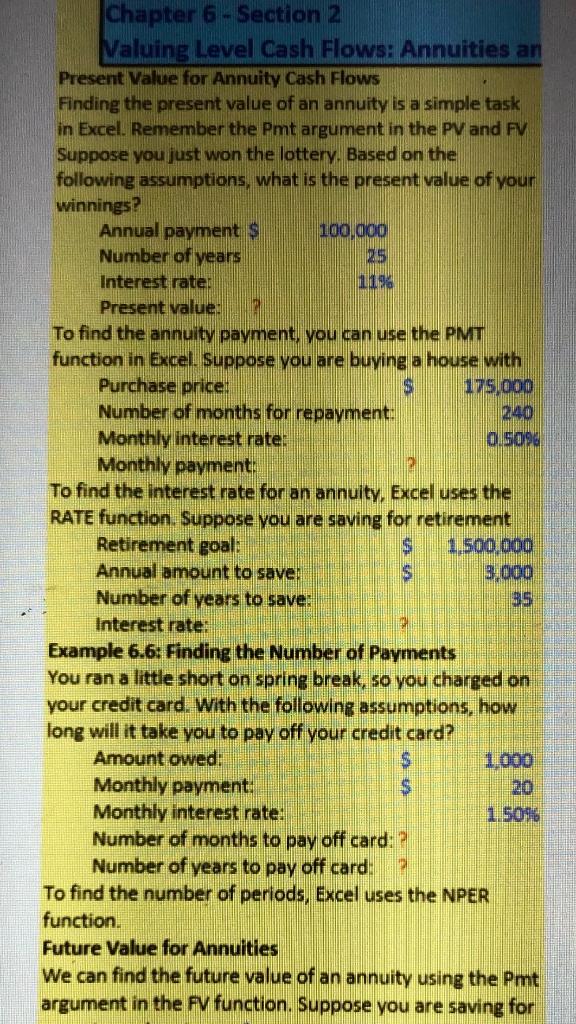

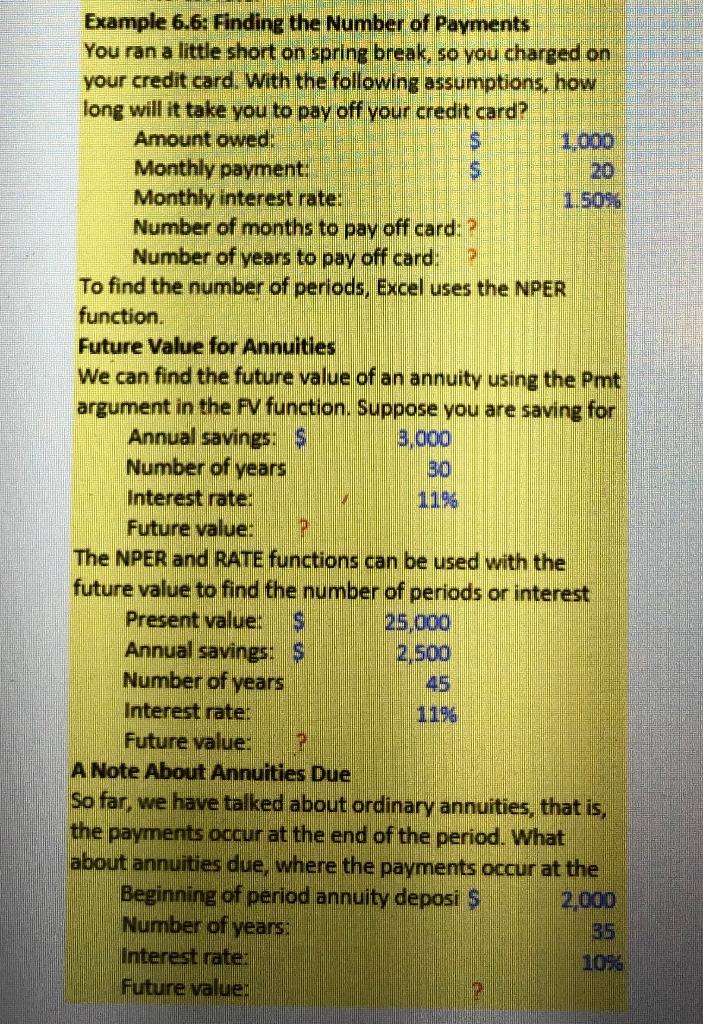

P Chapter 6 - Section 2 Valuing Level Cash Flows: Annuities an Present Value for Annuity Cash Flows Finding the present value of an annuity is a simple task in Excel. Remember the Pmt argument in the PV and FV Suppose you just won the lottery. Based on the following assumptions, what is the present value of your winnings? Annual payment S 100.000 Number of years 25 Interest rate: 119 Present value. To find the annuity payment, you can use the PMT function in Excel. Suppose you are buying a house with Purchase price: S 175 000 Number of months for repayment: 240 Monthly interest rate: 0.6096 Monthly payment: To find the interest rate for an annuity, Excel uses the RATE function Suppose you are saving for retirement Retirement goal: $ 1.500.000 Annual amount to save. $ 3.000 Number of years to save: 35 Interest rate: Example 6.6: Finding the Number of Payments You ran a little short on spring break, so you charged on your credit card. With the following assumptions, how long will it take you to pay off your credit card? Amount owed: $ 1,000 Monthly payment: $ 20 Monthly interest rate: 1.509 Number of months to pay off card: ? Number of years to pay off card: To find the number of periods, Excel uses the NPER function. Future Value for Annuities We can find the future value of an annuity using the Pmt argument in the fv function. Suppose you are saving for us Example 6.6: Finding the Number of Payments You ran a little short on spring break, so you charged on your credit card. With the following assumptions, how long will it take you to pay off your credit card? Amount owed: 1.000 Monthly payment: $ 20 Monthly interest rate: 1.5096 Number of months to pay off card: ? Number of years to pay off card: To find the number of periods, Excel uses the NPER function. Future Value for Annuities We can find the future value of an annuity using the Pmt argument in the FV function. Suppose you are saving for Annual savings: $ 3.000 Number of years Interest rate: Future value: P The NPER and RATE functions can be used with the future value to find the number of periods or interest Present value: S 25,000 Annual savings: $ 2,500 Number of years Interest rate: Future value: A Note About Annuities Due So far, we have talked about ordinary annuities, that is, the payments occur at the end of the period. What about annuities due, where the payments occur at the Beginning of period annuity deposi $ 2,000 Number of years Interest rate: 106. Future value