Question

P Ltd acquired / disposed the shares of S Ltd (whose share capital of $100 million comprises 100 million ordinary shares) as follows: Required: (a)

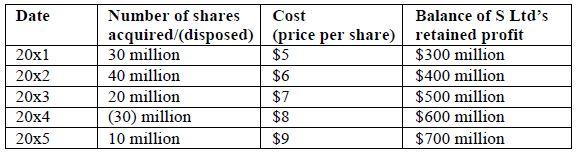

P Ltd acquired / disposed the shares of S Ltd (whose share capital of $100 million comprises 100 million ordinary shares) as follows:

Required: (a) Calculate the amount of goodwill that is recognised in the consolidated statement of financial position for each of the years 20x1 to 20x5. Assume that a direct shareholding of more than 50% gives rise to control and a direct shareholding of 20% or more but less than 50% gives rise to significant influence.

(b) Based on P Ltds acquisitions/disposal of the shares of S Ltd, identify the various types of changes in shareholding and explain the accounting treatment for goodwill for each type of change in shareholding.

Date 20x1 20x2 20x3 20x4 20x5 Number of shares Cost Balance of S Ltd's acquired/(disposed) (price per share) retained profit 30 million $5 $300 million 40 million $6 $400 million 20 million $7 $500 million (30) million $8 $600 million 10 million $9 $700 millionStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started