Answered step by step

Verified Expert Solution

Question

1 Approved Answer

P Corporation, a U.S. Company, invested 60,000 pound sterling () to create a subsidiary, 5 Company, in United Kingdom on January 1, 2020. Additional information

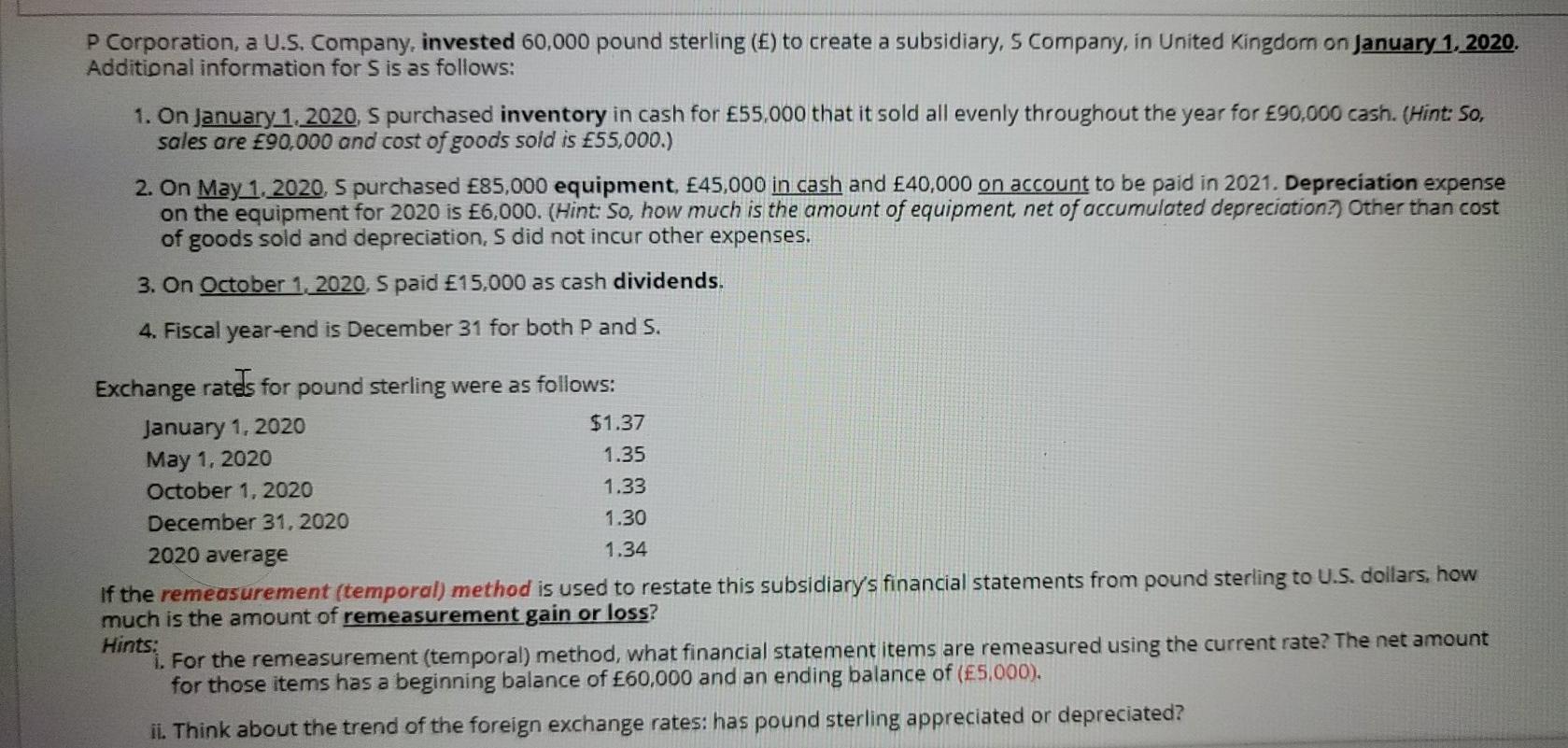

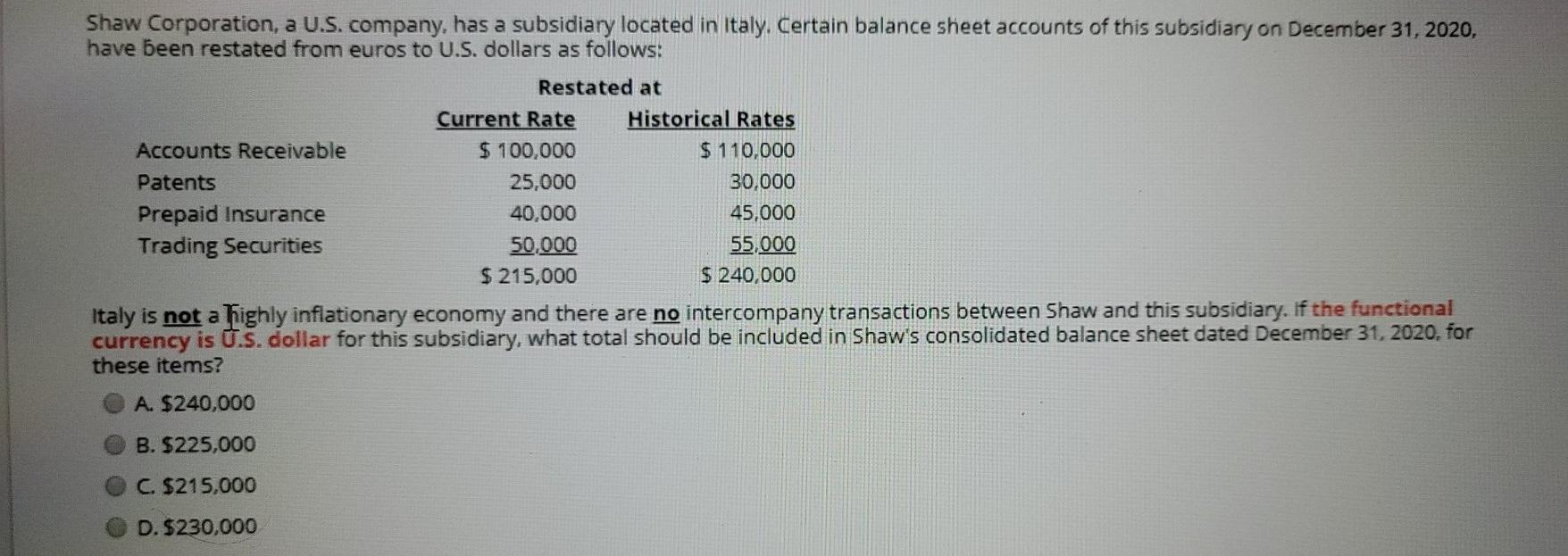

P Corporation, a U.S. Company, invested 60,000 pound sterling () to create a subsidiary, 5 Company, in United Kingdom on January 1, 2020. Additional information for S is as follows: 1. On January 1, 2020, S purchased inventory in cash for 55,000 that it sold all evenly throughout the year for 90,000 cash. (Hint: so, sales are 90,000 and cost of goods sold is 55,000.) 2. On May 1, 2020. S purchased 85,000 equipment, 45,000 in cash and 40,000 on account to be paid in 2021. Depreciation expense on the equipment for 2020 is 6,000. (Hint: So, how much is the amount of equipment net of accumulated depreciation?) Other than cost of goods sold and depreciation, S did not incur other expenses. 3. On October 1, 2020. S paid 15,000 as cash dividends. 4. Fiscal year-end is December 31 for both P and S. Exchange rates for pound sterling were as follows: January 1, 2020 $1.37 May 1, 2020 1.35 October 1, 2020 1.33 December 31, 2020 1.30 2020 average 1.34 If the remeasurement (temporal) method is used to restate this subsidiary's financial statements from pound sterling to U.S. dollars, how much is the amount of remeasurement gain or loss? Hints: i. For the remeasurement (temporal) method, what financial statement items are remeasured using the current rate? The net amount for those items has a beginning balance of 60,000 and an ending balance of (5,000). it. Think about the trend of the foreign exchange rates: has pound sterling appreciated or depreciated? Shaw Corporation, a U.S. company, has a subsidiary located in Italy. Certain balance sheet accounts of this subsidiary on December 31, 2020, have been restated from euros to U.S. dollars as follows: Restated at Current Rate Historical Rates Accounts Receivable $ 100,000 $ 110,000 Patents 25,000 30,000 Prepaid Insurance 40,000 45,000 Trading Securities 50,000 55,000 $ 215,000 $ 240,000 Italy is not a highly inflationary economy and there are no intercompany transactions between Shaw and this subsidiary. If the functional currency is U.S. dollar for this subsidiary, what total should be included in Shaw's consolidated balance sheet dated December 31, 2020, for these items? A. $240,000 B. $225,000 C. $215,000 D. $230,000 P Corporation, a U.S. Company, invested 60,000 pound sterling () to create a subsidiary, 5 Company, in United Kingdom on January 1, 2020. Additional information for S is as follows: 1. On January 1, 2020, S purchased inventory in cash for 55,000 that it sold all evenly throughout the year for 90,000 cash. (Hint: so, sales are 90,000 and cost of goods sold is 55,000.) 2. On May 1, 2020. S purchased 85,000 equipment, 45,000 in cash and 40,000 on account to be paid in 2021. Depreciation expense on the equipment for 2020 is 6,000. (Hint: So, how much is the amount of equipment net of accumulated depreciation?) Other than cost of goods sold and depreciation, S did not incur other expenses. 3. On October 1, 2020. S paid 15,000 as cash dividends. 4. Fiscal year-end is December 31 for both P and S. Exchange rates for pound sterling were as follows: January 1, 2020 $1.37 May 1, 2020 1.35 October 1, 2020 1.33 December 31, 2020 1.30 2020 average 1.34 If the remeasurement (temporal) method is used to restate this subsidiary's financial statements from pound sterling to U.S. dollars, how much is the amount of remeasurement gain or loss? Hints: i. For the remeasurement (temporal) method, what financial statement items are remeasured using the current rate? The net amount for those items has a beginning balance of 60,000 and an ending balance of (5,000). it. Think about the trend of the foreign exchange rates: has pound sterling appreciated or depreciated? Shaw Corporation, a U.S. company, has a subsidiary located in Italy. Certain balance sheet accounts of this subsidiary on December 31, 2020, have been restated from euros to U.S. dollars as follows: Restated at Current Rate Historical Rates Accounts Receivable $ 100,000 $ 110,000 Patents 25,000 30,000 Prepaid Insurance 40,000 45,000 Trading Securities 50,000 55,000 $ 215,000 $ 240,000 Italy is not a highly inflationary economy and there are no intercompany transactions between Shaw and this subsidiary. If the functional currency is U.S. dollar for this subsidiary, what total should be included in Shaw's consolidated balance sheet dated December 31, 2020, for these items? A. $240,000 B. $225,000 C. $215,000 D. $230,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started