Answered step by step

Verified Expert Solution

Question

1 Approved Answer

P Ltd, S Ltd and A Ltd, acquisition of subsidiary and investment in associates, IFRS 3 and IAS 28) On Jul 1, 2019, P

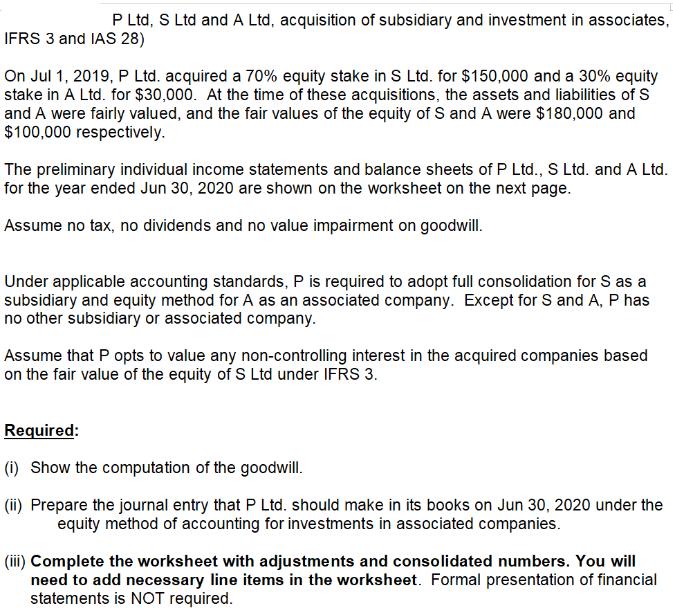

P Ltd, S Ltd and A Ltd, acquisition of subsidiary and investment in associates, IFRS 3 and IAS 28) On Jul 1, 2019, P Ltd. acquired a 70% equity stake in S Ltd. for $150,000 and a 30% equity stake in A Ltd. for $30,000. At the time of these acquisitions, the assets and liabilities of S and A were fairly valued, and the fair values of the equity of S and A were $180,000 and $100,000 respectively. The preliminary individual income statements and balance sheets of P Ltd., S Ltd. and A Ltd. for the year ended Jun 30, 2020 are shown on the worksheet on the next page. Assume no tax, no dividends and no value impairment on goodwill. Under applicable accounting standards, P is required to adopt full consolidation for S as a subsidiary and equity method for A as an associated company. Except for S and A, P has no other subsidiary or associated company. Assume that P opts to value any non-controlling interest in the acquired companies based on the fair value of the equity of S Ltd under IFRS 3. Required: (i) Show the computation of the goodwill. (ii) Prepare the journal entry that P Ltd. should make in its books on Jun 30, 2020 under the equity method of accounting for investments in associated companies. (iii) Complete the worksheet with adjustments and consolidated numbers. You will need to add necessary line items in the worksheet. Formal presentation of financial statements is NOT required.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started