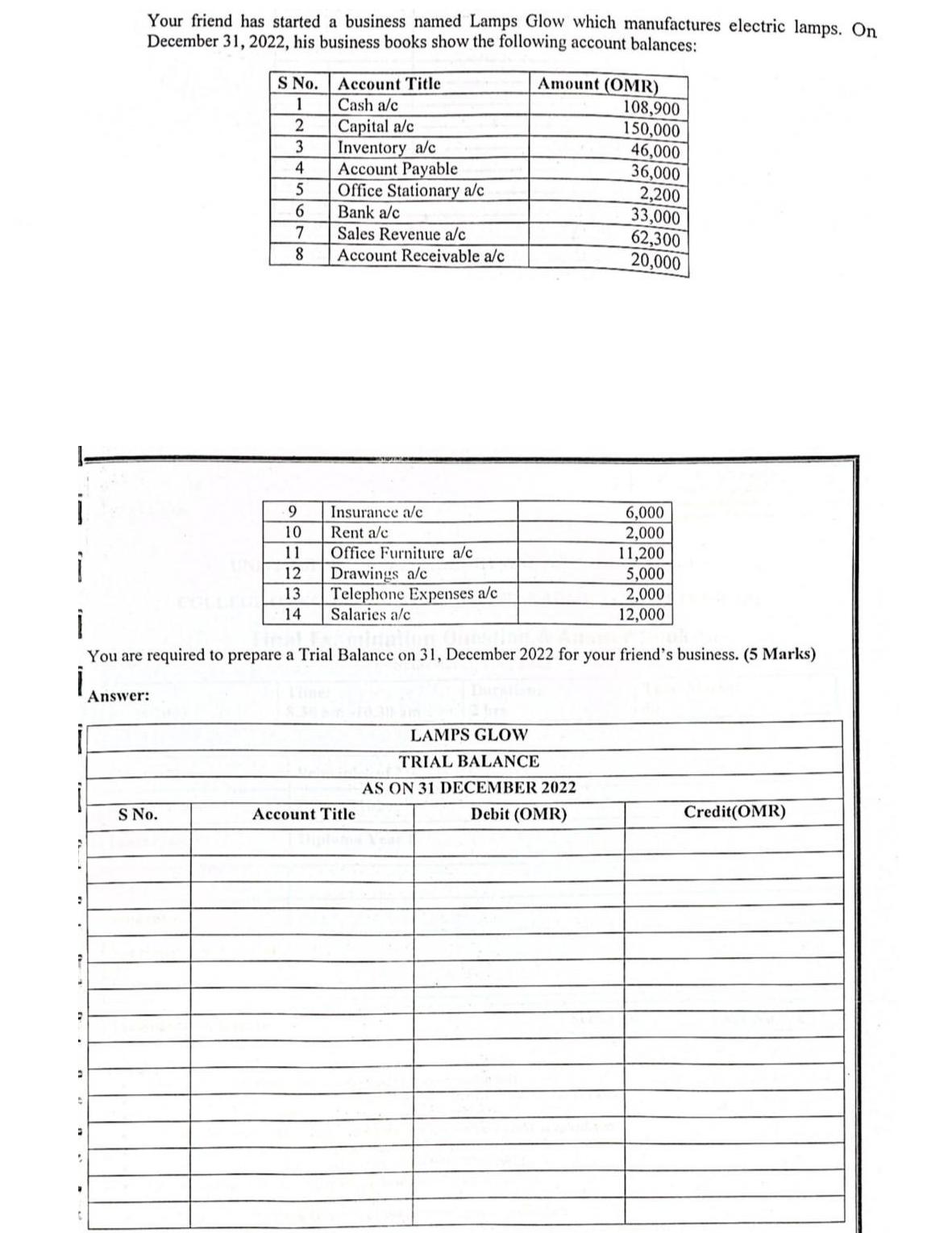

> : P - 2 : i You are required to prepare a Trial Balance on 31, December 2022 for your friend's business. (5

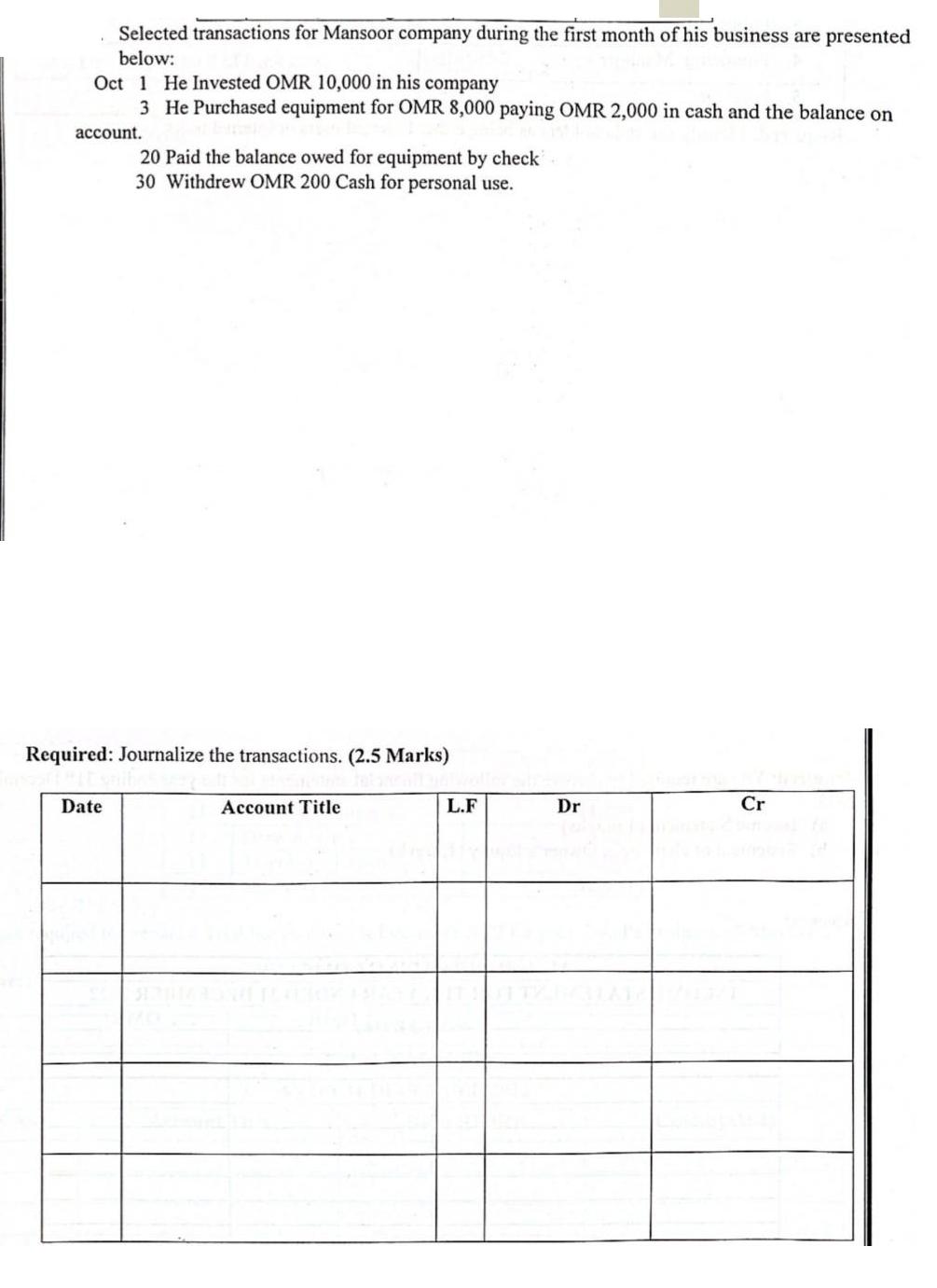

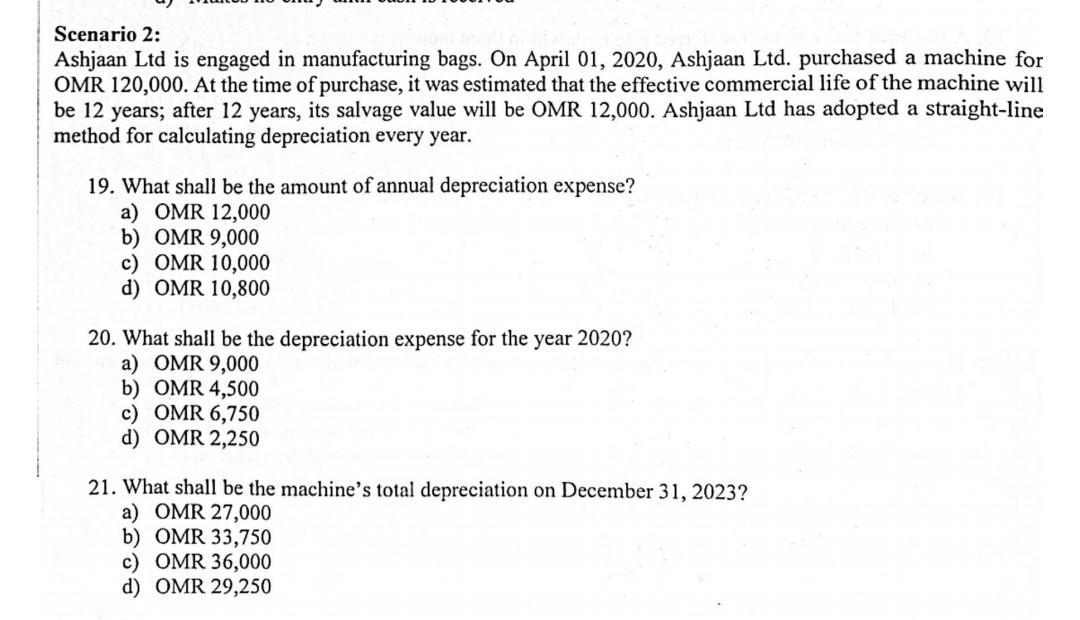

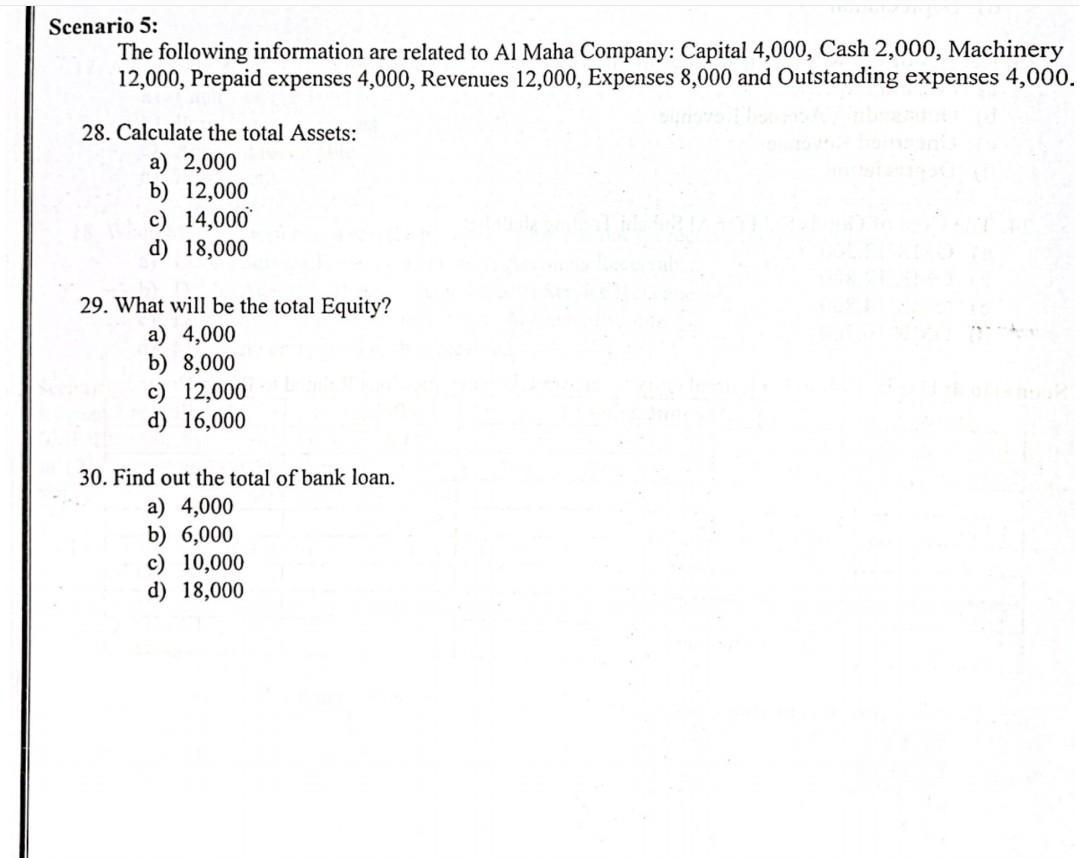

> : P - 2 : i You are required to prepare a Trial Balance on 31, December 2022 for your friend's business. (5 Marks) : = Your friend has started a business named Lamps Glow which manufactures electric lamps. On December 31, 2022, his business books show the following account balances: 2 Answer: S No. 1 2 3 4 5 6 7 8 S No. 9 10 11 12 13 14 Account Title Cash a/c Capital a/c Inventory a/c Account Payable Office Stationary a/c Bank a/c Sales Revenue a/c Account Receivable a/c Insurance a/c Rent a/c Office Furniture a/c Drawings a/c Telephone Expenses a/c Salaries a/c Amount (OMR) 108,900 150,000 46,000 36,000 2,200 33,000 62,300 20,000 Account Title 6,000 2,000 11,200 5,000 2,000 12,000 LAMPS GLOW TRIAL BALANCE AS ON 31 DECEMBER 2022 Debit (OMR) Credit (OMR) Selected transactions for Mansoor company during the first month of his business are presented below: Oct 1 He Invested OMR 10,000 in his company 3 He Purchased equipment for OMR 8,000 paying OMR 2,000 in cash and the balance on account. 20 Paid the balance owed for equipment by check 30 Withdrew OMR 200 Cash for personal use. Required: Journalize the transactions. (2.5 Marks) Date Account Title L.F Dr Cr Scenario 2: Ashjaan Ltd is engaged in manufacturing bags. On April 01, 2020, Ashjaan Ltd. purchased a machine for OMR 120,000. At the time of purchase, it was estimated that the effective commercial life of the machine will be 12 years; after 12 years, its salvage value will be OMR 12,000. Ashjaan Ltd has adopted a straight-line method for calculating depreciation every year. 19. What shall be the amount of annual depreciation expense? a) OMR 12,000 b) OMR 9,000 c) OMR 10,000 d) OMR 10,800 20. What shall be the depreciation expense for the year 2020? a) OMR 9,000 b) OMR 4,500 c) OMR 6,750 d) OMR 2,250 21. What shall be the machine's total depreciation on December 31, 2023? a) OMR 27,000 b) OMR 33,750 c) OMR 36,000 d) OMR 29,250 Scenario 5: The following information are related to Al Maha Company: Capital 4,000, Cash 2,000, Machinery 12,000, Prepaid expenses 4,000, Revenues 12,000, Expenses 8,000 and Outstanding expenses 4,000. 28. Calculate the total Assets: a) 2,000 b) 12,000 c) 14,000 d) 18,000 29. What will be the total Equity? a) 4,000 b) 8,000 c) 12,000 d) 16,000 30. Find out the total of bank loan. a) 4,000 b) 6,000 c) 10,000 d) 18,000

Step by Step Solution

3.45 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

19 1 Cost of machine OMR 120000 2 Salvage value OMR 12000 3 Estimated life 12 yea...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started