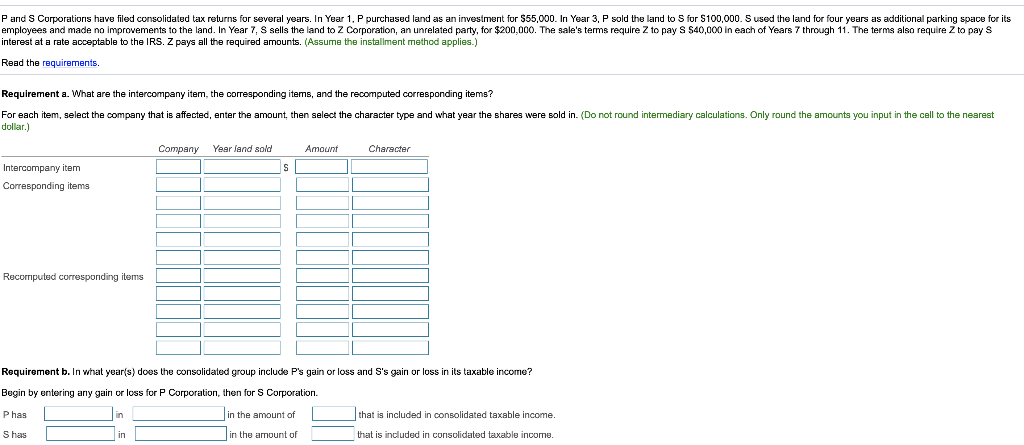

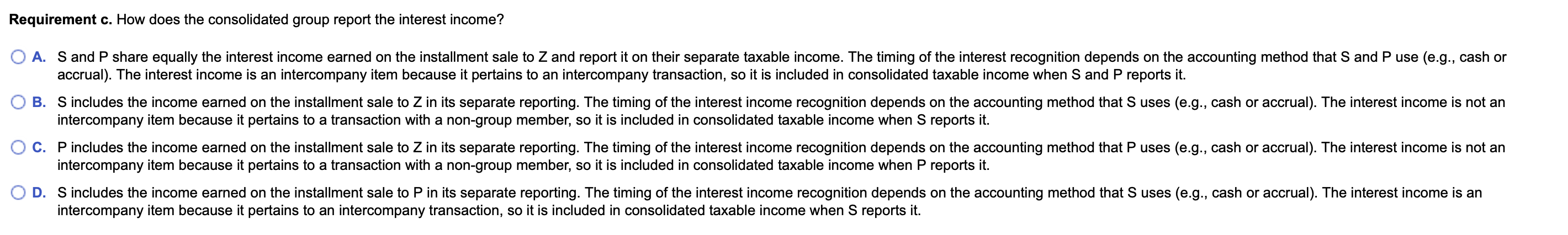

P and S Corporations have filed consolidated tax returns for several years. In Year 1,P purchased land as an investment for $55,000. In Year 3, P sold the land to Sfor S100,000. S used the land for four years as additional parking space for its employees and made no improvements to the land. In Year 7, S sells the land to Z Corporation, an unrelated party, for $200,000. The sale's terms require Z to pay $ $40,000 in each of Years 7 through 11. The terms also require Z to pays interest at a rate acceptable to the IRS. Z pays all the required amounts. (Assume the installment method applies.) Read the requirements. Requirement a. What are the intercompany item, the corresponding items, and the recomputed corresponding items? For each item, select the company that is affected, enter the amount, then select the character type and what year the shares were sold in. (Do not round intermediary calculations. Only round the amounts you input in the cell to the nearest dollar.) Company Year land sold Amount Character Intercompany item Corresponding items Recomputed corresponding items Requirement b. In what year(s) does the consolidated group include P's gain or loss and S's gain or loss in its taxable income? Begin by entering any gain or loss for P Corporation, then for S Corporation. Phas in the amount of that is included in consolidated taxable income Shas in in the amount of that is included in consolidated taxable income. Requirement c. How does the consolidated group report the interest income? O A. S and P share equally the interest income earned on the installment sale to Z and report it on their separate taxable income. The timing of the interest recognition depends on the accounting method that S and P use (e.g., cash or accrual). The interest income is an intercompany item because it pertains to an intercompany transaction, so it is included in consolidated taxable income when S and P reports it. B. S includes the income earned on the installment sale to Z in its separate reporting. The timing of the interest income recognition depends on the accounting method that S uses (e.g., cash or accrual). The interest income is not an intercompany item because it pertains to a transaction with a non-group member, so it is included in consolidated taxable income when S reports it. C. P includes the income earned on the installment sale to Z in its separate reporting. The timing of the interest income recognition depends on the accounting method that Puses (e.g., cash or accrual). The interest income is not an intercompany item because it pertains to a transaction with a non-group member, so it is included in consolidated taxable income when P reports it. D. S includes the income earned on the installment sale to P in its separate reporting. The timing of the interest income recognition depends on the accounting method that S uses (e.g., cash or accrual). The interest income is an intercompany item because it pertains to an intercompany transaction, so it is included in consolidated taxable income when S reports it. P and S Corporations have filed consolidated tax returns for several years. In Year 1,P purchased land as an investment for $55,000. In Year 3, P sold the land to Sfor S100,000. S used the land for four years as additional parking space for its employees and made no improvements to the land. In Year 7, S sells the land to Z Corporation, an unrelated party, for $200,000. The sale's terms require Z to pay $ $40,000 in each of Years 7 through 11. The terms also require Z to pays interest at a rate acceptable to the IRS. Z pays all the required amounts. (Assume the installment method applies.) Read the requirements. Requirement a. What are the intercompany item, the corresponding items, and the recomputed corresponding items? For each item, select the company that is affected, enter the amount, then select the character type and what year the shares were sold in. (Do not round intermediary calculations. Only round the amounts you input in the cell to the nearest dollar.) Company Year land sold Amount Character Intercompany item Corresponding items Recomputed corresponding items Requirement b. In what year(s) does the consolidated group include P's gain or loss and S's gain or loss in its taxable income? Begin by entering any gain or loss for P Corporation, then for S Corporation. Phas in the amount of that is included in consolidated taxable income Shas in in the amount of that is included in consolidated taxable income. Requirement c. How does the consolidated group report the interest income? O A. S and P share equally the interest income earned on the installment sale to Z and report it on their separate taxable income. The timing of the interest recognition depends on the accounting method that S and P use (e.g., cash or accrual). The interest income is an intercompany item because it pertains to an intercompany transaction, so it is included in consolidated taxable income when S and P reports it. B. S includes the income earned on the installment sale to Z in its separate reporting. The timing of the interest income recognition depends on the accounting method that S uses (e.g., cash or accrual). The interest income is not an intercompany item because it pertains to a transaction with a non-group member, so it is included in consolidated taxable income when S reports it. C. P includes the income earned on the installment sale to Z in its separate reporting. The timing of the interest income recognition depends on the accounting method that Puses (e.g., cash or accrual). The interest income is not an intercompany item because it pertains to a transaction with a non-group member, so it is included in consolidated taxable income when P reports it. D. S includes the income earned on the installment sale to P in its separate reporting. The timing of the interest income recognition depends on the accounting method that S uses (e.g., cash or accrual). The interest income is an intercompany item because it pertains to an intercompany transaction, so it is included in consolidated taxable income when S reports it