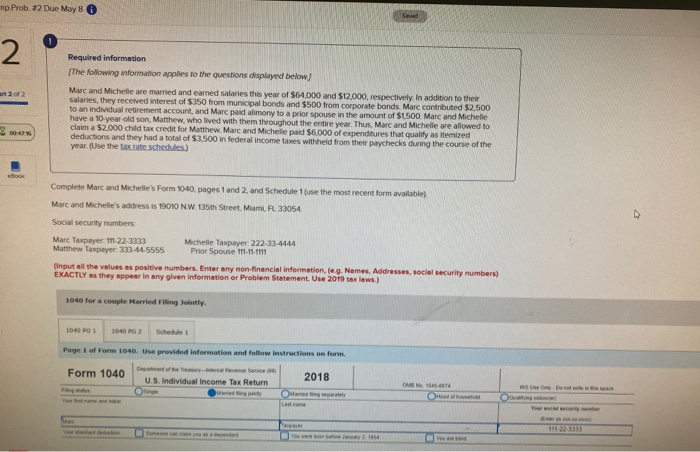

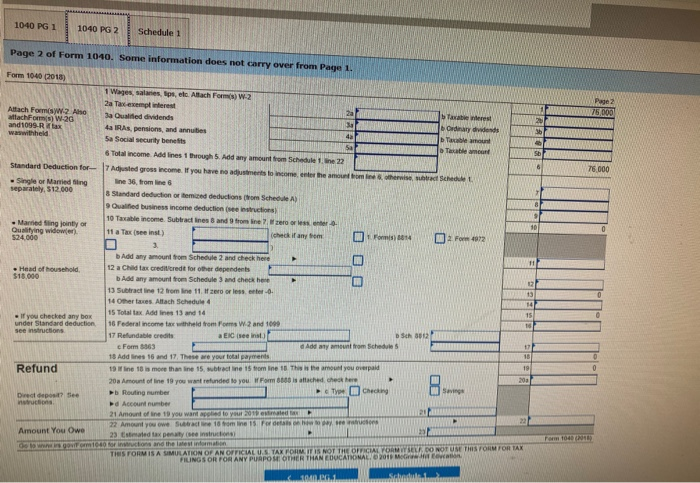

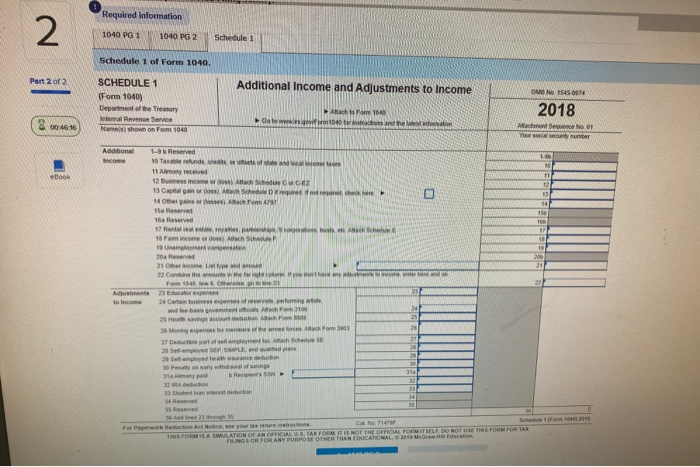

p. Prob. #2 Due May 8 6 Required information The following information applies to the questions displayed below IN Marc and Michelle are married and earned salaries this year of $64,000 and $12,000, respectively in addition to their salaries, they received interest of $350 from municipal bonds and $500 from corporate bonds. Marc contributed $2.500 to an individual retirement account, and Marc pakalimony to a prior spouse in the amount of $1500. Marc and Michelle have a 10 year-old son, Matthew, who lived with them thoughout the entire year. Thus, Mare and Michelle are allowed to claim a $2.000 child tax credit for Matthew. Mare and Michelle paid $6.000 of expenditures that quality as itemized deductions and they had a total of $3.500 in federal income taxes withheld from the paychecks during the course of the year. Use the text schedules) use the most recent for available) Complete Mare and Michelle's Form 1040, page 1 and 2 and Schedule Marc and Michelie's address is 19010 NW 5th Street, Miami, FL 33054 Social security numbers Mare Taxpayer 223033 Matthew Taxpayer: 333 44 5555 Michelle Taxpayer: 222-33-4444 Prior spouse input all the values as positive numbers. Enter any non-financial information, le Name Addresses, social security numbers) EXACTLY as they appear in any given information or Problem Statement. Use 2019 tax laws.) 1040 for a couple Marr i ng Jointly 1040 01 1040 G2 Schedule 1 Page 1 of Form 100. provided information and follow instructions on form. Form 1040 U.S. Individual income Tax Return 2018 1040 PG 1 1040 PG 2 Schedule 1 Page 2 of Form 1040. Some information does not carry over from Page 1. Form 1040 (2018) Attach Forms 2 Ano attachForms W.2G and 1099-R tax was withheld Standard Deduction for - Single of Manied sing separately $12.000 1 Wages, sales, lips, etc. Allach For W-2 2a Tax exempt interest 3a Qualified dividende 4 As, pensions, and annuities 5a Social security benefits 6 Total income. Add lines through 5. Add any amount from Schedule 1, the 22 7 Austed gross income. If you have ne adjustments to come enter the amount om Iine 36. tromline 8 Standard deduction or temced deductions from Schedule Oualified business income deduction restructions 10 Taxable income. Subtract lines and from line e r orienter 11 a Tax (see inst.) check if any om i S L Manned fling jointly or Qualifying widown om 872 Head of household, BE Bales - If you checked any box under Standard deduction Add any amount from Schedule and check here 12 a Chid tax credit credit for other dependents Add any amount from Schedule and check here 13 Subtract line 12 from line 11 of zero or less enter-0. 14 Omar taxes. Attach Schedule 4 15 Total tax A nes 13 and 14 16 Federal income tax withheld from From W-2 and 1099 17 Refundable credits EC (see ins) Form $363 Add y n from Schedules 13 Addnes 16 and 17. These we your total payments 19 line 18 is more than in 15. wbtaines troine 18 This the amount you verpaid 20 Amount of line to you want refunded to you for is attached check the Routing number Type Checking d Account number 21 Amount of line to you want ed to your 2011 22 Amount you owe Subac 10mline 15 23 Estated tax penatis instructions con and the informat TICS TORM IS A SIMULATION OF AN OFFICIAL USTANO IS NOT THE OFFICIAL VORMISELE DO NOT USE THIS FORM FOR V AMAN 2011 Me i Refund Direct deposit see Amount You Owe Required information 1040 PG 1 1040 PG 2 Schedule 1 Schedule 1 of Form 1040. Part 2 of 2 Additional Income and Adjustments to Income OMON 1545001 SCHEDULE 1 (Form 1040) Department of the Treasury em Revenue Service Nam shown on Form 1040 2018 8 00:46:16 www.govifcem 100 rud our SeoENDI security number of land 1-9b Reserved 10 Table refunds 11 Almony received 12 Dessin 13 Capital 14 Other 15 Aach Schacuc Aache r For 4797 17 Resta s construitsche 18 Famiones c h Scheue V Unc enso 21 Cheri Led 22 the Form 1641, onun 23 Edico expenses 24 Carte r performing wsts and bass gu a cho 100 25 He c ho 0 26 spor themed chom 27 Deductoare Anth Schee SE 23 Selangoed SER ME 29 Samped hen detin 30 Peon say who savings Simona SIRA wion 23 Sentul 14 Reserved THIS FIMIS A SIMULATION OF AN OFFICIA p. Prob. #2 Due May 8 6 Required information The following information applies to the questions displayed below IN Marc and Michelle are married and earned salaries this year of $64,000 and $12,000, respectively in addition to their salaries, they received interest of $350 from municipal bonds and $500 from corporate bonds. Marc contributed $2.500 to an individual retirement account, and Marc pakalimony to a prior spouse in the amount of $1500. Marc and Michelle have a 10 year-old son, Matthew, who lived with them thoughout the entire year. Thus, Mare and Michelle are allowed to claim a $2.000 child tax credit for Matthew. Mare and Michelle paid $6.000 of expenditures that quality as itemized deductions and they had a total of $3.500 in federal income taxes withheld from the paychecks during the course of the year. Use the text schedules) use the most recent for available) Complete Mare and Michelle's Form 1040, page 1 and 2 and Schedule Marc and Michelie's address is 19010 NW 5th Street, Miami, FL 33054 Social security numbers Mare Taxpayer 223033 Matthew Taxpayer: 333 44 5555 Michelle Taxpayer: 222-33-4444 Prior spouse input all the values as positive numbers. Enter any non-financial information, le Name Addresses, social security numbers) EXACTLY as they appear in any given information or Problem Statement. Use 2019 tax laws.) 1040 for a couple Marr i ng Jointly 1040 01 1040 G2 Schedule 1 Page 1 of Form 100. provided information and follow instructions on form. Form 1040 U.S. Individual income Tax Return 2018 1040 PG 1 1040 PG 2 Schedule 1 Page 2 of Form 1040. Some information does not carry over from Page 1. Form 1040 (2018) Attach Forms 2 Ano attachForms W.2G and 1099-R tax was withheld Standard Deduction for - Single of Manied sing separately $12.000 1 Wages, sales, lips, etc. Allach For W-2 2a Tax exempt interest 3a Qualified dividende 4 As, pensions, and annuities 5a Social security benefits 6 Total income. Add lines through 5. Add any amount from Schedule 1, the 22 7 Austed gross income. If you have ne adjustments to come enter the amount om Iine 36. tromline 8 Standard deduction or temced deductions from Schedule Oualified business income deduction restructions 10 Taxable income. Subtract lines and from line e r orienter 11 a Tax (see inst.) check if any om i S L Manned fling jointly or Qualifying widown om 872 Head of household, BE Bales - If you checked any box under Standard deduction Add any amount from Schedule and check here 12 a Chid tax credit credit for other dependents Add any amount from Schedule and check here 13 Subtract line 12 from line 11 of zero or less enter-0. 14 Omar taxes. Attach Schedule 4 15 Total tax A nes 13 and 14 16 Federal income tax withheld from From W-2 and 1099 17 Refundable credits EC (see ins) Form $363 Add y n from Schedules 13 Addnes 16 and 17. These we your total payments 19 line 18 is more than in 15. wbtaines troine 18 This the amount you verpaid 20 Amount of line to you want refunded to you for is attached check the Routing number Type Checking d Account number 21 Amount of line to you want ed to your 2011 22 Amount you owe Subac 10mline 15 23 Estated tax penatis instructions con and the informat TICS TORM IS A SIMULATION OF AN OFFICIAL USTANO IS NOT THE OFFICIAL VORMISELE DO NOT USE THIS FORM FOR V AMAN 2011 Me i Refund Direct deposit see Amount You Owe Required information 1040 PG 1 1040 PG 2 Schedule 1 Schedule 1 of Form 1040. Part 2 of 2 Additional Income and Adjustments to Income OMON 1545001 SCHEDULE 1 (Form 1040) Department of the Treasury em Revenue Service Nam shown on Form 1040 2018 8 00:46:16 www.govifcem 100 rud our SeoENDI security number of land 1-9b Reserved 10 Table refunds 11 Almony received 12 Dessin 13 Capital 14 Other 15 Aach Schacuc Aache r For 4797 17 Resta s construitsche 18 Famiones c h Scheue V Unc enso 21 Cheri Led 22 the Form 1641, onun 23 Edico expenses 24 Carte r performing wsts and bass gu a cho 100 25 He c ho 0 26 spor themed chom 27 Deductoare Anth Schee SE 23 Selangoed SER ME 29 Samped hen detin 30 Peon say who savings Simona SIRA wion 23 Sentul 14 Reserved THIS FIMIS A SIMULATION OF AN OFFICIA