p1

p2

p3

p4

p1

p2

I apologize the question did not allow me to make it bigger so I had to take multiple photos.

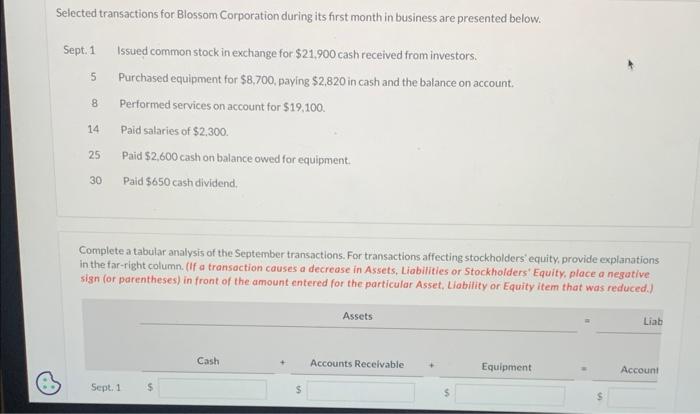

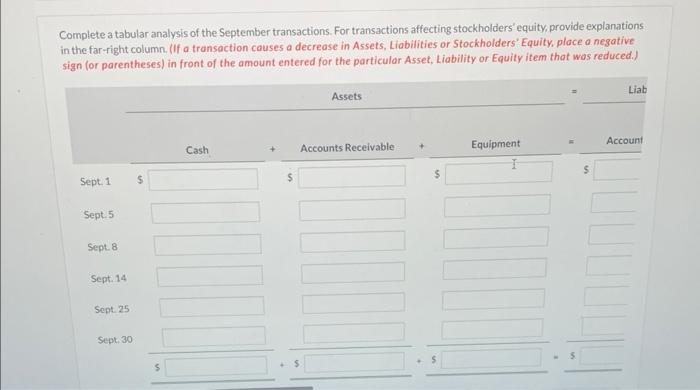

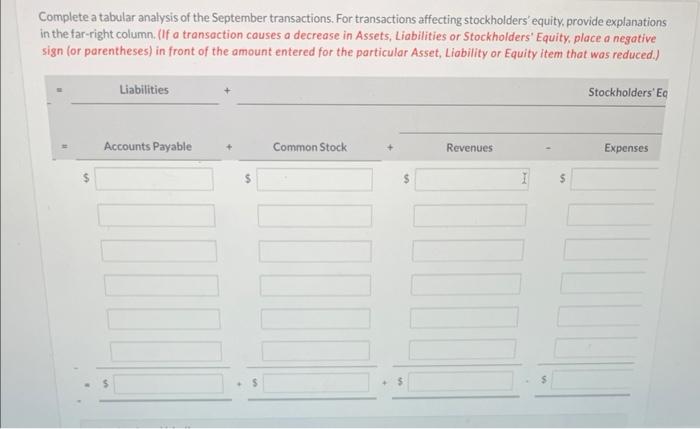

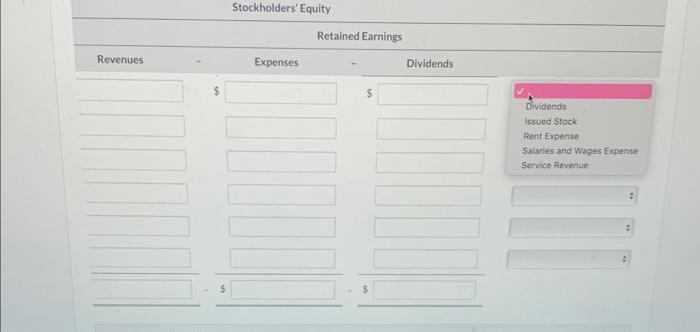

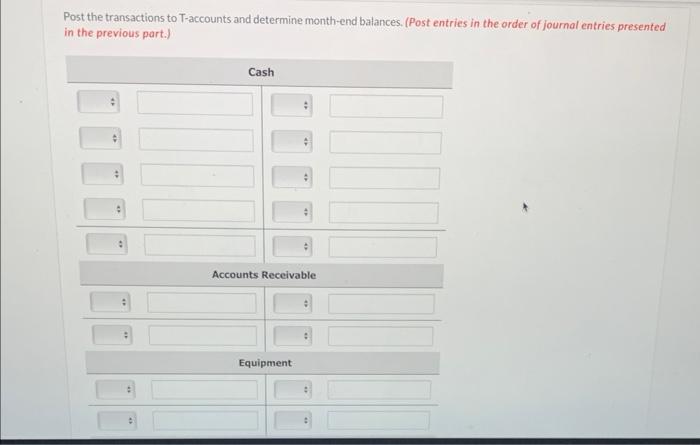

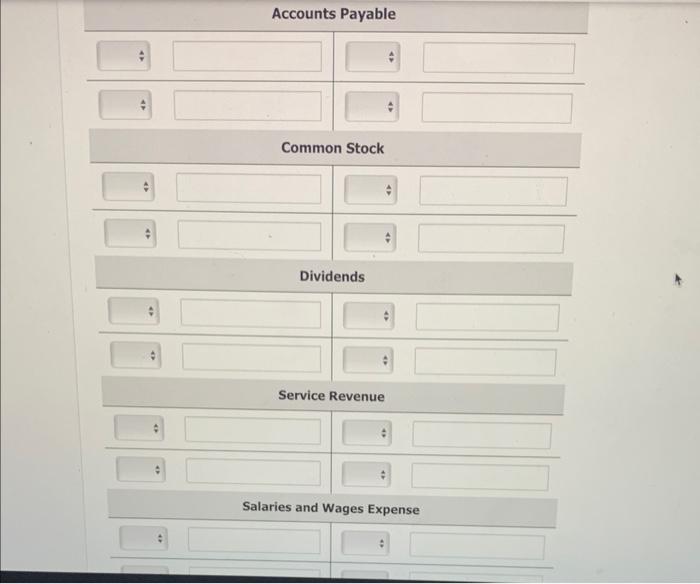

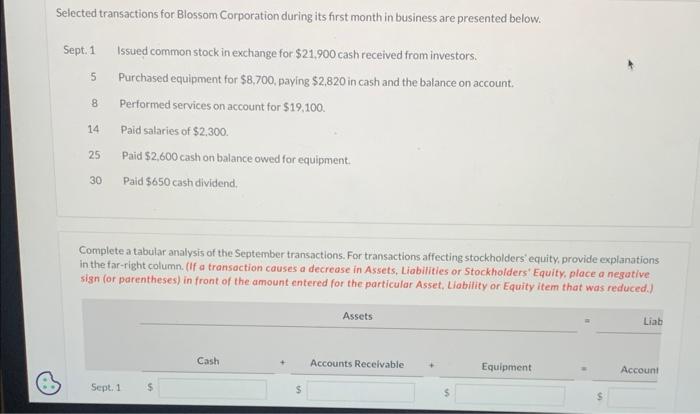

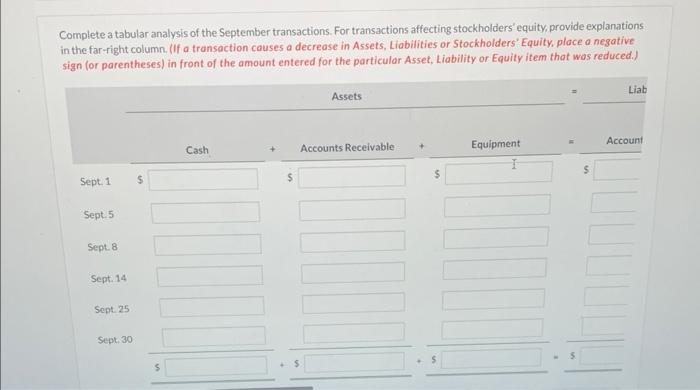

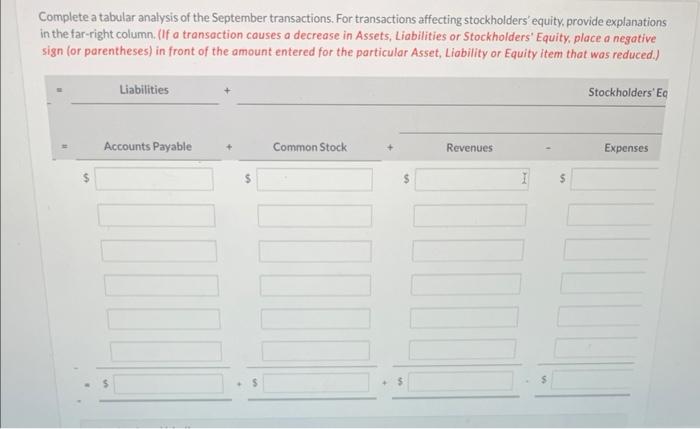

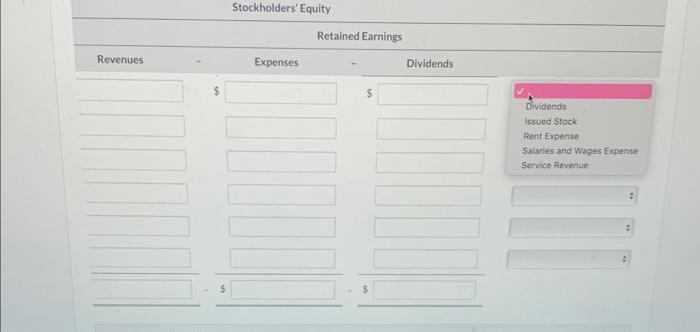

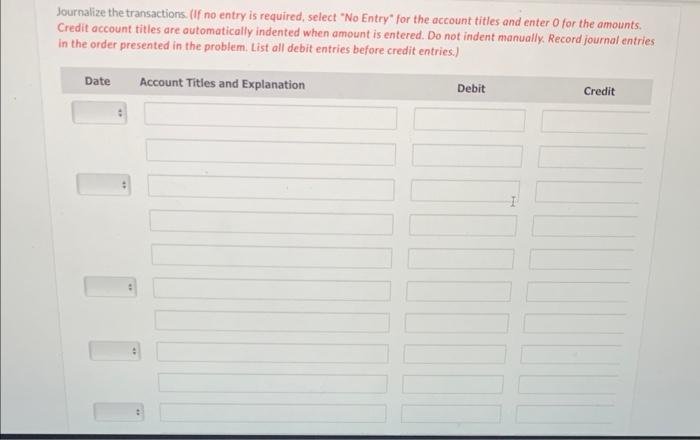

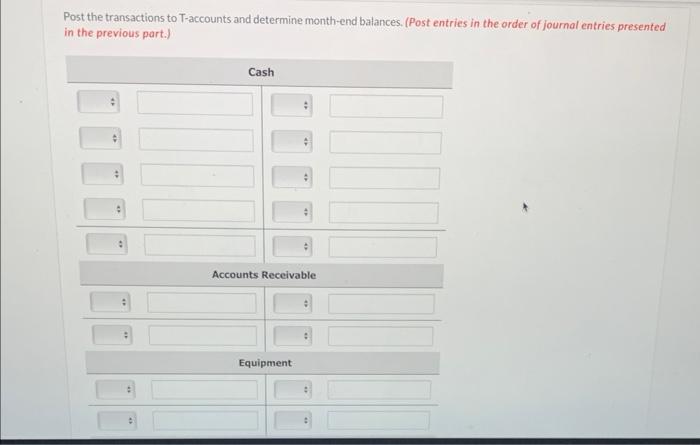

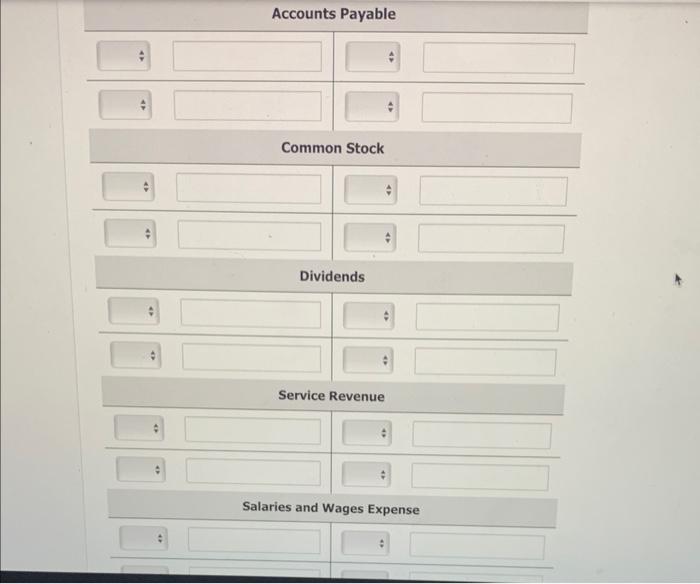

Selected transactions for Blossom Corporation during its first month in business are presented below. Sept.1 Issued common stock in exchange for $21,900 cash received from investors. 5 Purchased equipment for $8,700, paying $2,820 in cash and the balance on account. 8 Performed services on account for $19,100. 14 Paid salaries of $2,300. 25 Paid $2,600 cash on balance owed for equipment. 30 Paid $650 cash dividend. Complete a tabular analysis of the September transactions. For transactions affecting stockholdersi equity, provide explanations in the far-right column. (If a transaction causes a decrease in Assets, Liabilities or Stockholders' Equity, place a negative sign (or parentheses) in front of the amount entered for the particular Asset, Liability or Equity item that was reduced.) Complete a tabular analysis of the September transactions. For transactions affecting stockholders' equity, provide explanations in the far-right column. (If a transaction causes a decrease in Assets, Liabilities or Stockholders' Equity. place a negative sign (or parentheses) in front of the amount entered for the particular Asset, Liability or Equity item that was reduced.) Complete a tabular analysis of the September transactions. For transactions affecting stockholders' equity, provide explanations in the far-right column. (If a transaction causes a decrease in Assets, Liabilities or Stockholders' Equity, place a negative sign (or parentheses) in front of the amount entered for the particular Asset, Liability or Equity item that was reduced.) Dividends $ Dividends: Issued Stock Rent Expense Salaries and Wages Expense Service Revenue. Journalize the transactions. (If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually. Record journal entries in the order presented in the problem. List all debit entries before credit entries.) Post the transactions to T-accounts and determine month-end balances. (Post entries in the order of journal entries presented in the previous part.) Accounts Payable Salaries and Wages Expense

p1

p1 p2

p2 p3

p3 p4

p4

p1

p1 p2

p2