p1 2.6 (lo 3,4) jude limited has been authorized to issue

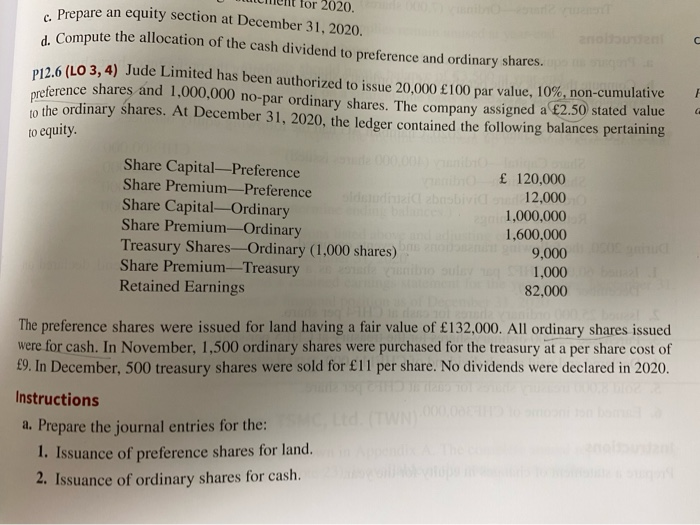

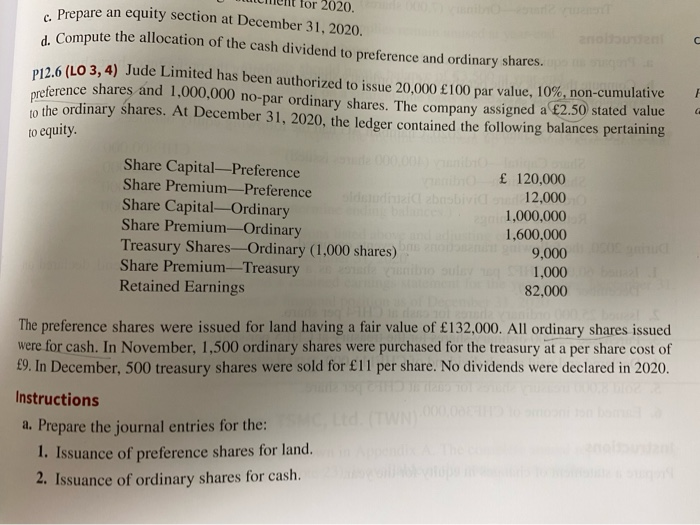

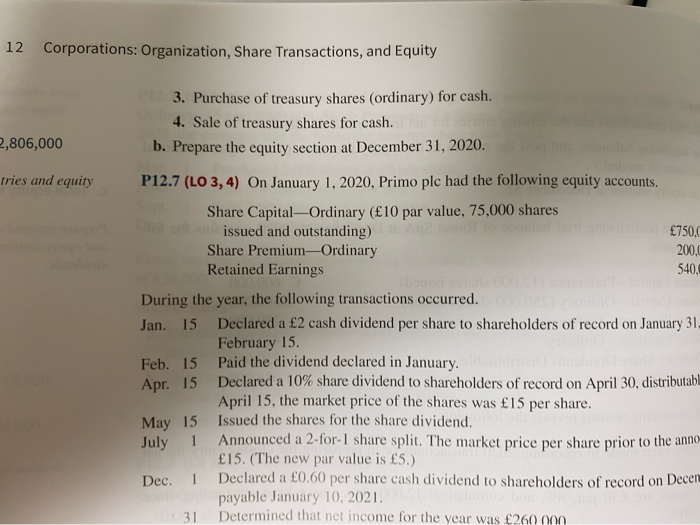

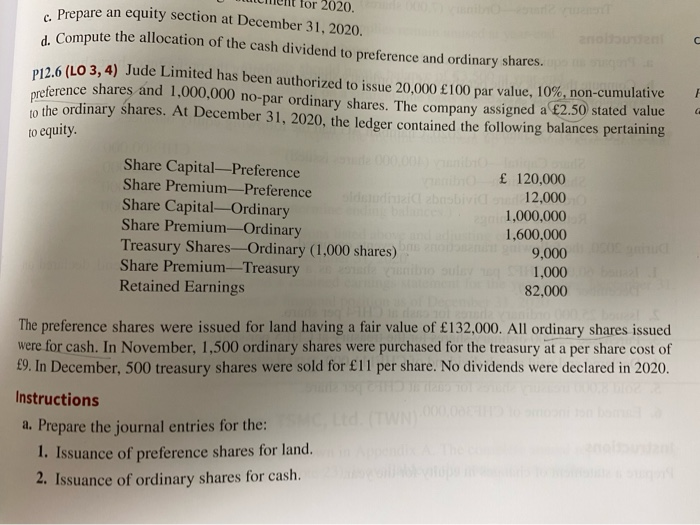

for 2020. c. Prepare an equity section at December 31, 2020. noben d. Compute the allocation of the cash dividend to preference and ordinary shares. P12.6 (LO 3, 4) Jude Limited has been authorized to issue 20,000 100 par value, 10%, non-cumulative preference shares and 1,000,000 no-par ordinary shares. The company assigned a 2.50 stated value to the ordinary shares. At December 31, 2020, the ledger contained the following balances pertaining to equity. Share Capital-Preference Share Premium-Preference Share Capital-Ordinary Share Premium-Ordinary Treasury Shares-Ordinary (1,000 shares) Share Premium-Treasury Canto Retained Earnings 120,000 12,000 1,000,000 1,600,000 9,000 1,000 82,000 The preference shares were issued for land having a fair value of 132,000. All ordinary shares issued were for cash. In November, 1,500 ordinary shares were purchased for the treasury at a per share cost of 9. In December, 500 treasury shares were sold for 11 per share. No dividends were declared in 2020. Instructions a. Prepare the journal entries for the 1. Issuance of preference shares for land. 2. Issuance of ordinary shares for cash. 12 Corporations: Organization, Share Transactions, and Equity 2,806,000 tries and equity 3. Purchase of treasury shares ordinary) for cash. 4. Sale of treasury shares for cash. b. Prepare the equity section at December 31, 2020. P12.7 (LO 3,4) On January 1, 2020, Primo plc had the following equity accounts. Share Capital-Ordinary (10 par value, 75,000 shares issued and outstanding) 750,0 Share Premium-Ordinary 200.0 Retained Earnings 540 During the year, the following transactions occurred. Jan. 15 Declared a 2 cash dividend per share to shareholders of record on January 31, February 15. Feb. 15 Paid the dividend declared in January. Apr. 15 Declared a 10% share dividend to shareholders of record on April 30, distributabl April 15, the market price of the shares was 15 per share. May 15 Issued the shares for the share dividend. Announced a 2-for-1 share split. The market price per share prior to the anno 15. (The new par value is 5.) Dec. 1 Declared a 0.60 per share cash dividend to shareholders of record on Decen payable January 10, 2021. 31 Determined that net income for the year was 260 000 July 1