Answered step by step

Verified Expert Solution

Question

1 Approved Answer

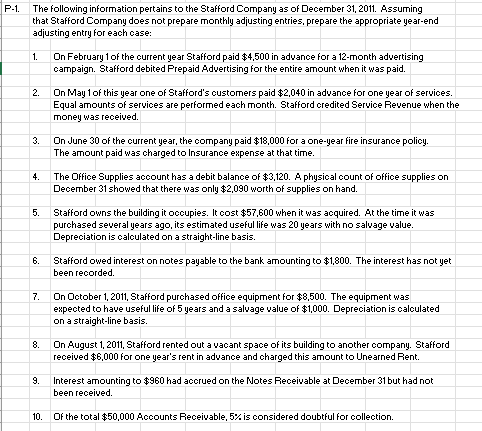

P-1. The following information pertains to the Stafford Company as of December 31, 2011. Assuming that Stafford Company does not prepare monthly adjusting entries,

P-1. The following information pertains to the Stafford Company as of December 31, 2011. Assuming that Stafford Company does not prepare monthly adjusting entries, prepare the appropriate year-end adjusting entry for each case: 1. 2. 3. On June 30 of the current year, the company paid $18,000 for a one-year fire insurance policy. The amount paid was charged to Insurance expense at that time. 5. 4. The Office Supplies account has a debit balance of $3,120. A physical count of office supplies on December 31 showed that there was only $2,090 worth of supplies on hand. 6. On February 1 of the current year Stafford paid $4,500 in advance for a 12-month advertising campaign. Stafford debited Prepaid Advertising for the entire amount when it was paid. On May 1 of this year one of Stafford's customers paid $2,040 in advance for one year of services. Equal amounts of services are performed each month. Stafford credited Service Revenue when the money was received. 8. 9. Stafford owns the building it occupies. It cost $57,600 when it was acquired. At the time it was purchased several years ago, its estimated useful life was 20 years with no salvage value. Depreciation is calculated on a straight-line basis. 7. On October 1, 2011, Stafford purchased office equipment for $8,500. The equipment was expected to have useful life of 5 years and a salvage value of $1,000. Depreciation is calculated on a straight-line basis. Stafford owed interest on notes payable to the bank amounting to $1,800. The interest has not yet been recorded. On August 1, 2011, Stafford rented out a vacant space of its building to another company. Stafford received $6,000 for one year's rent in advance and charged this amount to Unearned Rent. Interest amounting to $960 had accrued on the Notes Receivable at December 31 but had not been received. 10. Of the total $50,000 Accounts Receivable, 5% is considered doubtful for collection.

Step by Step Solution

★★★★★

3.40 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Here are the adjusting entries for Stafford Company as of December 31 2011 1 Prepaid Advertising 750 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started