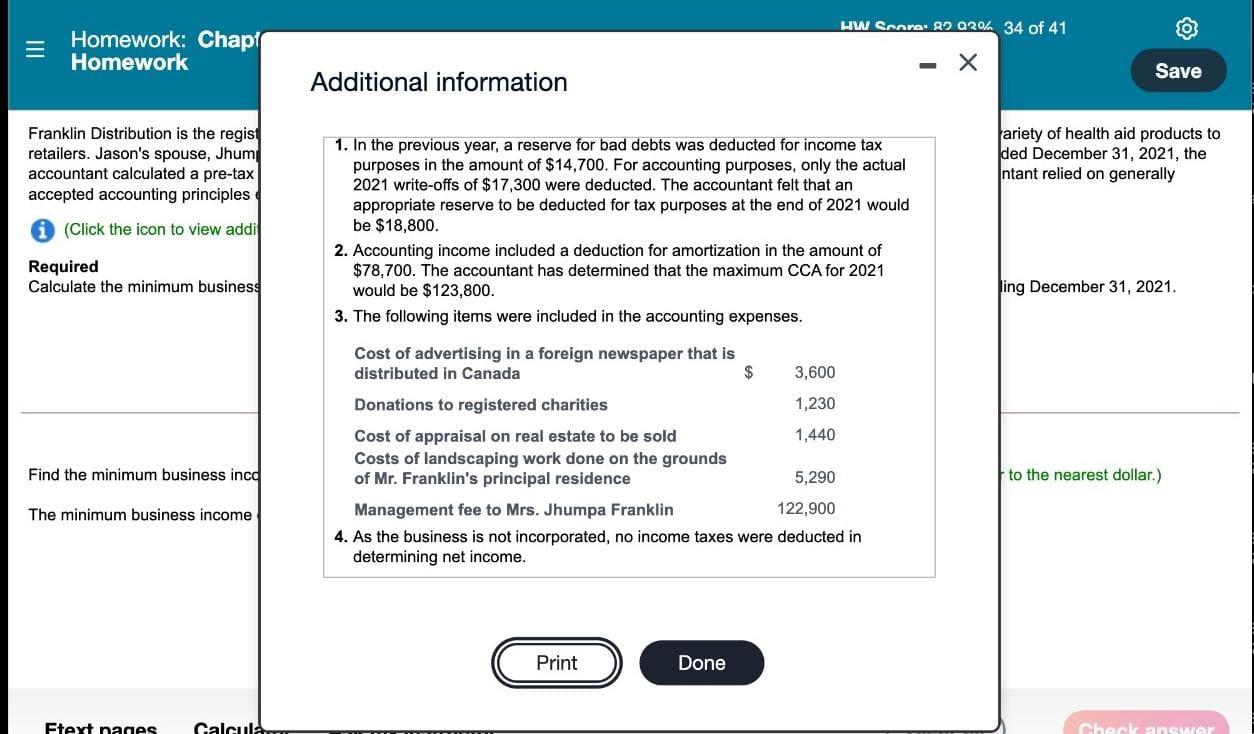

P TIL Homework: Chapter 6 Homework Question 36, Self-Study Problem 6-10 (similar to) HW Score: 82.93%, 34 of 41 points O Points: 0 of 3 Save SC 2C Franklin Distribution is the registered name of a business, carried on by Jason Franklin as a sole proprietorship, that distributes a wide variety of health aid products to retailers. Jason's spouse, Jhumpa Franklin, is an avid golfer with no interest or experience in business matters. For the taxation year ended December 31, 2021, the accountant calculated a pre-tax accounting income for Franklin Distribution of $272,600. In calculating this amount, Mr. Franklin's accountant relied on generally accepted accounting principles except for the fact that no provision is made at the end of the year for anticipated doubtful debts. in se A (Click the icon to view additional information.) in Required Calculate the minimum business income for Franklin Distribution that will be included in Mr. Franklin's income tax return for the year ending December 31, 2021. th W. Im SC 20 Find the minimum business income for Franklin Distribution that will be included in Mr. Franklin's income tax return. (Round your answer to the nearest dollar.) The minimum business income of Franklin Distribution is $ Sc 20 Sc 20 HW Score: R2 20% 34 of 41 Homework: Chap Homework Save Additional information Franklin Distribution is the regist retailers. Jason's spouse, Jhum accountant calculated a pre-tax accepted accounting principles ariety of health aid products to ded December 31, 2021, the Intant relied on generally i (Click the icon to view addi 1. In the previous year, a reserve for bad debts was deducted for income tax purposes in the amount of $14,700. For accounting purposes, only the actual 2021 write-offs of $17,300 were deducted. The accountant felt that an appropriate reserve to be deducted for tax purposes at the end of 2021 would be $18,800. 2. Accounting income included a deduction for amortization in the amount of $78,700. The accountant has determined that the maximum CCA for 2021 would be $123,800. 3. The following items were included in the accounting expenses. Required Calculate the minimum business Jing December 31, 2021. Cost of advertising in a foreign newspaper that is distributed in Canada $ 3,600 Donations to registered charities 1,230 Cost of appraisal on real estate to be sold 1,440 Costs of landscaping work done on the grounds of Mr. Franklin's principal residence 5,290 Management fee to Mrs. Jhumpa Franklin 122,900 4. As the business is not incorporated, no income taxes were deducted in determining net income. Find the minimum business inca to the nearest dollar.) The minimum business income Print Done Fteyt nanes Calculam Check answer P TIL Homework: Chapter 6 Homework Question 36, Self-Study Problem 6-10 (similar to) HW Score: 82.93%, 34 of 41 points O Points: 0 of 3 Save SC 2C Franklin Distribution is the registered name of a business, carried on by Jason Franklin as a sole proprietorship, that distributes a wide variety of health aid products to retailers. Jason's spouse, Jhumpa Franklin, is an avid golfer with no interest or experience in business matters. For the taxation year ended December 31, 2021, the accountant calculated a pre-tax accounting income for Franklin Distribution of $272,600. In calculating this amount, Mr. Franklin's accountant relied on generally accepted accounting principles except for the fact that no provision is made at the end of the year for anticipated doubtful debts. in se A (Click the icon to view additional information.) in Required Calculate the minimum business income for Franklin Distribution that will be included in Mr. Franklin's income tax return for the year ending December 31, 2021. th W. Im SC 20 Find the minimum business income for Franklin Distribution that will be included in Mr. Franklin's income tax return. (Round your answer to the nearest dollar.) The minimum business income of Franklin Distribution is $ Sc 20 Sc 20 HW Score: R2 20% 34 of 41 Homework: Chap Homework Save Additional information Franklin Distribution is the regist retailers. Jason's spouse, Jhum accountant calculated a pre-tax accepted accounting principles ariety of health aid products to ded December 31, 2021, the Intant relied on generally i (Click the icon to view addi 1. In the previous year, a reserve for bad debts was deducted for income tax purposes in the amount of $14,700. For accounting purposes, only the actual 2021 write-offs of $17,300 were deducted. The accountant felt that an appropriate reserve to be deducted for tax purposes at the end of 2021 would be $18,800. 2. Accounting income included a deduction for amortization in the amount of $78,700. The accountant has determined that the maximum CCA for 2021 would be $123,800. 3. The following items were included in the accounting expenses. Required Calculate the minimum business Jing December 31, 2021. Cost of advertising in a foreign newspaper that is distributed in Canada $ 3,600 Donations to registered charities 1,230 Cost of appraisal on real estate to be sold 1,440 Costs of landscaping work done on the grounds of Mr. Franklin's principal residence 5,290 Management fee to Mrs. Jhumpa Franklin 122,900 4. As the business is not incorporated, no income taxes were deducted in determining net income. Find the minimum business inca to the nearest dollar.) The minimum business income Print Done Fteyt nanes Calculam Check