Question

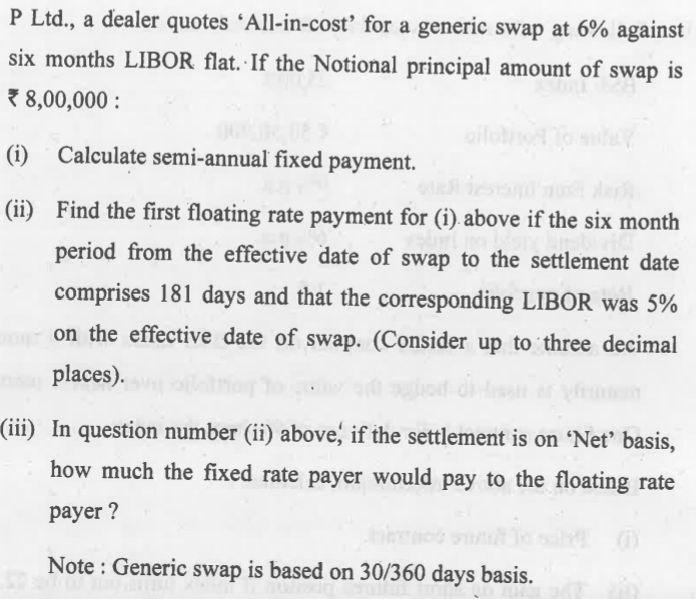

P Ltd., a dealer quotes 'All-in-cost' for a generic swap at 6% against six months LIBOR flat. If the Notional principal amount of swap

P Ltd., a dealer quotes 'All-in-cost' for a generic swap at 6% against six months LIBOR flat. If the Notional principal amount of swap is 7 8,00,000 : oilo (i) Calculate semi-annual fixed payment. (ii) Find the first floating rate payment for (i). above if the six month period from the effective date of swap to the settlement date comprises 181 days and that the corresponding LIBOR was 5% on the effective date of swap. (Consider up to three decimal places). (iii) In question number (ii) above, if the settlement is on 'Net' basis, how much the fixed rate payer would pay to the floating rate payer ? Note : Generic swap is based on 30/360 days basis.

Step by Step Solution

3.39 Rating (174 Votes )

There are 3 Steps involved in it

Step: 1

Semi annual fixed payment Notional principal amount x All in cost x ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Multinational Finance Evaluating Opportunities Costs and Risks of Operations

Authors: Kirt C. Butler

5th edition

1118270126, 978-1118285169, 1118285166, 978-1-119-2034, 978-1118270127

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App