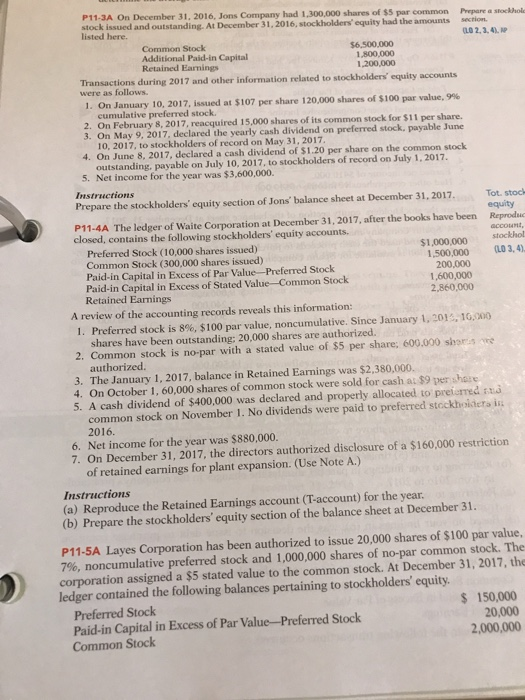

P11-3A On December 31, 2016, Jons Company had 1,300,000 shares of $5 par common Prepare a stockhol stock issued and outstanding. At December 31,2016, stockholders' equity had the amounts secrion listed here. (10 2,3,4AP Common Stock Additional Paid-in Capital Retained Earnings $6,500,000 1,800,000 1,200,000 Transactions during 2017 and other information related to stockholders' equity accounts were as follows. 1. On January 10, 2017, issued at S107 per share l 20,000 shares of si 00 par value,% cumulative preferred stock. 2. On February 8,2017, reacquired 15,000 shares of its common stock for $11 per share. 10, 2017, to stockholders of record on May 31, 2017 4. On June 8, 2017, declared a cash dividend of $1.20 per share on the common stock outstanding, payable on July 10, 2017, to stockholders of record on July 1, 2017. 5. Net income for the year was $3,600,000. Instructions Prepare the stockholders' equity section of Jons' balance sheet at December 31, 2017. Tot. stock P11-4A The ledger of Waite Corporation at December 31, 2017, after the books have been Reprodu $1,000,000 stockhol equity closed, contains the following stockholders' equity accounts. Preferred Stock (10,000 shares issued) Common Stock (300,000 shares issued) Paid-in Capital in Excess of Par Value-Preferred Stock Paid-in Capital in Excess of Stated Value-Common Stock Retained Earnings 1.500.000 3.41 200,000 1,600,000 2,860,000 A review of the accounting records reveals this information: Preferred stock is 8%, $100 par value, noncumulative. Since January 1, 201, 10.000 1. shares have been outstanding: 20,000 shares are authorized. 2. Common stock is no-par with a stated value of $5 per share; 600.000 shorss ore authorized. 3. The January 1, 2017, balance in Retained Earnings was $2,380,000. 4. On October 1, 60,000 shares of common stock were sold for cash a $9 per share 5. A cash dividend of $400,000 was declared and properly allocated to preierred st common stock on November 1. No dividends were paid to preferred stockhoidets ir 2016. 6. Net income for the year was $880,000. 7. On December 31, 2017, the directors authorized disclosure of a $160,000 restriction of retained earnings for plant expansion. (Use Note A.) Instructions (a) Reproduce the Retained Earnings account (T-account) for the year. (b) Prepare the stockholders' equity section of the balance sheet at December 31. P11-5A Layes Corporation has been authorized to issue 20,000 shares of $100 par value, 7%, noncumulative preferred stock and 1,000,000 shares of no-par common stock. The corporation assigned a $5 stated value to the common stock. At December 31, 2017, the ledger contained the following balances pertaining to stockholders' equity. S 150,000 20,000 2,000,000 Preferred Stock Paid-in Capital in Excess of Par Value-Preferred Stock Common Stock