Question

Shell Camping Gear, Inc., is considering two mutually exclusive projects. Each requires an initial investment of $100,000. John Shell, president of the company, has set

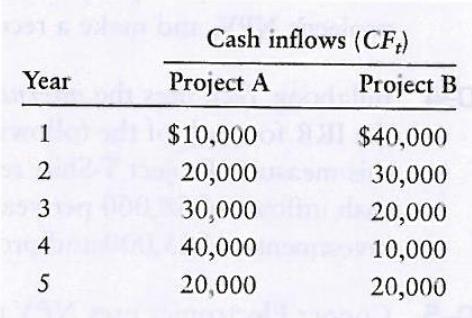

Shell Camping Gear, Inc., is considering two mutually exclusive projects. Each requires an initial investment of $100,000. John Shell, president of the company, has set a maximum payback period of 4 years. The after-tax cash inflows associated with each project are shown in the following table: a. Determine the payback period of each project. b. Because they are mutually exclusive, Shell must choose one. Which should the company invest in? c. Explain why one of the projects is a better choice than the other

a. Determine the payback period of each project. b. Because they are mutually exclusive, Shell must choose one. Which should the company invest in? c. Explain why one of the projects is a better choice than the other

Step by Step Solution

3.39 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

a Payback period Project A 10000200003000040000 100000 therefore 4 years Project B 400003000020...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Principles Of Managerial Finance

Authors: Lawrence J. Gitman, Chad J. Zutter

13th Edition

9780132738729, 136119468, 132738724, 978-0136119463

Students also viewed these Computer Network questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App