The efficiency of Working Capital Management Bill Gates, Chairman of Microsoft inc, is concerned about the firm's high level of investment in short term

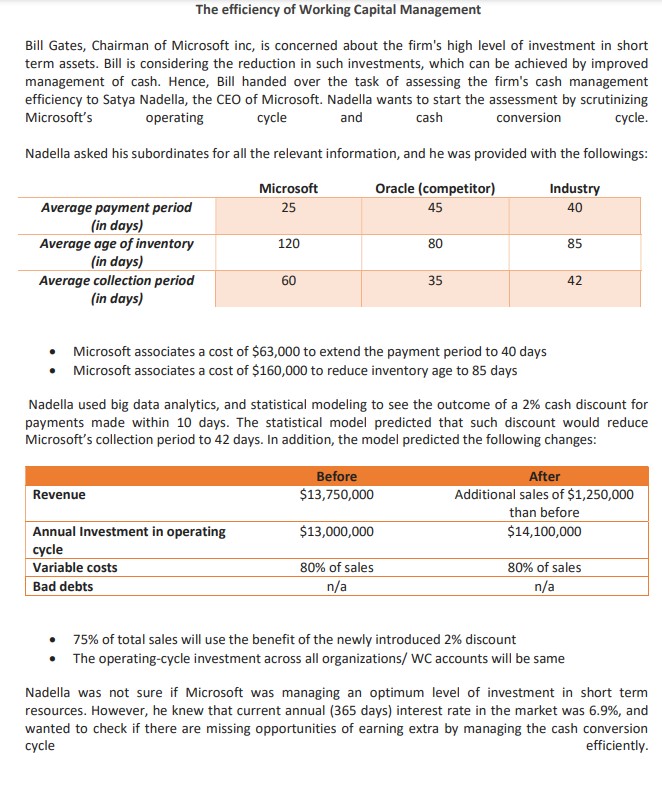

The efficiency of Working Capital Management Bill Gates, Chairman of Microsoft inc, is concerned about the firm's high level of investment in short term assets. Bill is considering the reduction in such investments, which can be achieved by improved management of cash. Hence, Bill handed over the task of assessing the firm's cash management efficiency to Satya Nadella, the CEO of Microsoft. Nadella wants to start the assessment by scrutinizing Microsoft's cycle cash conversion operating and cycle. Nadella asked his subordinates for all the relevant information, and he was provided with the followings: Oracle (competitor) 45 Average payment period (in days) Average age of inventory (in days) Average collection period (in days) Microsoft 25 Revenue 120 Annual Investment in operating cycle Variable costs Bad debts 60 Microsoft associates a cost of $63,000 to extend the payment period to 40 days Microsoft associates a cost of $160,000 to reduce inventory age to 85 days Before $13,750,000 80 $13,000,000 35 Nadella used big data analytics, and statistical modeling to see the outcome of a 2% cash discount for payments made within 10 days. The statistical model predicted that such discount would reduce Microsoft's collection period to 42 days. In addition, the model predicted the following changes: 80% of sales n/a Industry 40 85 42 After Additional sales of $1,250,000 than before $14,100,000 80% of sales n/a 75% of total sales will use the benefit of the newly introduced 2% discount The operating-cycle investment across all organizations/ WC accounts will be same Nadella was not sure if Microsoft was managing an optimum level of investment in short term resources. However, he knew that current annual (365 days) interest rate in the market was 6.9%, and wanted to check if there are missing opportunities of earning extra by managing the cash conversion cycle efficiently. a) Assuming a constant rate for purchases, production, and sales throughout the year, what are Microsoft and its competitors existing operating cycle (OC), cash conversion cycle (CCC), and how much resource is absorbed in there CCCs? b) If Microsoft can optimize operations according to industry standards, what would its operating cycle (OC), cash conversion cycle (CCC) be, and how much of the resources will be absorbed in its CCC under these more efficient conditions? What about Oracle? c) What is the annual cost of Microsoft's operational inefficiency, or in other words, longer CCC? d) Based on your findings so far, should Microsoft & Oracle try to achieve industry level efficiency? Why or why not? Deadline Answer all the aforementioned questions (with calculations). Turn the assignment in through Classroom) on or before 03 September, 2023. N.B. - Each day of delayed submission of any item will be penalized with 1% reduction in the overall grade. Plagiarism will be met with highest penalty.

Step by Step Solution

3.49 Rating (146 Votes )

There are 3 Steps involved in it

Step: 1

Based on the information provided we can assess the efficiency of Microsofts working capital management and compare it with industry standards and the competitor Oracle Lets address each question one ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started