Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Frankie, Dino, Sammy, Peter, & Joey incorporate their partnership, Each member makes the following contributions to the new corporation, Rat Pack Vegas, Inc. (Rats,

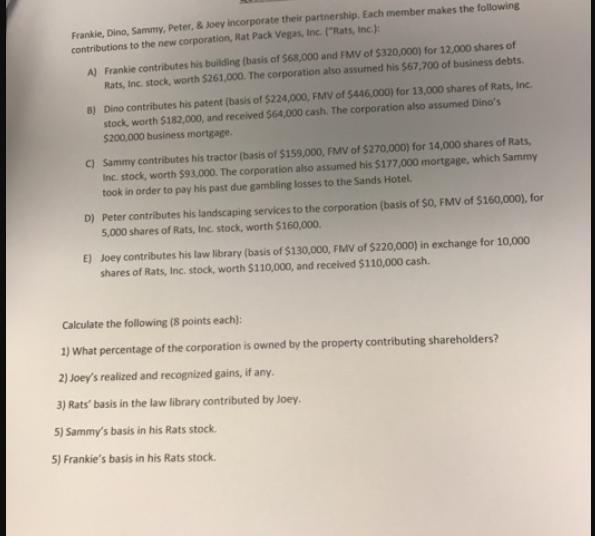

Frankie, Dino, Sammy, Peter, & Joey incorporate their partnership, Each member makes the following contributions to the new corporation, Rat Pack Vegas, Inc. ("Rats, Inc.): A) Frankie contributes his building (basis of $68,000 and FMV of $320,000) for 12,000 shares of Rats, Inc. stock, worth $261,000. The corporation also assumed his $67,700 of business debts. 8) Dino contributes his patent (basis of 5224,000, FMV of 5446,000) for 13,000 shares of Rats, Inc. stock, worth $182,000, and received $64,000 cash. The corporation also assumed Dino's $200,000 business mortgage. C) Sammy contributes his tractor (basis of $159,000, FMV of $270,000) for 14,000 shares of Rats, Inc. stock, worth $93,000. The corporation also assumed his $177,000 mortgage, which Sammy took in order to pay his past due gambling losses to the Sands Hotel. D) Peter contributes his landscaping services to the corporation (basis of $0, FMV of $160,000), for 5,000 shares of Rats, Inc. stock, worth $160,000. E) Joey contributes his law library (basis of $130,000, FMV of $220,000) in exchange for 10,000 shares of Rats, Inc. stock, worth $110,000, and received $110,000 cash. Calculate the following (8 points each): 1) What percentage of the corporation is owned by the property contributing shareholders? 2) Joey's realized and recognized gains, if any. 3) Rats' basis in the law library contributed by Joey. 5) Sammy's basis in his Rats stock. 5) Frankie's basis in his Rats stock.

Step by Step Solution

★★★★★

3.46 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

1 A Frankie 1200040000 30 B Dino 1300040000 325 C Sammy 1400040000 35 D Peter 500040000 125 E Joey 1000040000 25 The property contributing shareholder...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started