Question

P is currently an all-equity company, which expects to stay profitable for an indefinite number of years, with an expected annual Earnings Before Interest and

P is currently an all-equity company, which expects to stay profitable for an indefinite number of years, with an expected annual Earnings Before Interest and Taxes of $390,000. The size of this company's income puts it into a 40% income tax rate bracket. Its cost of equity equals 13%.

r is considering taking a loan in the amount of $350,000 at an annual loan interest rate of 5%. Will this affect the company's valuation? Let's do some math! (When solving this problem, assume that all Miller-Modigliani assumptions hold.)

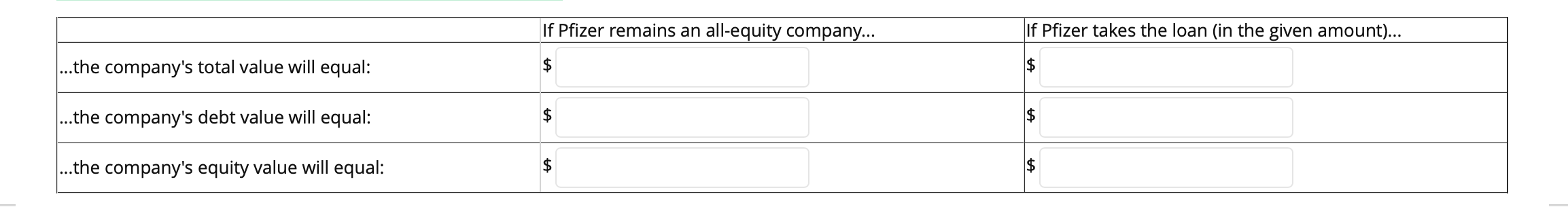

Fill out the table below. Round all values to WHOLE dollar.

Hint: You won't need to use one of the numbers that is given

If Pfizer remains an all-equity company... If Pfizer takes the loan (in the given amount)... ...the company's total value will equal: $ $ ...the company's debt value will equal: $ $ ...the company's equity value will equal: $ $Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started