Question

P11-12 (similar to) Question Help Incremental operating cash flows Richard and Linda Thomson operate a local lawn maintenance service for commercial and residential property. They

| P11-12 (similar to) | Question Help |

Incremental operating cash flowsRichard and Linda Thomson operate a local lawn maintenance service for commercial and residential property. They have been using a John Deere riding mower for the past several years and believe that it is time to buy a new one. They would like to know the incremental (relevant) cash flows associated with the replacement of the old riding mower. The following data are available.

1. There are 5 years of remaining useful life on the old mower.

2. The old mower has a zero book value.

3. The new mower is expected to last 5 years.

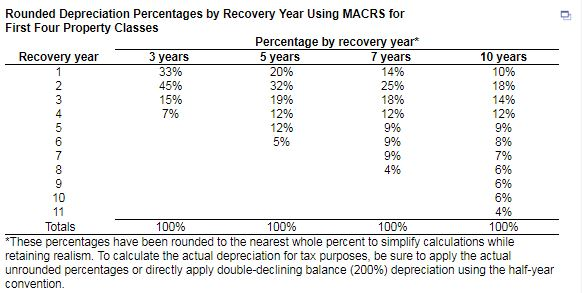

4. The Thomsons will follow a 5-year MACRS

recovery period for the new mower.5. Depreciable value of the new lawn mower is $1,760.

6. They are subject to a 40% tax rate.

7. The new mower is expected to be more fuel-efficient, maneuverable, and will require less maintenance than the previous models which should result in reduced operating expenses of $510 per year.8. The Thomsons will buy a maintenance contract that calls for annual payments of $112 for the expected life of the mower.

Create an incremental operating cash flow statement for the replacement of Richard and Linda's John Deere riding mower. Show the incremental operating cash flow for the next 6 years.

Rounded Depreciation Percentages by Recovery Year Using MACRS for First Four Property Classes Percentage by recovery year 7 years 14% 25% 18% 12% 10 years 10% 18% 5 years 3 years 3396 Recovery year 3296 19% 12% 12% 5% 15% 12% 8% 6% 8% 6% 4% 4% 100% 100% These percentages have been rounded to the nearest whole percent to simplify calculations while retaining realism. To calculate the actual depreciation for tax purposes, be sure to apply the actual unrounded percentages or directly apply double-declining balance (200%) depreciation using the half-year conventionStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started