Answered step by step

Verified Expert Solution

Question

1 Approved Answer

P art of solutions: I have already got the completed answer for this question, so I don't need you to give me answer for the

Part of solutions:

I have already got the completed answer for this question, so I don't need you to give me answer for the question. The only thing I need you to help me is give the detailed calculation and explanation for the red part I marked.

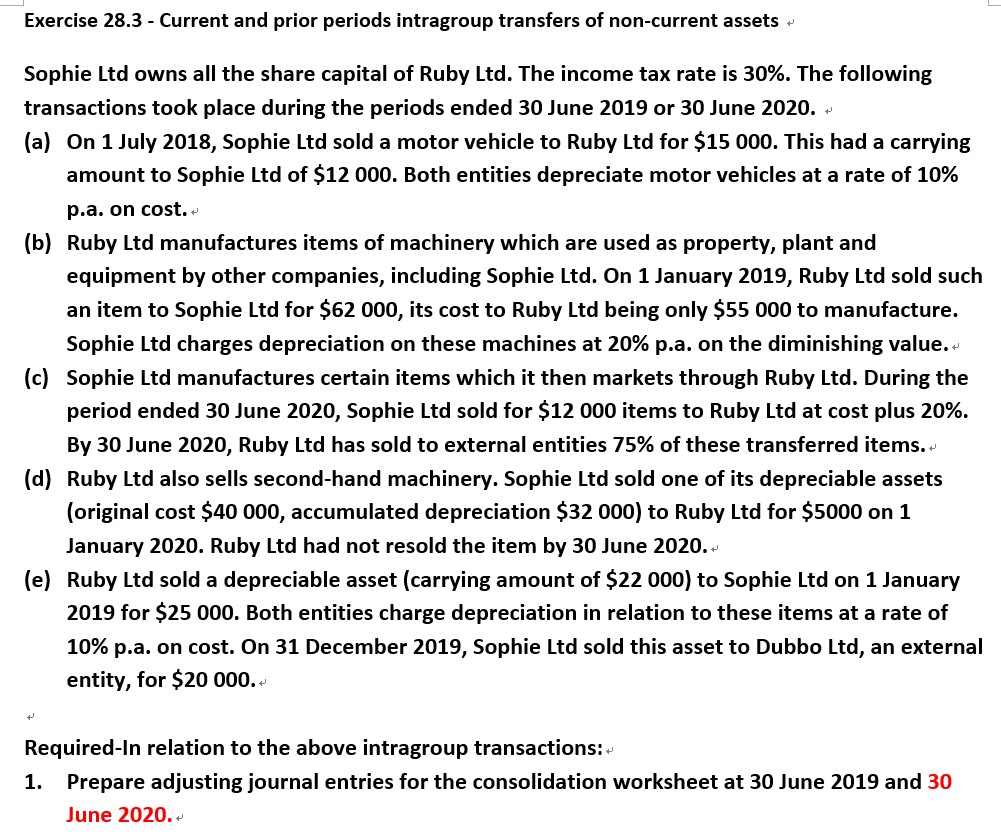

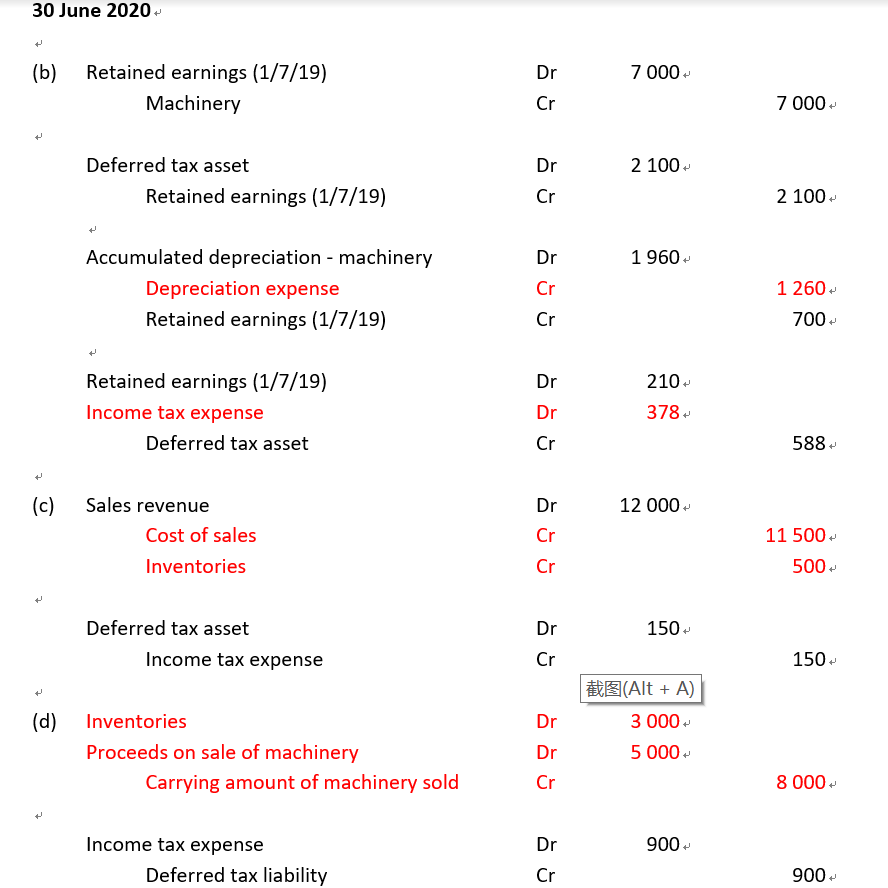

Exercise 28.3 - Current and prior periods intragroup transfers of non-current assets Sophie Ltd owns all the share capital of Ruby Ltd. The income tax rate is 30%. The following transactions took place during the periods ended 30 June 2019 or 30 June 2020.- (a) On 1 July 2018, Sophie Ltd sold a motor vehicle to Ruby Ltd for $15 000. This had a carrying amount to Sophie Ltd of $12 000. Both entities depreciate motor vehicles at a rate of 10% p.a. on cost. (b) Ruby Ltd manufactures items of machinery which are used as property, plant and equipment by other companies, including Sophie Ltd. On 1 January 2019, Ruby Ltd sold such an item to Sophie Ltd for $62 000, its cost to Ruby Ltd being only $55 000 to manufacture. Sophie Ltd charges depreciation on these machines at 20% p.a. on the diminishing value. (c) Sophie Ltd manufactures certain items which it then markets through Ruby Ltd. During the period ended 30 June 2020, Sophie Ltd sold for $12 000 items to Ruby Ltd at cost plus 20%. By 30 June 2020, Ruby Ltd has sold to external entities 75% of these transferred items.- (d) Ruby Ltd also sells second-hand machinery. Sophie Ltd sold one of its depreciable assets (original cost $40 000, accumulated depreciation $32 000) to Ruby Ltd for $5000 on 1 January 2020. Ruby Ltd had not resold the item by 30 June 2020.- (e) Ruby Ltd sold a depreciable asset (carrying amount of $22 000) to Sophie Ltd on 1 January 2019 for $25 000. Both entities charge depreciation in relation to these items at a rate of 10% p.a. on cost. On 31 December 2019, Sophie Ltd sold this asset to Dubbo Ltd, an external entity, for $20 000. t Required-In relation to the above intragroup transactions:- 1. Prepare adjusting journal entries for the consolidation worksheet at 30 June 2019 and 30 June 2020. 30 June 2020 t (b) Dr 7 000 Retained earnings (1/7/19) Machinery Cr 7 000 - Dr 2 100- Deferred tax asset Retained earnings (1/7/19) Cr 2 100- Dr 1960- Accumulated depreciation - machinery Depreciation expense Retained earnings (1/7/19) Cr 1 260 700- Cr Dr 210- Retained earnings (1/7/19) Income tax expense Deferred tax asset Dr 378 Cr 588 t + (c) Dr 12 000 Sales revenue Cost of sales Inventories Cr 11 500- 500- Cr Dr 150 t Deferred tax asset Income tax expense Cr 150 - + Dr (d) Inventories Proceeds on sale of machinery Carrying amount of machinery sold Alt + A) 3 000 - 5000 - Dr Cr 8 000- Dr 900- Income tax expense Deferred tax liability Cr 900- t Dr 1995 855 Dr (e) Retained earnings (1/7/19) Income tax expense Depreciation expense Carrying amount of asset sold Cr 150 Cr 2 700 Exercise 28.3 - Current and prior periods intragroup transfers of non-current assets Sophie Ltd owns all the share capital of Ruby Ltd. The income tax rate is 30%. The following transactions took place during the periods ended 30 June 2019 or 30 June 2020.- (a) On 1 July 2018, Sophie Ltd sold a motor vehicle to Ruby Ltd for $15 000. This had a carrying amount to Sophie Ltd of $12 000. Both entities depreciate motor vehicles at a rate of 10% p.a. on cost. (b) Ruby Ltd manufactures items of machinery which are used as property, plant and equipment by other companies, including Sophie Ltd. On 1 January 2019, Ruby Ltd sold such an item to Sophie Ltd for $62 000, its cost to Ruby Ltd being only $55 000 to manufacture. Sophie Ltd charges depreciation on these machines at 20% p.a. on the diminishing value. (c) Sophie Ltd manufactures certain items which it then markets through Ruby Ltd. During the period ended 30 June 2020, Sophie Ltd sold for $12 000 items to Ruby Ltd at cost plus 20%. By 30 June 2020, Ruby Ltd has sold to external entities 75% of these transferred items.- (d) Ruby Ltd also sells second-hand machinery. Sophie Ltd sold one of its depreciable assets (original cost $40 000, accumulated depreciation $32 000) to Ruby Ltd for $5000 on 1 January 2020. Ruby Ltd had not resold the item by 30 June 2020.- (e) Ruby Ltd sold a depreciable asset (carrying amount of $22 000) to Sophie Ltd on 1 January 2019 for $25 000. Both entities charge depreciation in relation to these items at a rate of 10% p.a. on cost. On 31 December 2019, Sophie Ltd sold this asset to Dubbo Ltd, an external entity, for $20 000. t Required-In relation to the above intragroup transactions:- 1. Prepare adjusting journal entries for the consolidation worksheet at 30 June 2019 and 30 June 2020. 30 June 2020 t (b) Dr 7 000 Retained earnings (1/7/19) Machinery Cr 7 000 - Dr 2 100- Deferred tax asset Retained earnings (1/7/19) Cr 2 100- Dr 1960- Accumulated depreciation - machinery Depreciation expense Retained earnings (1/7/19) Cr 1 260 700- Cr Dr 210- Retained earnings (1/7/19) Income tax expense Deferred tax asset Dr 378 Cr 588 t + (c) Dr 12 000 Sales revenue Cost of sales Inventories Cr 11 500- 500- Cr Dr 150 t Deferred tax asset Income tax expense Cr 150 - + Dr (d) Inventories Proceeds on sale of machinery Carrying amount of machinery sold Alt + A) 3 000 - 5000 - Dr Cr 8 000- Dr 900- Income tax expense Deferred tax liability Cr 900- t Dr 1995 855 Dr (e) Retained earnings (1/7/19) Income tax expense Depreciation expense Carrying amount of asset sold Cr 150 Cr 2 700Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started