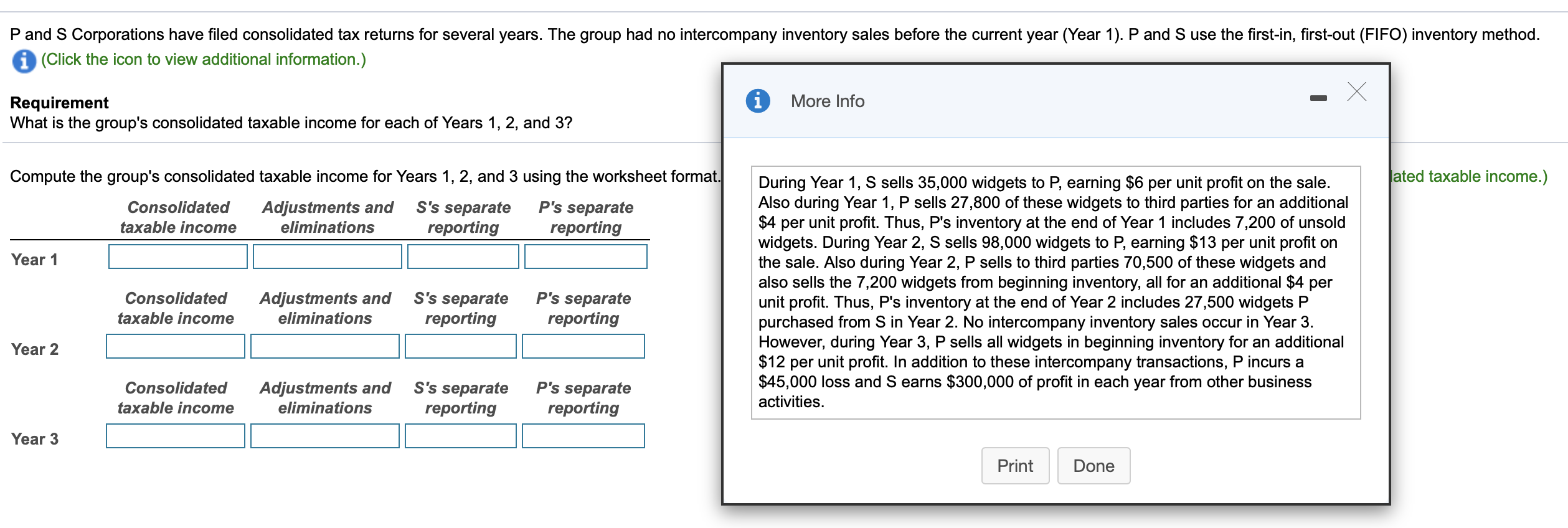

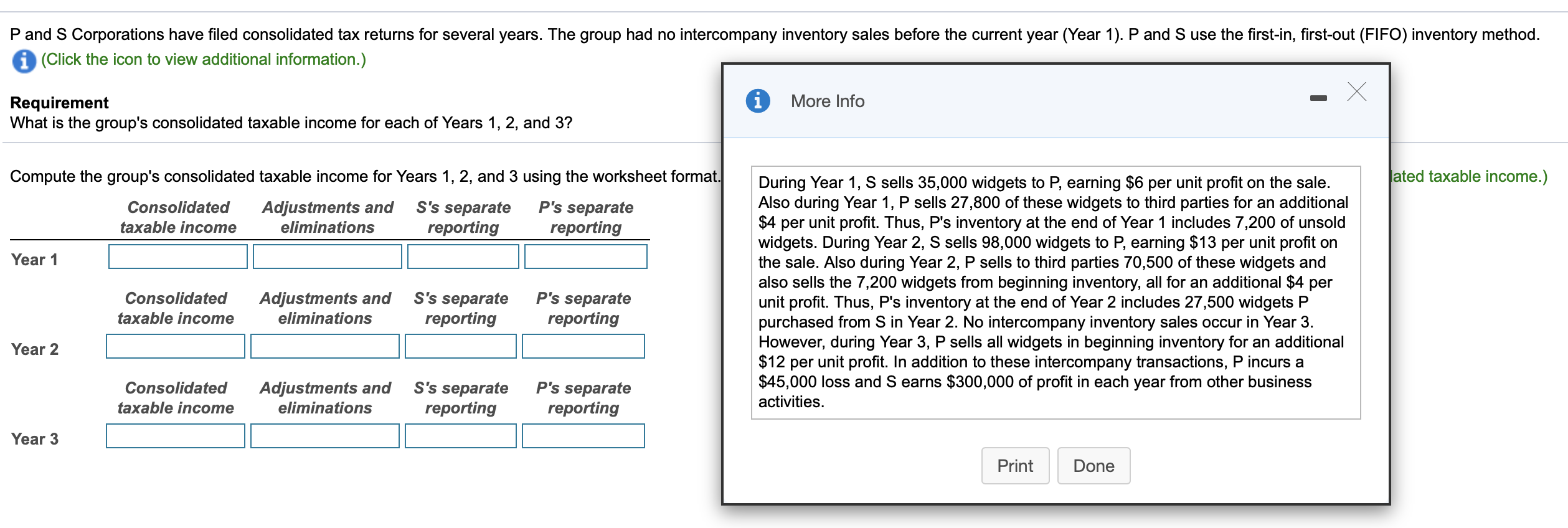

P and S Corporations have filed consolidated tax returns for several years. The group had no intercompany inventory sales before the current year (Year 1). P and S use the first-in, first-out (FIFO) inventory method. i (Click the icon to view additional information.) Requirement i More Info What is the group's consolidated taxable income for each of Years 1, 2, and 3? ated taxable income.) Compute the group's consolidated taxable income for Years 1, 2, and 3 using the worksheet format. Consolidated Adjustments and S's separate P's separate taxable income eliminations reporting reporting Year 1 Consolidated taxable income Adjustments and eliminations S's separate reporting P's separate reporting During Year 1, S sells 35,000 widgets to P, earning $6 per unit profit on the sale. Also during Year 1, P sells 27,800 of these widgets to third parties for an additional $4 per unit profit. Thus, P's inventory at the end of Year 1 includes 7,200 of unsold widgets. During Year 2, S sells 98,000 widgets to P, earning $13 per unit profit on the sale. Also during Year 2, P sells to third parties 70,500 of these widgets and also sells the 7,200 widgets from beginning inventory, all for an additional $4 per unit profit. Thus, P's inventory at the end of Year 2 includes 27,500 widgets P purchased from S in Year 2. No intercompany inventory sales occur in Year 3. However, during Year 3, P sells all widgets in beginning inventory for an additional $12 per unit profit. In addition to these intercompany transactions, P incurs a $45,000 loss and Searns $300,000 of profit in each year from other business activities. Year 2 Consolidated taxable income Adjustments and eliminations S's separate reporting P's separate reporting Year 3 Print Done P and S Corporations have filed consolidated tax returns for several years. The group had no intercompany inventory sales before the current year (Year 1). P and S use the first-in, first-out (FIFO) inventory method. i (Click the icon to view additional information.) Requirement i More Info What is the group's consolidated taxable income for each of Years 1, 2, and 3? ated taxable income.) Compute the group's consolidated taxable income for Years 1, 2, and 3 using the worksheet format. Consolidated Adjustments and S's separate P's separate taxable income eliminations reporting reporting Year 1 Consolidated taxable income Adjustments and eliminations S's separate reporting P's separate reporting During Year 1, S sells 35,000 widgets to P, earning $6 per unit profit on the sale. Also during Year 1, P sells 27,800 of these widgets to third parties for an additional $4 per unit profit. Thus, P's inventory at the end of Year 1 includes 7,200 of unsold widgets. During Year 2, S sells 98,000 widgets to P, earning $13 per unit profit on the sale. Also during Year 2, P sells to third parties 70,500 of these widgets and also sells the 7,200 widgets from beginning inventory, all for an additional $4 per unit profit. Thus, P's inventory at the end of Year 2 includes 27,500 widgets P purchased from S in Year 2. No intercompany inventory sales occur in Year 3. However, during Year 3, P sells all widgets in beginning inventory for an additional $12 per unit profit. In addition to these intercompany transactions, P incurs a $45,000 loss and Searns $300,000 of profit in each year from other business activities. Year 2 Consolidated taxable income Adjustments and eliminations S's separate reporting P's separate reporting Year 3 Print Done