Answered step by step

Verified Expert Solution

Question

1 Approved Answer

P 6-7 Workpaper (upstream sales current and previous years) Par Corporation acquired an 80 percent interest in Sin Corporation on January 1, 2011, for $108,000

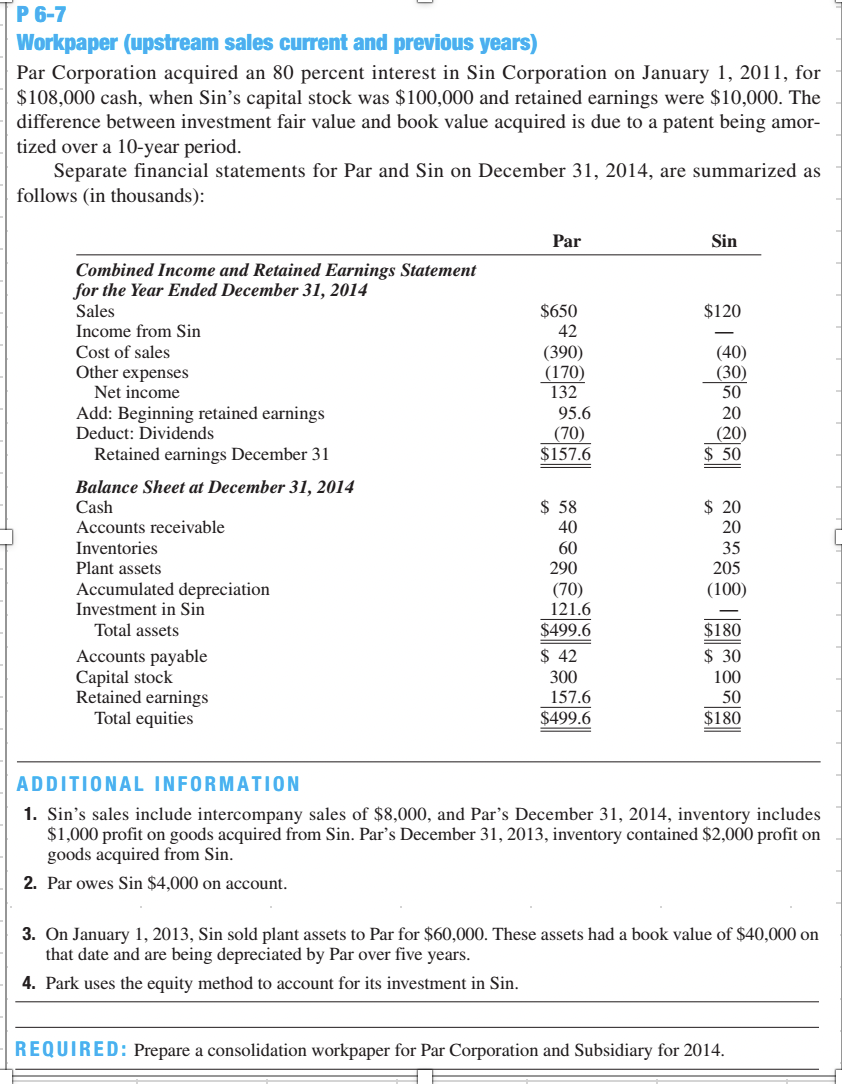

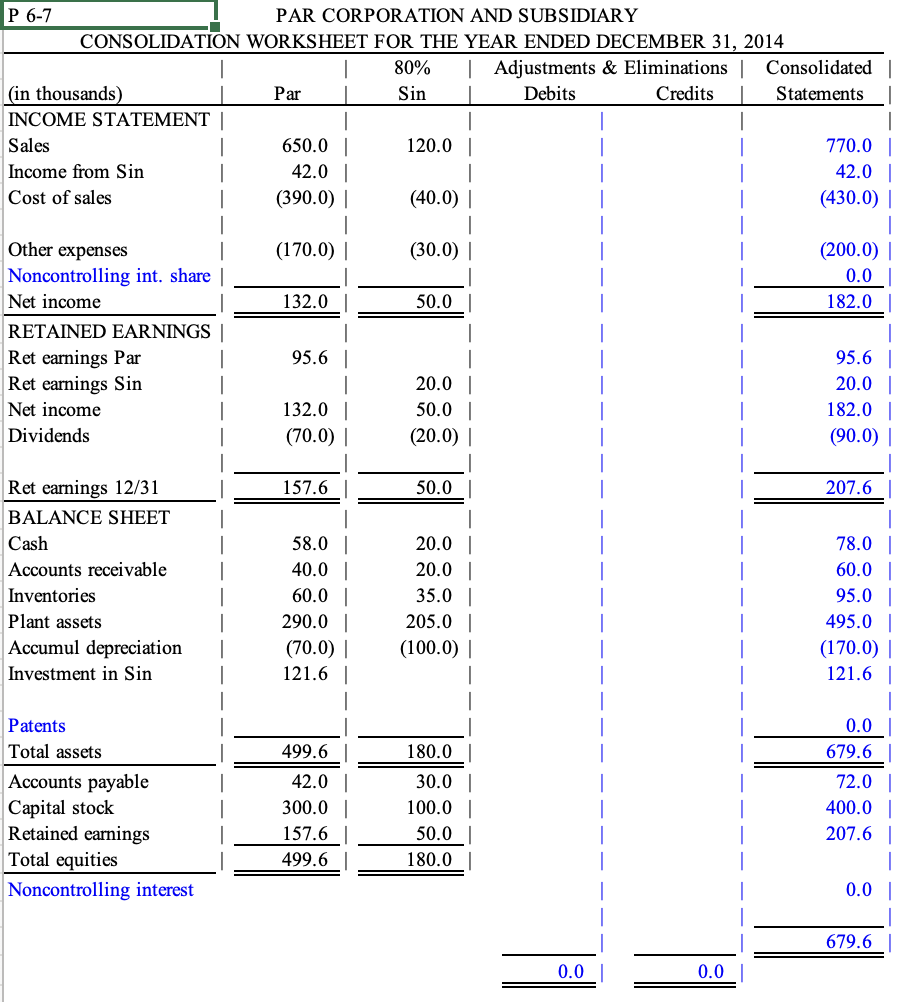

P 6-7 Workpaper (upstream sales current and previous years) Par Corporation acquired an 80 percent interest in Sin Corporation on January 1, 2011, for $108,000 cash, when Sin's capital stock was $100,000 and retained earnings were $10,000. The difference between investment fair value and book value acquired is due to a patent being amor- tized over a 10-year period. Separate financial statements for Par and Sin on December 31, 2014, are summarized as follows (in thousands): Par Sin $120 $650 42 (390) (170) 132 (40) (30) 50 20 (20) $ 50 95.6 (70) $157.6 Combined Income and Retained Earnings Statement for the Year Ended December 31, 2014 Sales Income from Sin Cost of sales Other expenses Net income Add: Beginning retained earnings Deduct: Dividends Retained earnings December 31 Balance Sheet at December 31, 2014 Cash Accounts receivable Inventories Plant assets Accumulated depreciation Investment in Sin Total assets Accounts payable Capital stock Retained earnings Total equities $ 20 20 35 205 (100) $ 58 40 60 290 (70) 121.6 $499.6 $ 42 300 157.6 $499.6 $180 $ 30 100 50 $180 ADDITIONAL INFORMATION 1. Sin's sales include intercompany sales of $8,000, and Paris December 31, 2014, inventory includes $1,000 profit on goods acquired from Sin. Par's December 31, 2013, inventory contained $2,000 profit on goods acquired from Sin. 2. Par owes Sin $4,000 on account. 3. On January 1, 2013, Sin sold plant assets to Par for $60,000. These assets had a book value of $40,000 on that date and are being depreciated by Par over five years. 4. Park uses the equity method to account for its investment in Sin. REQUIRED: Prepare a consolidation workpaper for Par Corporation and Subsidiary for 2014. P 6-7 PAR CORPORATION AND SUBSIDIARY CONSOLIDATION WORKSHEET FOR THE YEAR ENDED DECEMBER 31, 2014 80% | Adjustments & Eliminations Consolidated (in thousands) Par Sin Debits Credits Statements INCOME STATEMENT Sales 650.0 120.0 770.0 Income from Sin 42.0 | 42.0 | Cost of sales (390.0) | (40.0) | (430.0) | Other expenses (170.0) (30.0) | (200.0 0.0 182.0 132.0 50.0 Noncontrolling int. share Net income RETAINED EARNINGS Ret earnings Par Ret earnings Sin Net income Dividends 95.6 95.6 | 20.01 182.0 | (90.0) | 20.0 50.0 (20.0) 132.01 (70.0) 157.6 50.0 207.6 Ret earnings 12/31 BALANCE SHEET Cash Accounts receivable Inventories Plant assets Accumul depreciation Investment in Sin 58.0 40.0 60.0 290.0 | (70.0) 121.6 20.0 20.0 35.0 205.0 (100.0) | 78.0 60.01 95.01 495.0 | (170.01 121.61 0.0 679.6 180.0 Patents Total assets Accounts payable Capital stock Retained earnings Total equities Noncontrolling interest 499.6 42.0 300.01 157.6 499.6 30.0 100.0 | 50.0 180.0 72.0 | 400.0 207.6 | 1 0.01 679.6 0.0 0.0

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started