P6-104 Compute gross profit rate and inventory loss using gross profit method Suzuki Company lost all of its inventory in a fire on December

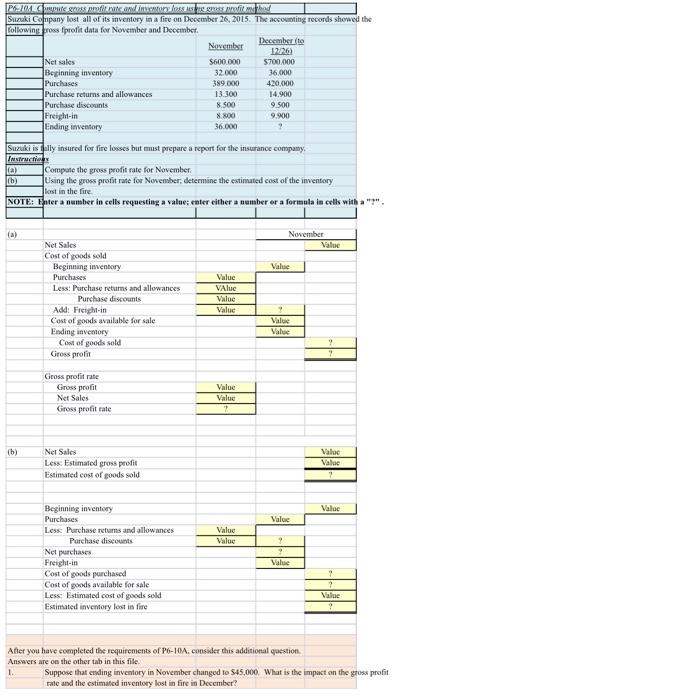

P6-104 Compute gross profit rate and inventory loss using gross profit method Suzuki Company lost all of its inventory in a fire on December 26, 2015. The accounting records showed the following cross fiprofit data for November and December. (0) (b) Net sales Beginning inventory Purchases Purchase returns and allowances Purchase discounts (a) Freight-in Ending inventory (b) Suzuki is fully insured for fire losses but must prepare a report for the insurance company. Instructions Compute the gross profit rate for November. Using the gross profit rate for November, determine the estimated cost of the inventory lost in the fire. NOTE: Enter a number in cells requesting a value; enter either a number or a formula in cells with a "?". Net Sales Cost of goods sold Beginning inventory Purchases Less: Purchase returns and allowances Purchase discounts Add: Freight-in Cost of goods available for sale Ending inventory Cost of goods sold Gross profit Gross profit rate Gross profit Net Sales Gross profit rate Net Sales Less: Estimated gross profit Estimated cost of goods sold Beginning inventory Purchases November $600.000 32.000 389.000 13.300 8.500 8.800 36.000 Less: Purchase returns and allowances Purchase discounts Net purchases Freight-in Cost of goods purchased Cost of goods available for sale Less: Estimated cost of goods sold Estimated inventory lost in fire Value VAlue Value Value December (to 12/26) $700.000 36.000 420,000 14.900 Value Value 7 9.500 9.900 ? Value Value November Value ? Value Value Value ? ? Value After you have completed the requirements of P6-10A, consider this additional question. Answers are on the other tab in this file. 1. Value 7 Valoc Value 7 Value 7 ? Value ? Suppose that ending inventory in November changed to $45,000. What is the impact on the gross profit rate and the estimated inventory lost in fire in December?

Step by Step Solution

3.46 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

The image shows an accounting exercise that deals with the calculation of gross profit for the months of November and December given certain financial ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started