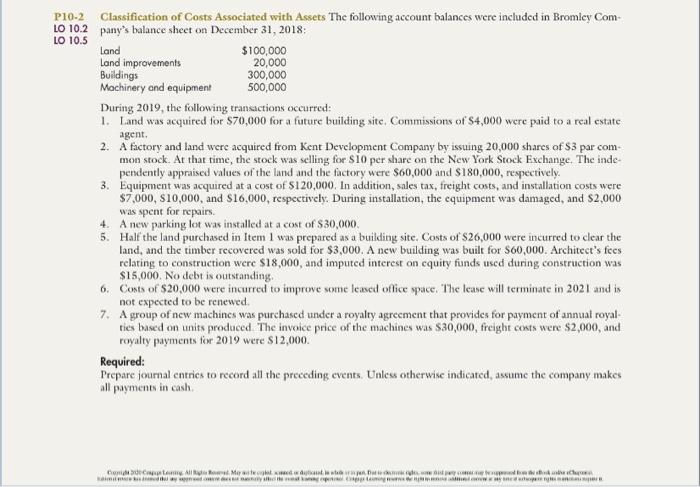

P10-2 Classification of Costs Associated with Assets The following account balances were included in Bromley Com- LO 10.2 pany's balance sheet on December 31, 2018 LO 10.5 Land $100,000 Land improvements 20,000 Buildings 300,000 Machinery and equipment 500,000 During 2019, the following transactions occurred: 1. Land was acquired for $70,000 for a future building site. Commissions of S4,000 were paid to a real estate agent, 2. A factory and land were acquired from Kent Development Company by issuing 20,000 shares of S3 par com mon stock. At that time, the stock was selling for Sio per share on the New York Stock Exchange. The inde pendently appraised values of the land and the factory were $60,000 and $180,000, respectively 3. Equipment was acquired at a cost of $120,000. In addition, sales tax, freight costs, and installation costs were $7,000, 510,000, and $16,000, respectively. During installation, the equipment was damaged, and $2,000 was spent for repairs 4. A new parking lot was installed at a cost of $30,000 5. Half the land purchased in Item I was prepared as a building site. Costs of S26,000 were incurred to clear the land, and the timber recovered was sold for $3,000. A new building was built for $60,000. Architect's fees relating to construction were $18,000, and imputed interest on cquity funds used during construction was $15,000. No debt is outstanding, 6. Costs of $20.000 were incurred to improve some leacut office space. The lease will terminate in 2021 and is not expected to be renewed. 7. A group of new machines was purchased under a royalty agreement that provides for payment of annual royal ties based on units produced. The invoice price of the machines was $30,000, freight costs were $2,000, and royalty payments for 2019 were $12,000. Required: Prepare journal entries to record all the preceding events. Unless otherwise indicated assume the company makes all payments in cash to Alla Madawa ya P10-2 Classification of Costs Associated with Assets The following account balances were included in Bromley Com- LO 10.2 pany's balance sheet on December 31, 2018 LO 10.5 Land $100,000 Land improvements 20,000 Buildings 300,000 Machinery and equipment 500,000 During 2019, the following transactions occurred: 1. Land was acquired for $70,000 for a future building site. Commissions of S4,000 were paid to a real estate agent, 2. A factory and land were acquired from Kent Development Company by issuing 20,000 shares of S3 par com mon stock. At that time, the stock was selling for Sio per share on the New York Stock Exchange. The inde pendently appraised values of the land and the factory were $60,000 and $180,000, respectively 3. Equipment was acquired at a cost of $120,000. In addition, sales tax, freight costs, and installation costs were $7,000, 510,000, and $16,000, respectively. During installation, the equipment was damaged, and $2,000 was spent for repairs 4. A new parking lot was installed at a cost of $30,000 5. Half the land purchased in Item I was prepared as a building site. Costs of S26,000 were incurred to clear the land, and the timber recovered was sold for $3,000. A new building was built for $60,000. Architect's fees relating to construction were $18,000, and imputed interest on cquity funds used during construction was $15,000. No debt is outstanding, 6. Costs of $20.000 were incurred to improve some leacut office space. The lease will terminate in 2021 and is not expected to be renewed. 7. A group of new machines was purchased under a royalty agreement that provides for payment of annual royal ties based on units produced. The invoice price of the machines was $30,000, freight costs were $2,000, and royalty payments for 2019 were $12,000. Required: Prepare journal entries to record all the preceding events. Unless otherwise indicated assume the company makes all payments in cash to Alla Madawa ya