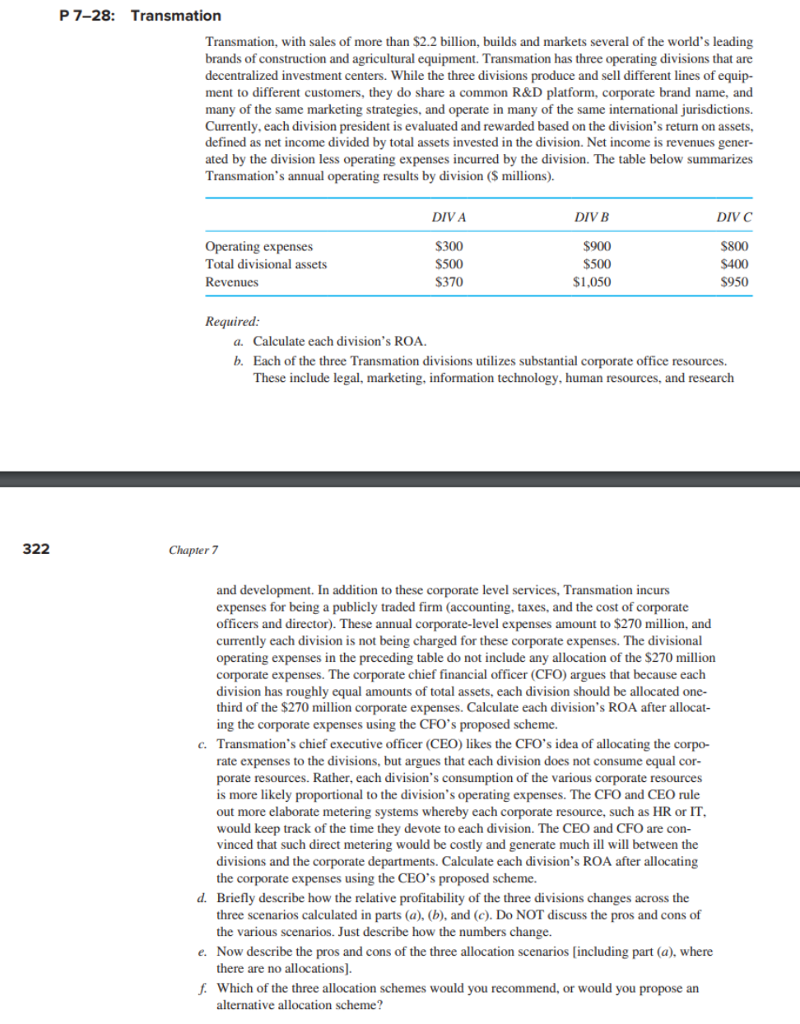

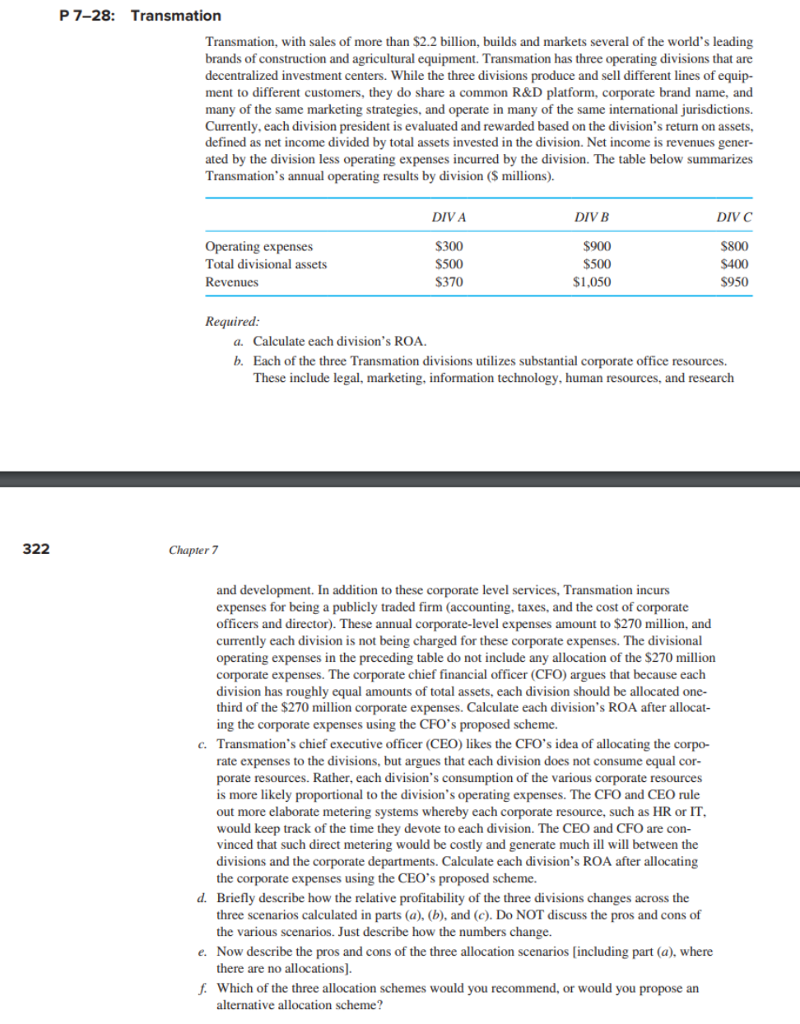

P 7-28: Transmation Transmation, with sales of more than $2.2 billion, builds and markets several of the world's leading brands of construction and agricultural equipment. Transmation has three operating divisions that are decentralized investment centers. While the three divisions produce and sell different lines of equip- ment to different customers, they do share a common R&D platform, corporate brand name, and many of the same marketing strategies, and operate in many of the same international jurisdictions. Currently, each division president is evaluated and rewarded based on the division's return on assets, defined as net income divided by total assets invested in the division. Net income is revenues gener- ated by the division less operating expenses incurred by the division. The table below summarizes Transmation's annual operating results by division (S millions) DIV A DIV B DIV C Operating expenses Total divisional assets Revenues S300 $500 S370 $900 $500 $1,050 $800 S400 S950 Required a. Calculate each division's ROA b. Each of the three Transmation divisions utilizes substantial corporate office resources. These include legal, marketing, information technology, human resources, and research 322 Chapter 7 o these corporate level services, Transmation incurs and development. In addition t expenses for being a publicly traded firm (accounting, taxes, and the cost of corporate officers and director). These annual corporate-level expenses amount to $270 million, and currently each division is not being charged for these corporate expenses. The divisional operating expenses in the preceding table do not include any allocation of the $270 million corporate expenses. The corporate chief financial officer (CFO) argues that because each division has roughly equal amounts of total assets, each division should be allocated one- third of the $270 million corporate expenses. Calculate each division's ROA after allocat ing the corporate expenses using the CFO's proposed scheme. Transmation's chief executive officer (CEO) likes the CFO's idea of allocating the corpo- rate expenses to the divisions, but argues that each division does not consume equal cor- porate resources. Rather, each division's consumption of the various corporate resources is more likely proportional to the division's operating expenses. The CFO and CEO rule out more elaborate metering systems whereby each corporate resource, such as HR or IT would keep track of the time they devote to each division. The CEO and CFO are con vinced that such direct metering would be costly and generate much ill will between the divisions and the corporate departments. Calculate each division's ROA after allocating the c. corporate expenses using the CEO's Briefly describe how the relative profitability of the three divisions changes across the three scenarios calculated in parts (a), (b), and (c). Do NOT discuss the pros and cons of the various scenarios. Just describe how the numbers change. Now describe the pros and cons of the three allocation scenarios [including part (a), where there are no allocations]. proposed scheme. d. e. f Which of the three allocation schemes would you recommend, or would you propose an alternative allocation scheme