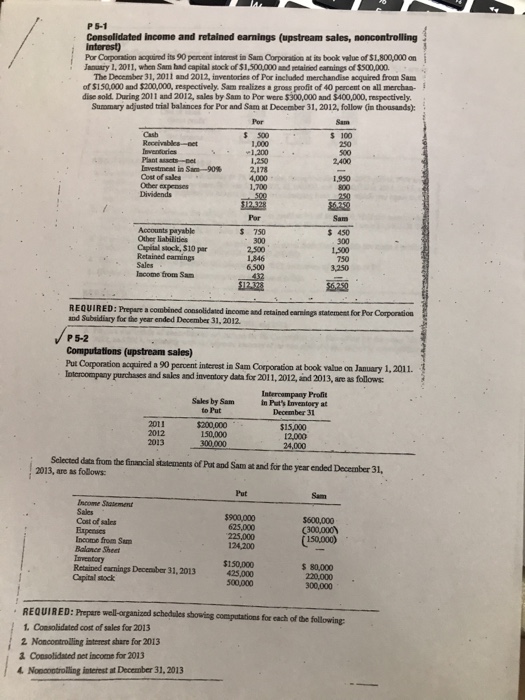

P S-1 Consolidated income and retained earnings (upstream sales, moncontrolling Por Corporation acguired its 90 percent intorest in Sam Corporation at its book value of $1,800,000 on January 1, 2011, when Sam bad capital stock of $1,500,000 and retainod earnings of $500,000 The December 31, 2011 and 2012, inventories of Por inchuded merchandise acquired from Sa of $150,000 and $200,000, respectively. Sam realizes a gross profit of 40 percent on all merchan- dise sold. During 2011 and 2012, sales by Sam to Por were $300,000 and $400,000, respectively Summary adjusted trial balances for Por and Sarm at December 31, 2012, follow (im thousands) $ 100 1,000 1,200 Plant asets-et Cost of sales Other exprases 2,178 4,000 1,700 1,950 Por Accounts payable Other liabilities Capital stock, $10 par Retained eamings Sales Iacome from Sam S 750 300 2,500 846 3 450 REQUIRED:Prepare a combinod consolidated income and retained and Subsidiary for the year ended December 31, 2012 earnings statemens for Por Corporationa P5-2 Computations (upstream sales) Put Corporation acqaired a 90 percent interest in Sam Corporation at book value on January 1, 2011. Iotcroompany purchases and sales and inventory data fox 2011,2012, and 2013, are as follows Intercampany Prolit Sales by Sam to Put in Put's Inventory at December 31 2011 2012 2013 $200,000 $15,000 Sclected data from the financial statements of Put and Sam at and for the year ended December 31, 2013, are as follows Put Sales Cost of sales $900,000 C300,000 (150,000) $ 80,000 300,000 Income from Sam Balance Sheet $150,000 425,000 Retained earnings Decemaber 31, 2013 Capital stock REQUIRED: Prepare well-organized schedules wing computations for each of the following Consolidated cost of sales for 2013 2 Noncontrolling isterest share for 2013 & Consolidated net income for 2013 Nonaostroliling interest at December 31, 2013 P S-1 Consolidated income and retained earnings (upstream sales, moncontrolling Por Corporation acguired its 90 percent intorest in Sam Corporation at its book value of $1,800,000 on January 1, 2011, when Sam bad capital stock of $1,500,000 and retainod earnings of $500,000 The December 31, 2011 and 2012, inventories of Por inchuded merchandise acquired from Sa of $150,000 and $200,000, respectively. Sam realizes a gross profit of 40 percent on all merchan- dise sold. During 2011 and 2012, sales by Sam to Por were $300,000 and $400,000, respectively Summary adjusted trial balances for Por and Sarm at December 31, 2012, follow (im thousands) $ 100 1,000 1,200 Plant asets-et Cost of sales Other exprases 2,178 4,000 1,700 1,950 Por Accounts payable Other liabilities Capital stock, $10 par Retained eamings Sales Iacome from Sam S 750 300 2,500 846 3 450 REQUIRED:Prepare a combinod consolidated income and retained and Subsidiary for the year ended December 31, 2012 earnings statemens for Por Corporationa P5-2 Computations (upstream sales) Put Corporation acqaired a 90 percent interest in Sam Corporation at book value on January 1, 2011. Iotcroompany purchases and sales and inventory data fox 2011,2012, and 2013, are as follows Intercampany Prolit Sales by Sam to Put in Put's Inventory at December 31 2011 2012 2013 $200,000 $15,000 Sclected data from the financial statements of Put and Sam at and for the year ended December 31, 2013, are as follows Put Sales Cost of sales $900,000 C300,000 (150,000) $ 80,000 300,000 Income from Sam Balance Sheet $150,000 425,000 Retained earnings Decemaber 31, 2013 Capital stock REQUIRED: Prepare well-organized schedules wing computations for each of the following Consolidated cost of sales for 2013 2 Noncontrolling isterest share for 2013 & Consolidated net income for 2013 Nonaostroliling interest at December 31, 2013