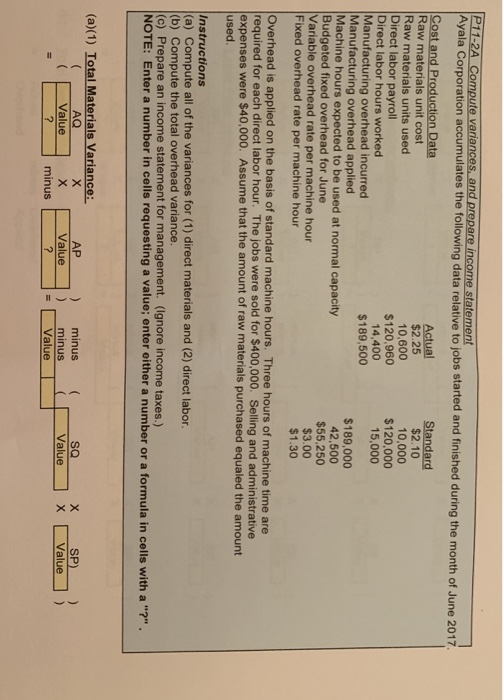

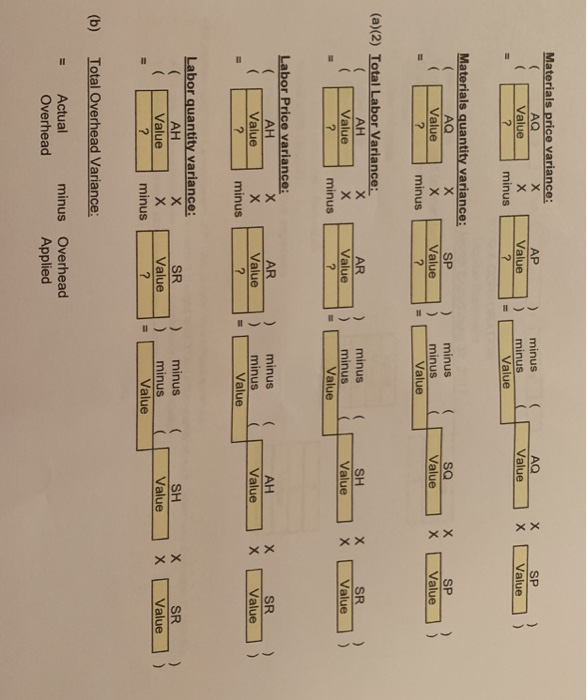

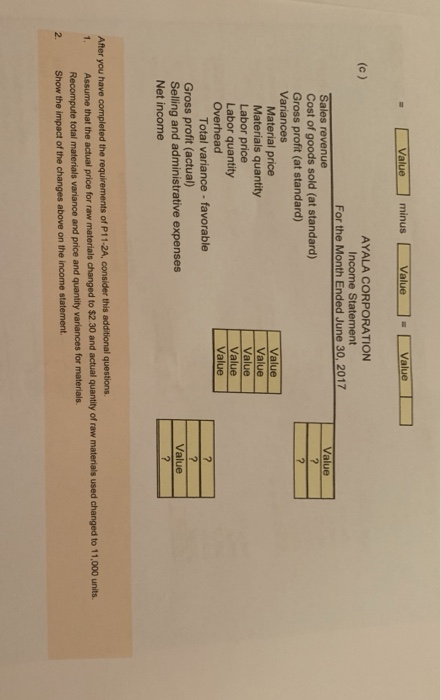

P11-2A Compute variances, and prepare income statement Ayala Corporation accumulates the following data relative to jobs started and finished during the month of June 2017 Cost and Production Data Raw materials unit cost Raw materials units used Direct labor payroll Direct labor hours worked Manufacturing overhead incurred Manufacturing overhead applied Machine hours expected to be used at normal capacity Budgeted fixed overhead for June Variable overhead rate per machine hour Fixed overhead rate per machine hour $2.25 10,600 $120,960 14,400 $189,500 Standard $2.10 10,000 $120,000 15,000 $189,000 42,500 $55,250 $3.00 $1.30 Overhead is applied on the basis of standard machine hours. Three hours of machine time are required for each direct labor hour. The jobs were sold for $400,000. Selling and administrative expenses were $40,000. Assume that the amount of raw materials purchased equaled the amount used Instructions (a) Compute all of the variances for (1) direct materials and (2) direct labor (b) Compute the total overhead variance (c) Prepare an income statement for management. (Ignore income taxes.) NOTE: Enter a number in cells requesting a value; enter either a number or a formula in cells with a "?" (a)(1) Total Materials Variance: AP ) minus( SQ X SP) AQ Value minus Value Materials price variance: AQ SP ) AQ Value AP ) minus minus Value Materials quantity variance: SP) SP Value AQ ) minus SQ minus sValue minus (a)(2) Total Labor Variance: SR) Value- ) minus (1 Value ]X[ Value]) minus( Value AR SH Value minus Labor Price variance: AH SR AR Value minus Value AH minus minus Value Labor quantity variance: AH SR) Value- ) minus ( Value X Value) ) SR minus( SH Value Value minus Total Overhead Variance: - Actual (b) minus Overhead Overhead Applied ValueValue AYALA CORPORATION Income Statement For the Month Ended June 30, 2017 Value Sales revenue Cost of goods sold (at standard) Gross profit (at standard) Variances Material price Materials quantity Labor price Labor quantity Value Value Value Value Value Overhead Total variance - favorable Gross profit (actual) Selling and administrative expenses Net income Value After you have completed the requirements of P11-2A, consider this additional questions 1. Assume that the actual price for raw materials changed to $2.30 and actual quantity of raw materials used changed to 11,000 units Recompute total materials variance and price and quantity variances for materials Show the impact of the changes above on the income statement. 2