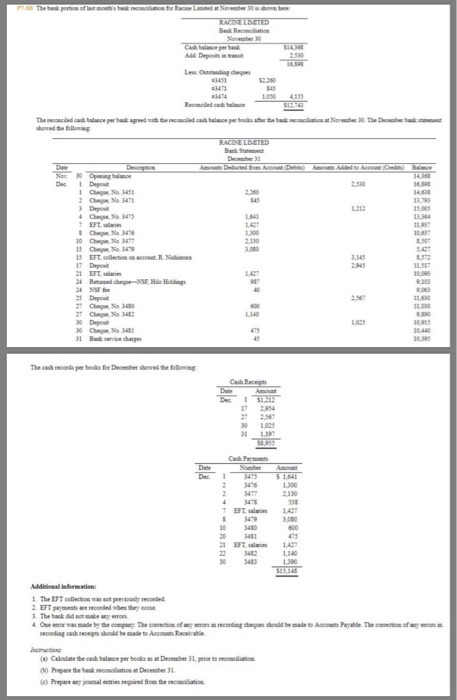

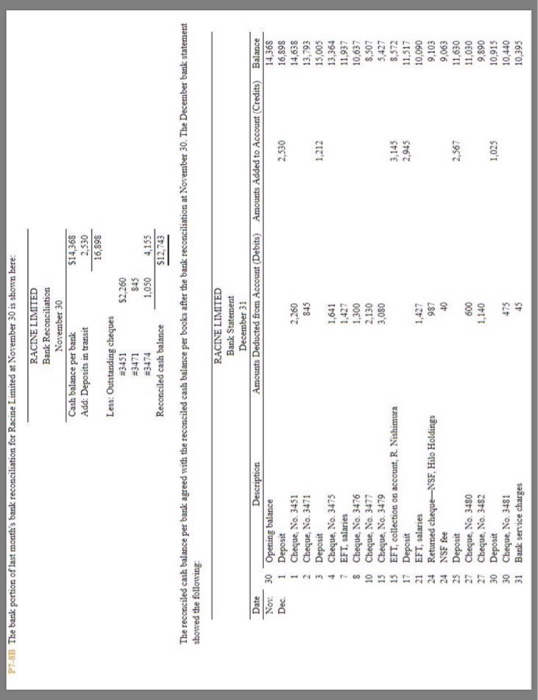

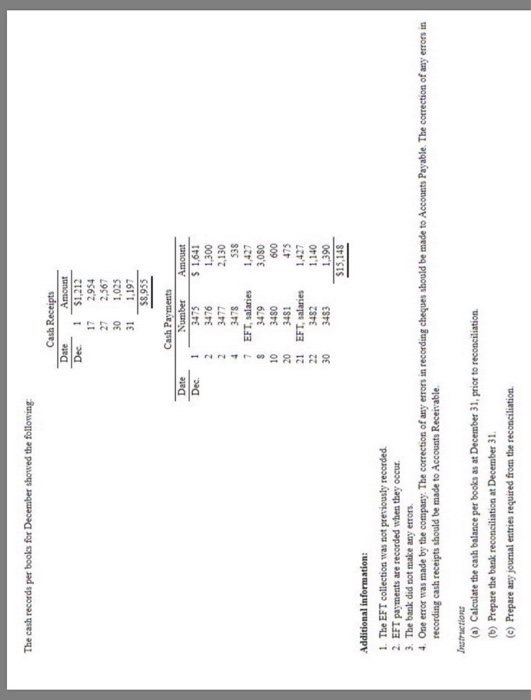

P The bk poro of last mous b reconos for RaceLimed at Noeber 30 how b BACINE LDETED Bnk Reconcilition November 30 Cah balnce per b $1436 Add Depesis in trai 2530 168PS Less Outstanding cheque a3451 2260 3471 3474 1050 4155 S12743 Recociled cash blase The Deceaber bak ta The ecociled ca balance per bak aged with the couciled cah balance per bocks aer the bak ecouciliation at Novber 30 hoed the following RACINE LDETED Bak Sttement December 3 Amoun Deducted from Apcout (Deb De Nov 30 Om bce Amovet Added to AccuCredn) Be Decripton Dec 2530 369 Cece No 1431 2 Che No 347 Dep Ca No 34 2260 139 45 1212 13.364 11,98 30,63 EFT alaries Che Ne 3476 10 Chee No 3477 1 Chese Ne 3479 142 1300 2130 3.080 1427 15 EFTellection on accoset, R. Nim 3145 8572 ITDeposi 21 EFTlain 24 Reted che-N, Ho Holdings 24 NSF f 2Degt Chee No 340 2Che No 342 30 Depot 30 Chee No 4 31 Bak enice charge 2945 1.517 J0090 1427 9.303 40 2567 11 630 600 1.00 L140 1,025 0,95 475 10,440 30,395 The cah recoeda per books for December showed the following Cash Raceipts Dee Dec $3 Amoust 2954 2567 27 S8955 Cah Pm Date Dec Amouet S 1.641 1300 2130 Number 3475 3476 2 3477 347 4 EFT alan 1427 3000 3479 3450 600 475 142 20 3481 21 EFT saln 3482 3483 1140 130 $354 Mdial informtien 1 The EFT cotlection was sot peioly recorded 2 EFT mt e recorded whes they occu 3 The bark did notmake ay eron 4 Oe eo was made by the company The comection of any eros in recording chequs should be made to Aceounts Payable. The coerection of ay emon ecoeding cah receipts should be made to Accouts Recevable e (a) Caleulate the cash balmce per beoks ma December 31, perior to reconciliation Prepare the bask recosciliation at December 31 () Prepare ay jounal ies ired om the reconiation 56EO St saap atua Otto S1601 068 6 IStEONanba 30 Deposit 27 Cheque, No. 3482 1,025 OtI't OSTE ON anba soda st 009 OE9 1 90 6 EO1'6 060 0 24 Returned cheque-NSF, Hilo Holdings LS11 usoda Lt emusN unoooe uo uogaoo 143 S 8,572 3,145 Oso'E 00 10 Cheque, No. 3477 9 ba s sauees 13L 19E'E S00'S 6L'E SE9't 1,212 3 Deposit 2 Cheque, No. 3471 1 Cheque, No. 3451 092 OES 16,898 $9Et1 sodag Amounts Deducted from Account (Debits) Amounts Added to Account (Credits) Description Opening balance Iaqaa DNI1ENI Sogo a pasmogs q aqmaoa aOE aqmao morger eq ap sae o0q ad aopqqr paoa aq paaeeq sad aoeq qres paaoas a ELZIS 1,050 09S # 3451 Less: Outstanding cheques 16,898 2,530 S9EIS Add: Deposits in transit Cash balance per bank November 30 wogeooaug DNIIENI neos s 0qaoNpa a g uoeoa mo o uouod eq a sLd opeuoa ap o pannbas saua emof Aue aredag () on (a) Calculate the cash balance per books as at December 31, prior to reconciliation recording cheques should be made to Accounts Payable. The correction of any e u sJ0a Aue jo uonaoo a eduoo apq apeu se Joa auo recording cash receipts should be made to Accounts Receivable. a Aue aeu ou pep eq a 2. EFT payments are recorded when they occur 1. The EFT collection was not previously recorded. Additional information: Sti'SIS 06 3483 Otl' 3482 SLt ISTE 009 OSTE of OSO'E 6LE saue SES SL 00E 9LtE 3475 aqn nouy 2,567 2,954 unoy Cash Receipts BuMono ap pamogs Jaquaoag aog ooq d spaooas e a