Answered step by step

Verified Expert Solution

Question

1 Approved Answer

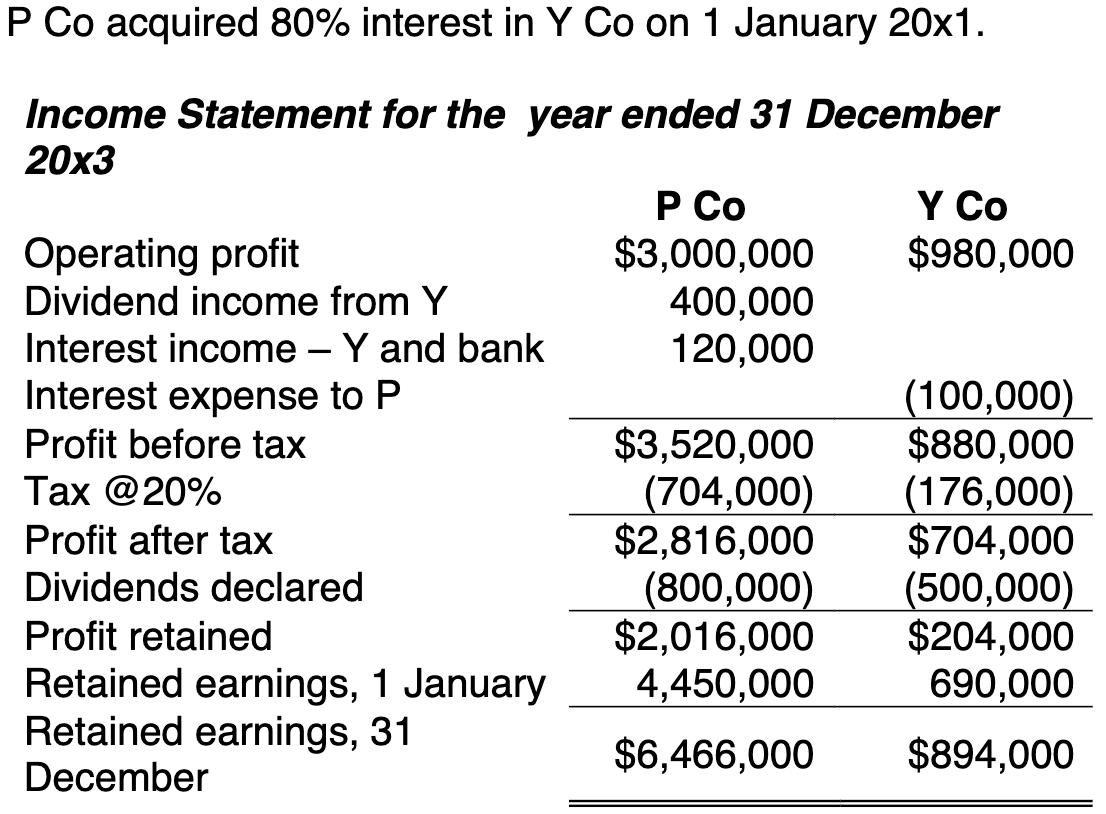

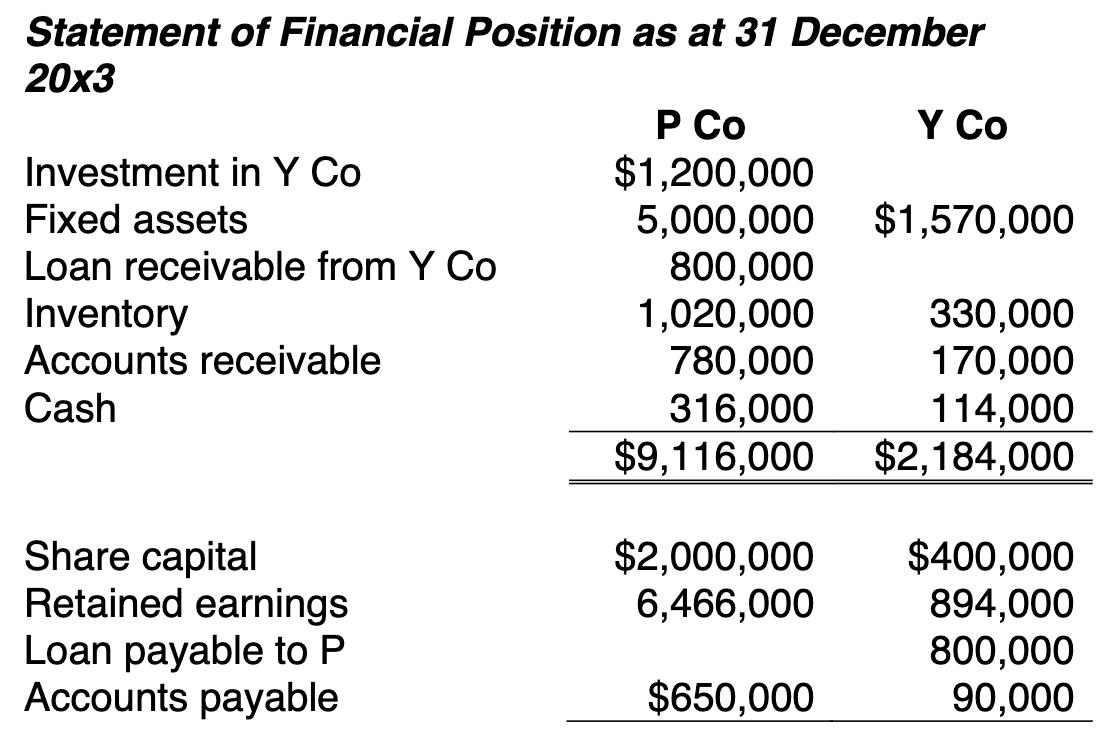

P Co acquired 80% interest in Y Co on 1 January 20x1. Income Statement for the year ended 31 December 20x3 Operating profit Dividend

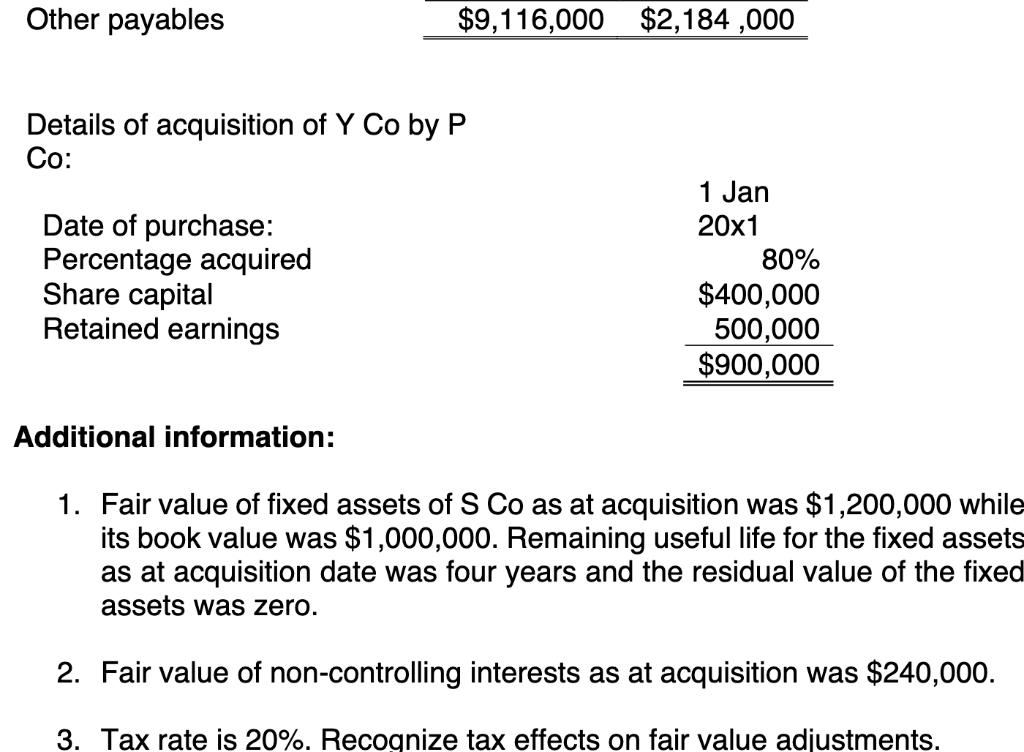

P Co acquired 80% interest in Y Co on 1 January 20x1. Income Statement for the year ended 31 December 20x3 Operating profit Dividend income from Y Interest income Y and bank Interest expense to P Profit before tax Tax @20% Profit after tax Dividends declared Profit retained Retained earnings, 1 January Retained earnings, 31 December P Co $3,000,000 400,000 120,000 Y Co $980,000 (100,000) $880,000 $3,520,000 (704,000) (176,000) $2,816,000 $704,000 (800,000) (500,000) $2,016,000 $204,000 4,450,000 690,000 $6,466,000 $894,000 Statement of Financial Position as at 31 December 20x3 Investment in Y Co Fixed assets Loan receivable from Y Co Inventory Accounts receivable Cash Share capital Retained earnings Loan payable to P Accounts payable P Co $1,200,000 5,000,000 $1,570,000 800,000 1,020,000 780,000 316,000 $9,116,000 Y Co $2,000,000 6,466,000 $650,000 330,000 170,000 114,000 $2,184,000 $400,000 894,000 800,000 90,000 Other payables Details of acquisition of Y Co by P Co: Date of purchase: Percentage acquired Share capital Retained earnings $9,116,000 $2,184,000 Additional information: 1 Jan 20x1 80% $400,000 500,000 $900,000 1. Fair value of fixed assets of S Co as at acquisition was $1,200,000 while its book value was $1,000,000. Remaining useful life for the fixed assets as at acquisition date was four years and the residual value of the fixed assets was zero. 2. Fair value of non-controlling interests as at acquisition was $240,000. 3. Tax rate is 20%. Recognize tax effects on fair value adjustments. Required (a) Prepare the consolidation adjustments for the year ended 31 December 20x3. (b) Perform an analytical check of the non-controlling interests' balance as at 31 December 20x3.

Step by Step Solution

★★★★★

3.39 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started