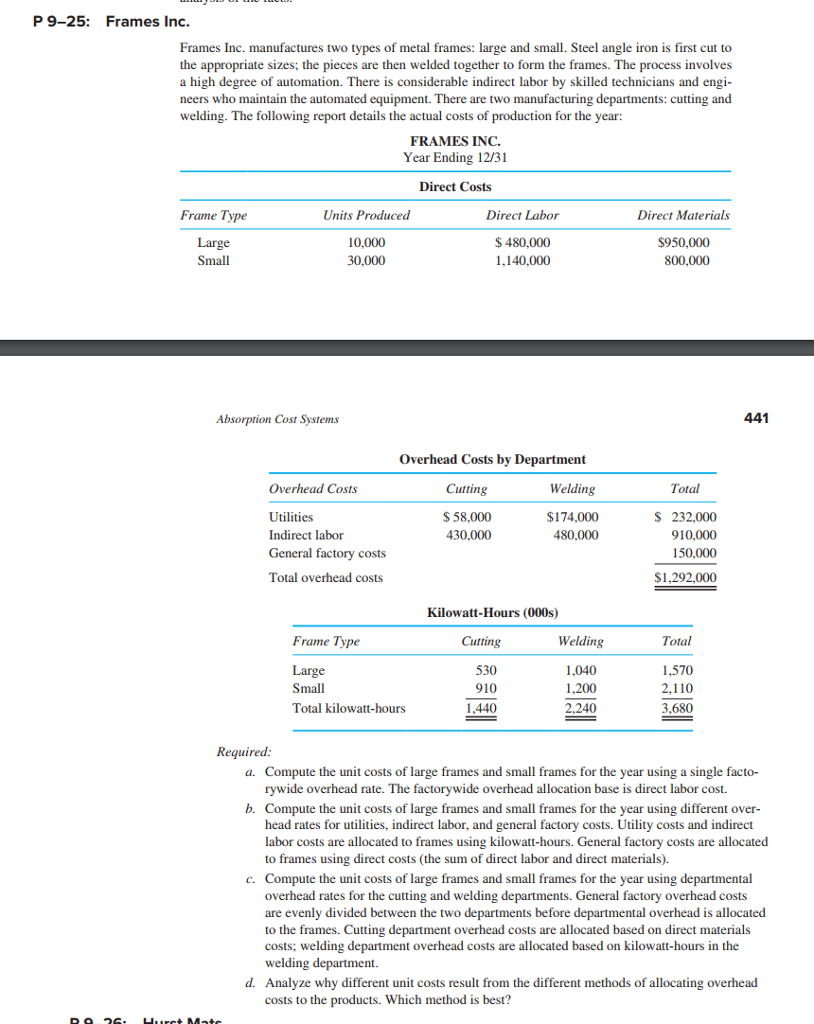

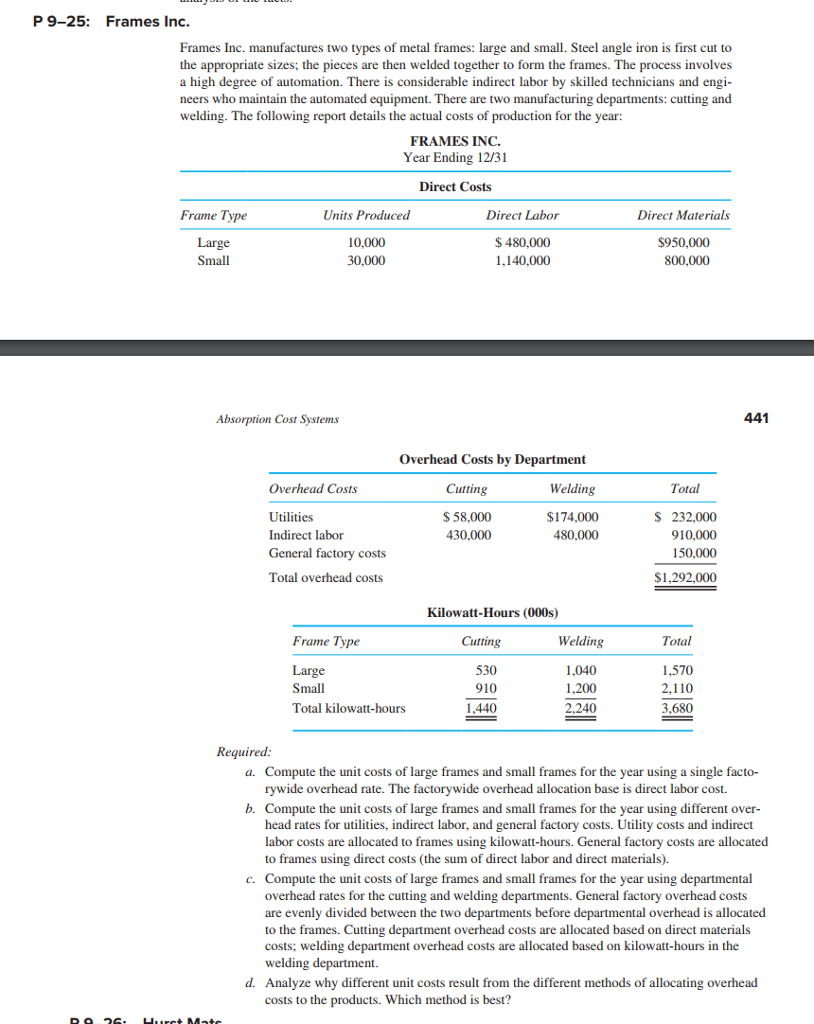

P 9-25: Frames Inc Frames Inc. manufactures two types of metal frames: large and small. Steel angle iron is first cut to the appropriate sizes; the pieces are then welded together to form the frames. The process involves a high degree of automation. There is considerable indirect labor by skilled technicians and engi- neers who maintain the automated equipment. There are two manufacturing departments: cutting and welding. The following report details the actual costs of production for the year: FRAMES INC. Year Ending 12/31 Direct Costs Frame Type Units Produced Direct Labor Direct Materials 10,000 30,000 $480,000 1,140,000 $950,000 800,000 Small Absorption Cost Systems 441 Overhead Costs by Department Overhead Costs Utilities Indirect labor General factory costs Total overhead costs Cutting $58,000 430,000 Welding Total 174,000 480,000 S 232,000 910,000 150,000 $1,292,000 Kilowatt-Hours (000s) Frame Type Cutting Welding Total 530 910 1.440 1040 1.200 2.240 1,570 Small Total kilowatt-hours 3,680 Required: Compute the unit costs of large frames and small frames for the year using a single facto- rywide overhead rate. The factorywide overhead allocation base is direct labor cost. Compute the unit costs of large frames and small frames for the year using different over- head rates for utilities, indirect labor, and general factory costs. Utility costs and indirect labor costs are allocated to frames using kilowatt-hours. General factory costs are allocated to frames using direct costs (the sum of direct labor and direct materials). Compute the unit costs of large frames and small frames for the year using departmental overhead rates for the cutting and welding departments. General factory overhead costs are evenly divided between the two departments before departmental overhead is allocated to the frames. Cutting department overhead costs are allocated based on direct materials costs; welding department overhead costs are allocated based on kilowatt-hours in the welding department. Analyze why different unit costs result from the different methods of allocating overhead costs to the products. Which method is best? a. b. c. d. P 9-25: Frames Inc Frames Inc. manufactures two types of metal frames: large and small. Steel angle iron is first cut to the appropriate sizes; the pieces are then welded together to form the frames. The process involves a high degree of automation. There is considerable indirect labor by skilled technicians and engi- neers who maintain the automated equipment. There are two manufacturing departments: cutting and welding. The following report details the actual costs of production for the year: FRAMES INC. Year Ending 12/31 Direct Costs Frame Type Units Produced Direct Labor Direct Materials 10,000 30,000 $480,000 1,140,000 $950,000 800,000 Small Absorption Cost Systems 441 Overhead Costs by Department Overhead Costs Utilities Indirect labor General factory costs Total overhead costs Cutting $58,000 430,000 Welding Total 174,000 480,000 S 232,000 910,000 150,000 $1,292,000 Kilowatt-Hours (000s) Frame Type Cutting Welding Total 530 910 1.440 1040 1.200 2.240 1,570 Small Total kilowatt-hours 3,680 Required: Compute the unit costs of large frames and small frames for the year using a single facto- rywide overhead rate. The factorywide overhead allocation base is direct labor cost. Compute the unit costs of large frames and small frames for the year using different over- head rates for utilities, indirect labor, and general factory costs. Utility costs and indirect labor costs are allocated to frames using kilowatt-hours. General factory costs are allocated to frames using direct costs (the sum of direct labor and direct materials). Compute the unit costs of large frames and small frames for the year using departmental overhead rates for the cutting and welding departments. General factory overhead costs are evenly divided between the two departments before departmental overhead is allocated to the frames. Cutting department overhead costs are allocated based on direct materials costs; welding department overhead costs are allocated based on kilowatt-hours in the welding department. Analyze why different unit costs result from the different methods of allocating overhead costs to the products. Which method is best? a. b. c. d