Answered step by step

Verified Expert Solution

Question

1 Approved Answer

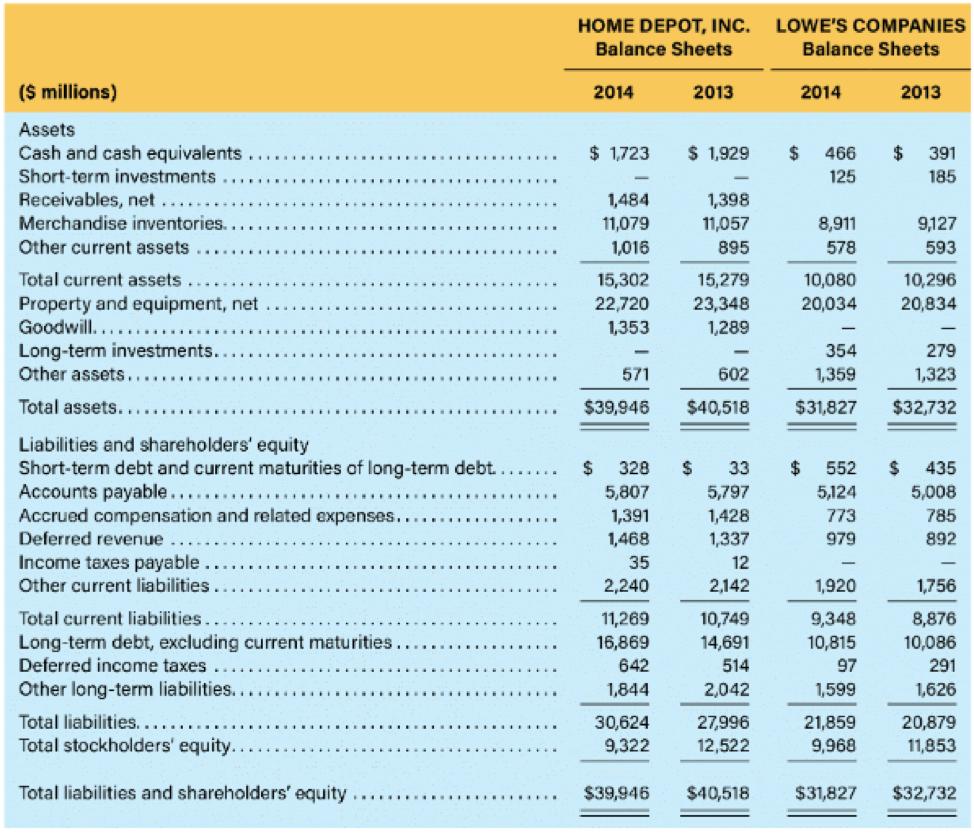

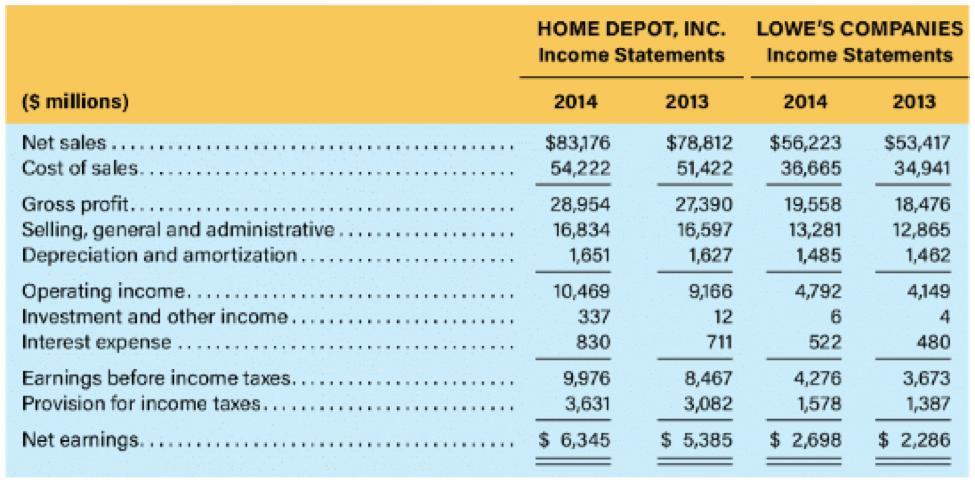

Analysis and Interpretation of Return on Investment for Competitors Balance sheets and income statements for The Home Depot, Inc., and Lowes Companies, Inc., follow. Refer

Analysis and Interpretation of Return on Investment for Competitors

Balance sheets and income statements for The Home Depot, Inc., and Lowe’s Companies, Inc., follow. Refer to these financial statements to answer the requirements.

- Compute return on equity (ROE), return on assets (ROA), and return on financial leverage (ROFL) for each company in 2014.

- Disaggregate the ROA’s computed into profit margin (PM) and asset turnover (AT) components. Which of these factors drives ROA for each company?

- Compute the gross profit margin (GPM) and operating expense-to-sales ratios for each company. How do these companies’ profitability measures compare?

- Compute the accounts receivable turnover (ART), inventory turnover (INVT), and property, plant, and equipment turnover (PPET) for each company. how do these companies’ turnover measures compare?

- Compare and evaluate these competitors’ performance in 2014.

Given information:

1. ICA 1 statutory tax rate = 35 %

2. The “Receivables, net” values for Lowe’s in 2014 and 2013 are 0.

HOME DEPOT, INC. Balance Sheets LOWE'S COMPANIES Balance Sheets ($ millions) 2014 2013 2014 2013 Assets Cash and cash equivalents.. Short-term investments $ 1,723 $ 1,929 24 466 $4 391 125 185 Receivables, net... Merchandise inventories. 1,484 11,079 1,016 1,398 11,057 8,911 9,127 Other current assets 895 578 593 Total current assets 15,302 22,720 15,279 23,348 10,296 20,834 10,080 Property and equipment, net Goodwill... 20,034 1,353 1,289 Long-term investments. Other assets. 354 279 571 602 1,359 1,323 Total assets. ... $39,946 $40,518 $31,827 $32,732 Liabilities and shareholders' equity Short-term debt and current maturities of long-term debt. Accounts payable.... . Accrued compensation and related expenses... Deferred revenue 24 552 5,124 24 328 33 %24 435 5,008 785 5,807 5,797 1,428 1,391 773 1,468 1,337 979 892 Income taxes payable. Other current liabilities 35 12 2,240 2,142 1,920 1,756 Total current liabilities. Long-term debt, excluding current maturities. Deferred income taxes 11,269 16,869 10,749 14,691 9,348 10,815 8,876 10,086 291 642 514 97 Other long-term liabilities... 1,844 2,042 1,599 1,626 Total liabilities... Total stockholders' equity. 27,996 12,522 30,624 21,859 20,879 9,322 9,968 11,853 Total liabilities and shareholders' equity $39,946 $40,518 $31,827 $32,732 ....... .......

Step by Step Solution

★★★★★

3.43 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started