Answered step by step

Verified Expert Solution

Question

1 Approved Answer

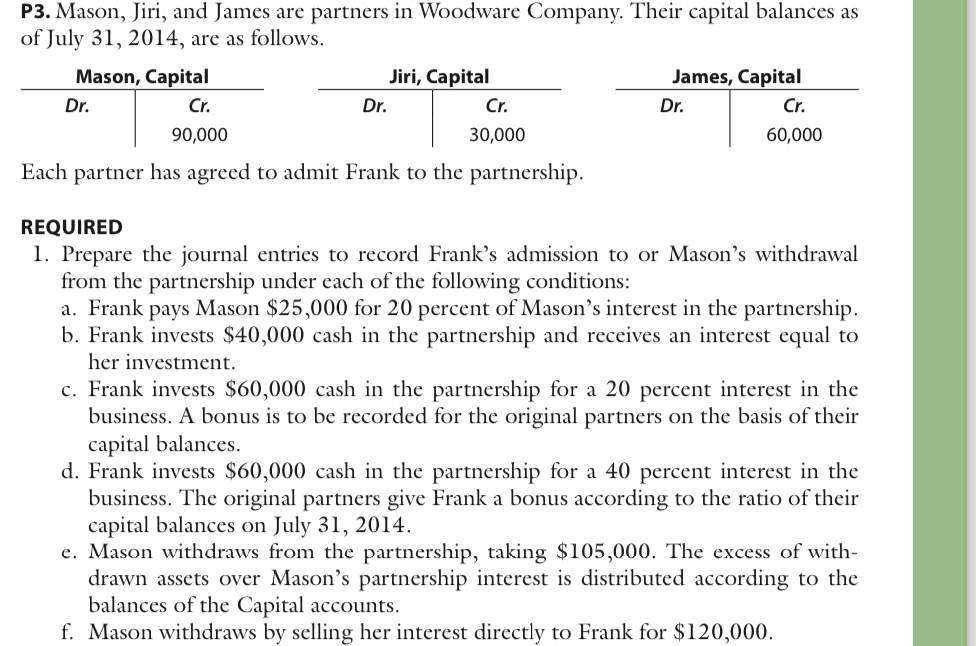

P 3 . Mason, Jiri, and James are partners in Woodware Company. Their capital balances as of July 3 1 , 2 0 1 4

P Mason, Jiri, and James are partners in Woodware Company. Their capital balances as of July are as follows.

tableMason CapitalDrCr

tableJiri CapitalDrCr

tableJames CapitalDrCr

Each partner has agreed to admit Frank to the partnership.

REQUIRED

Prepare the journal entries to record Frank's admission to or Mason's withdrawal from the partnership under each of the following conditions:

a Frank pays Mason $ for percent of Mason's interest in the partnership.

b Frank invests $ cash in the partnership and receives an interest equal to her investment.

c Frank invests $ cash in the partnership for a percent interest in the business. A bonus is to be recorded for the original partners on the basis of their capital balances.

d Frank invests $ cash in the partnership for a percent interest in the business. The original partners give Frank a bonus according to the ratio of their capital balances on July

e Mason withdraws from the partnership, taking $ The excess of withdrawn assets over Mason's partnership interest is distributed according to the balances of the Capital accounts.

f Mason withdraws by selling her interest directly to Frank for $P Mason, Jiri, and James are partners in Woodware Company. Their capital balances as of July are as follows.

tableMason CapitalDrCr

tableJiri CapitalDrCr

tableJames CapitalDrCr

Each partner has agreed to admit Frank to the partnership.

REQUIRED

Prepare the journal entries to record Frank's admission to or Mason's withdrawal from the partnership under each of the following conditions:

a Frank pays Mason $ for percent of Mason's interest in the partnership.

b Frank invests $ cash in the partnership and receives an interest equal to her investment.

c Frank invests $ cash in the partnership for a percent interest in the business. A bonus is to be recorded for the original partners on the basis of their capital balances.

d Frank invests $ cash in the partnership for a percent interest in the business. The original partners give Frank a bonus according to the ratio of their capital balances on July

e Mason withdraws from the partnership, taking $ The excess of withdrawn assets over Mason's partnership interest is distributed according to the balances of the Capital accounts.

f Mason withdraws by selling her interest directly to Frank for $P Mason, Jiri, and James are partners in Woodware Company. Their capital balances as of July are as follows.

tableMason CapitalDrCr

tableJiri CapitalDrCr

tableJames CapitalDrCr

Each partner has agreed to admit Frank to the partnership.

REQUIRED

Prepare the journal entries to record Frank's admission to or Mason's withdrawal from the partnership under each of the following conditions:

a Frank pays Mason $ for percent of Mason's interest in the partnership.

b Frank invests $ cash in the partnership and receives an interest equal to her investment.

c Frank invests $ cash in the partnership for a percent interest in the business. A bonus is to be recorded for the original partners on the basis of their capital balances.

d Frank invests $ cash in the partnership for a percent interest in the business. The original partners give Frank a bonus according to the ratio of their capital balances on July

e Mason withdraws from the partnership, taking $ The excess of withdrawn assets over Mason's partnership interest is distributed according to the balances of the Capital accounts.

f Mason withdraws by selling her interest directly to Frank for $

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started