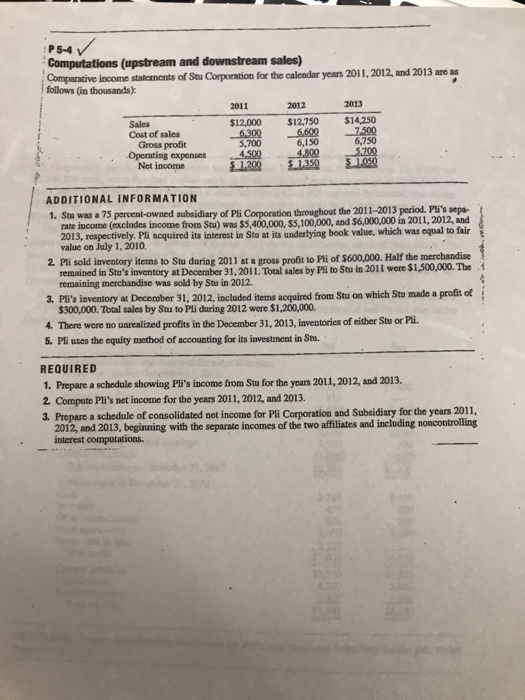

P 5-4 Computations (upstream and downstream sales) Comparative income statements of Stu follows (in thousands) Corporation for the caleadar years 201, 2012 and 2013 are a 2011 2012 2013 $12,000 $12,750 $14,250 Cost of sales Gross proit 5,700 6,150 6,750 Net income ADDITIONAL INFORMATION 1. Stu was a 75 percent-owned subsidiary of Pli Corporation throughout the 2011-2013 period. Pli's sepa- rate income (excludes income from Stu) was $5,400,000, $5,100,000, and $6,000,000 in 2011, 2012, and equal to fair 2013, respectively. Pli acquired its interest in Stu at its underlying book value, which was value on July 1, 2010 2. Pli sold inventory iterns to Stu during 2011 at a gross profit to Pli of $600,000. Half the merchandise remained in Stu's inventory at December 31, 2011. Total sales by Pli to Stu in 2011 were $1,500,000. Tbe .1 remaining merchandise was sold by Stu in 2012 3. Pli's inventory at December 31, 2012, included items acquired from Stu on which Stu made a profit of $300,000. Total sales by Stu to Pli during 2012 were $1,200,000. 4. There were no uarealized profits in the December 31, 2013, inventories of either Stu or Pli. 5. Pli uses the equity method of accounting for its investment in Sto REQUIRED 1. Prepare a schedale showing Pli's income from Stu for the years 2011, 2012, and 2013. 2. Compute Pli's net income for the years 2011, 2012, and 2013. 3 Prepare a schedule of coasolidated net income for Pli Corporation and Subsidiary for the years 2011, 2012, and 2013, beginning with the separate incomes of the two affiliates and including noncontrolling interest computations. P 5-4 Computations (upstream and downstream sales) Comparative income statements of Stu follows (in thousands) Corporation for the caleadar years 201, 2012 and 2013 are a 2011 2012 2013 $12,000 $12,750 $14,250 Cost of sales Gross proit 5,700 6,150 6,750 Net income ADDITIONAL INFORMATION 1. Stu was a 75 percent-owned subsidiary of Pli Corporation throughout the 2011-2013 period. Pli's sepa- rate income (excludes income from Stu) was $5,400,000, $5,100,000, and $6,000,000 in 2011, 2012, and equal to fair 2013, respectively. Pli acquired its interest in Stu at its underlying book value, which was value on July 1, 2010 2. Pli sold inventory iterns to Stu during 2011 at a gross profit to Pli of $600,000. Half the merchandise remained in Stu's inventory at December 31, 2011. Total sales by Pli to Stu in 2011 were $1,500,000. Tbe .1 remaining merchandise was sold by Stu in 2012 3. Pli's inventory at December 31, 2012, included items acquired from Stu on which Stu made a profit of $300,000. Total sales by Stu to Pli during 2012 were $1,200,000. 4. There were no uarealized profits in the December 31, 2013, inventories of either Stu or Pli. 5. Pli uses the equity method of accounting for its investment in Sto REQUIRED 1. Prepare a schedale showing Pli's income from Stu for the years 2011, 2012, and 2013. 2. Compute Pli's net income for the years 2011, 2012, and 2013. 3 Prepare a schedule of coasolidated net income for Pli Corporation and Subsidiary for the years 2011, 2012, and 2013, beginning with the separate incomes of the two affiliates and including noncontrolling interest computations