Answered step by step

Verified Expert Solution

Question

1 Approved Answer

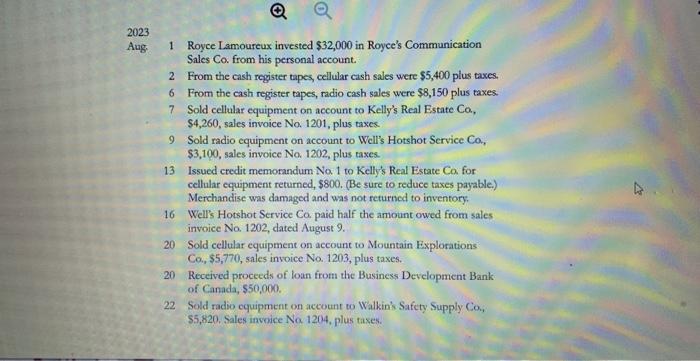

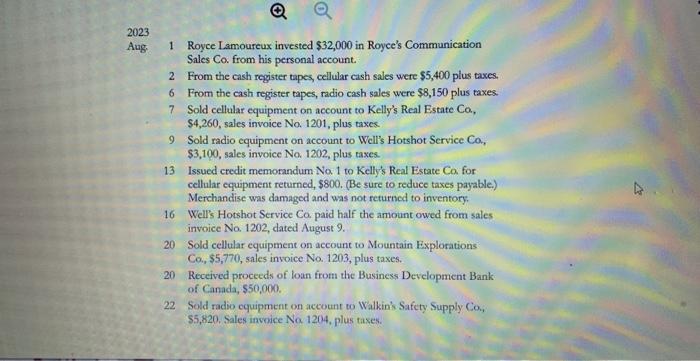

P12-2C. Royce's Communication Sales Co. began operating in August.Royce's does not offer discounts (all terms are net 30 days), and 8% PST and 5% GST

P12-2C. Royce's Communication Sales Co. began operating in August.Royce's does not offer discounts (all terms are net 30 days), and 8% PST and 5% GST are charges on all sales.Cost of inventory is calculated at 70% of sales. The following transactions occured in August:

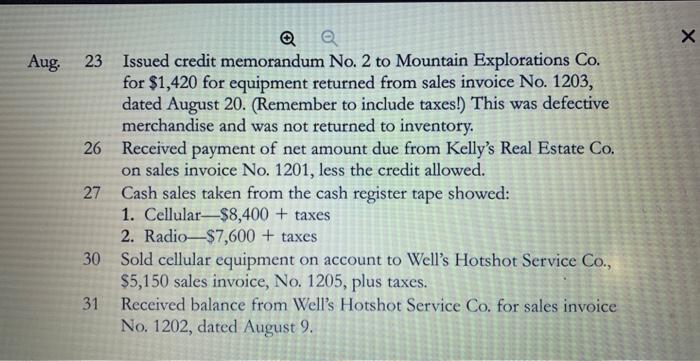

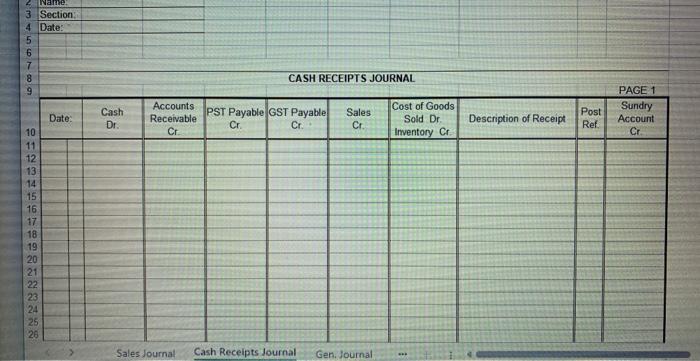

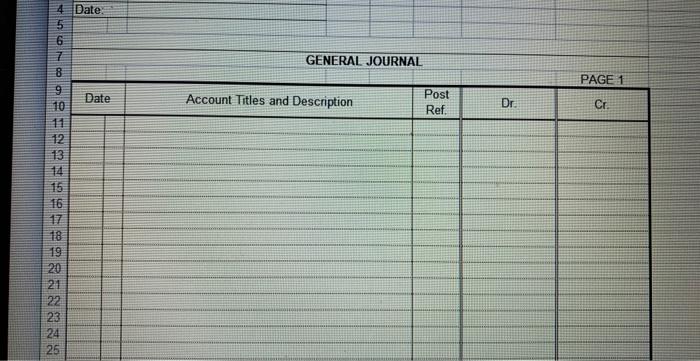

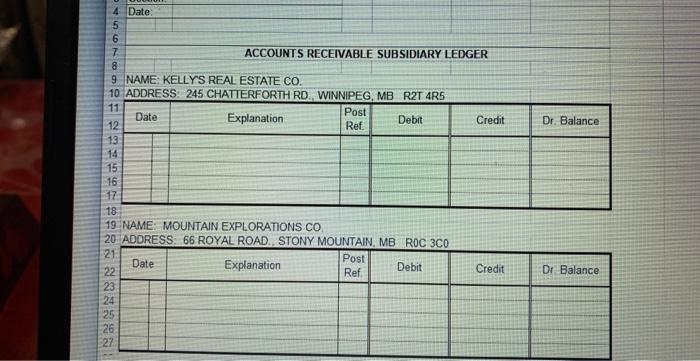

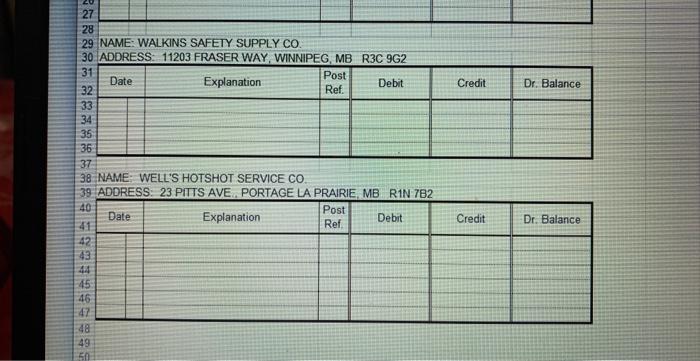

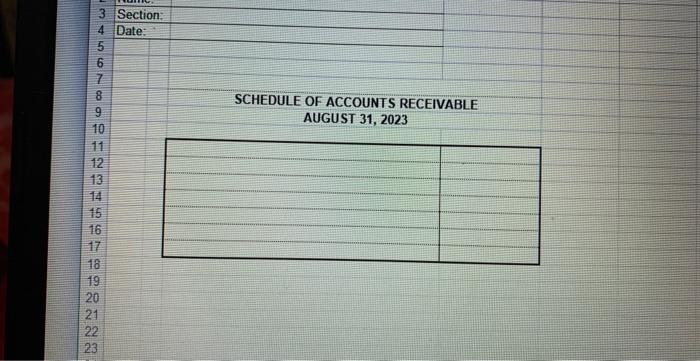

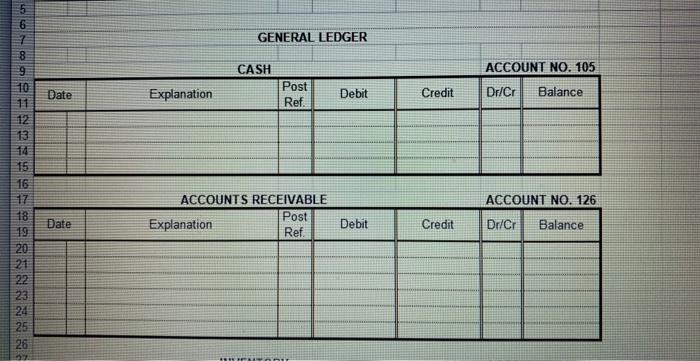

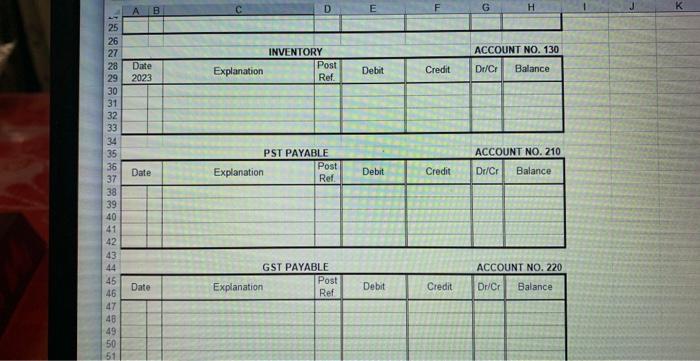

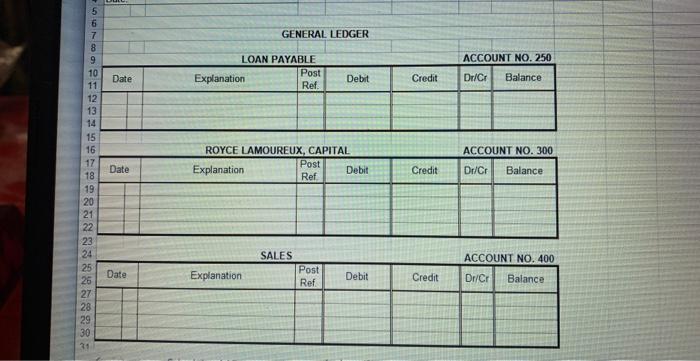

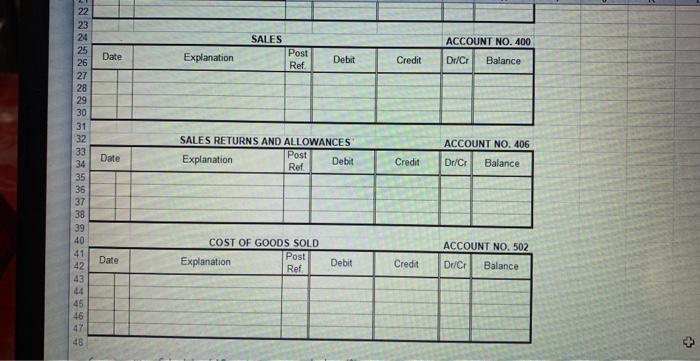

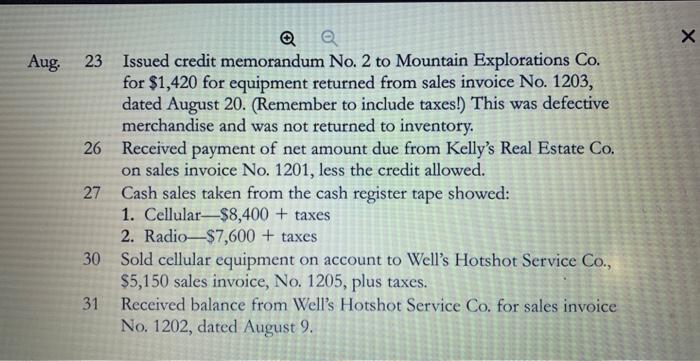

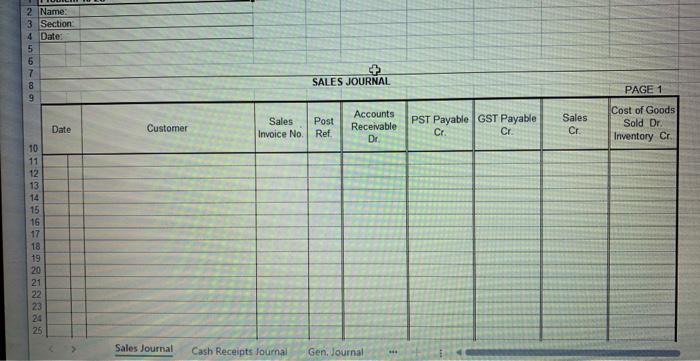

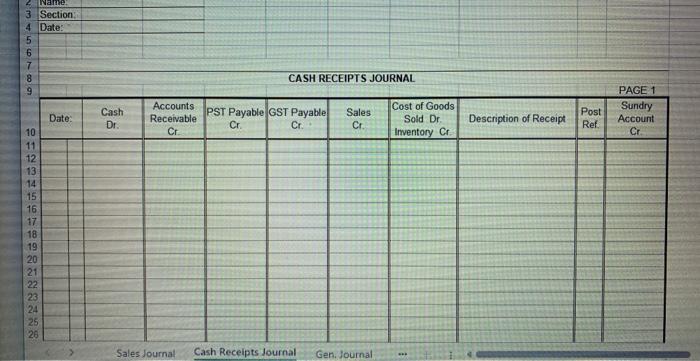

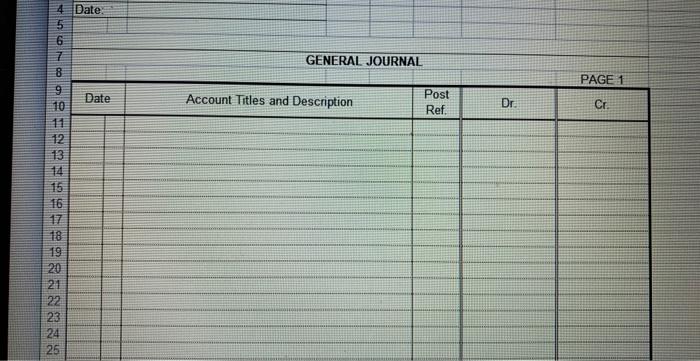

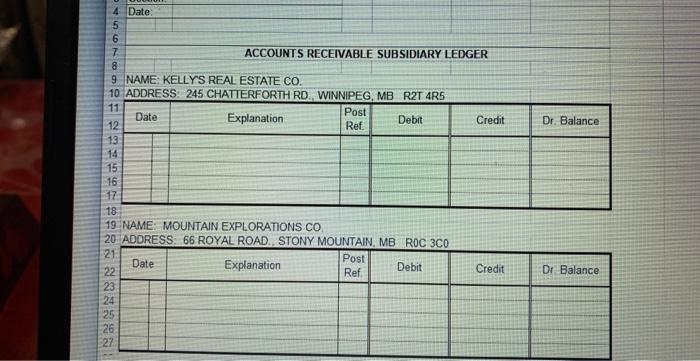

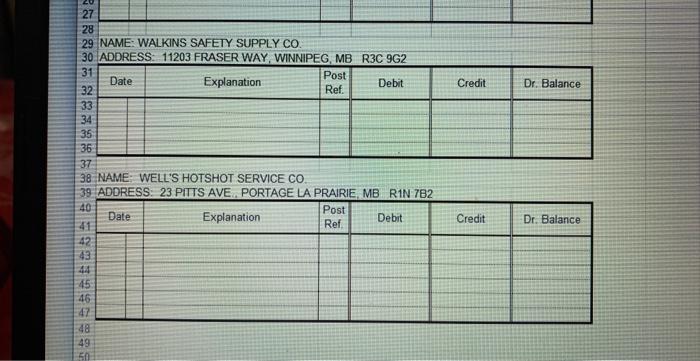

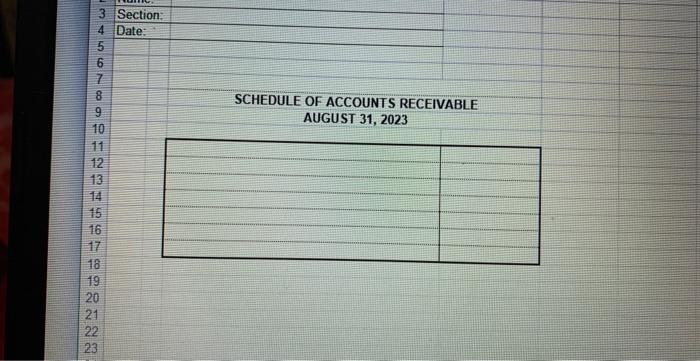

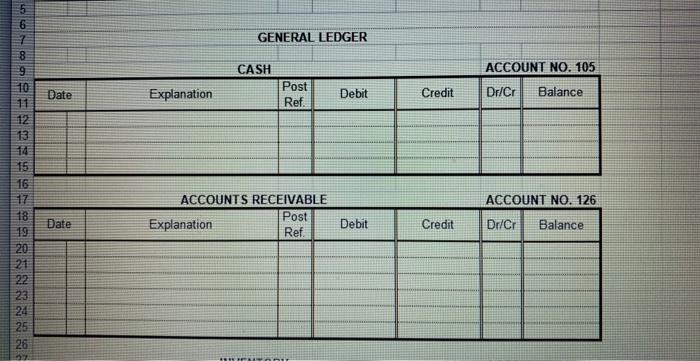

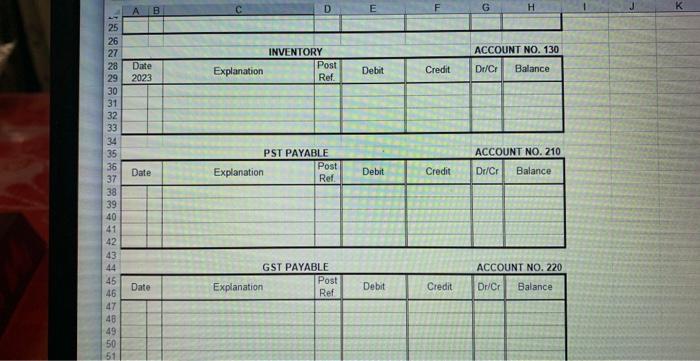

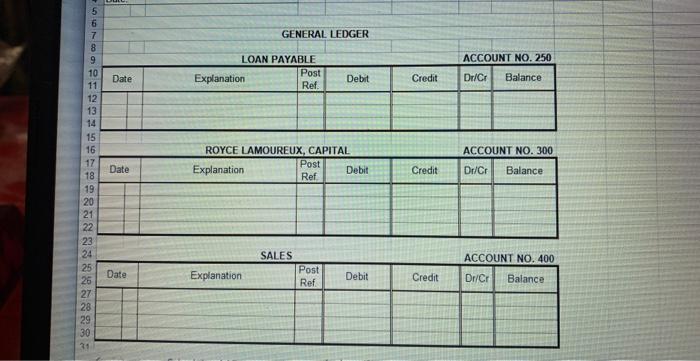

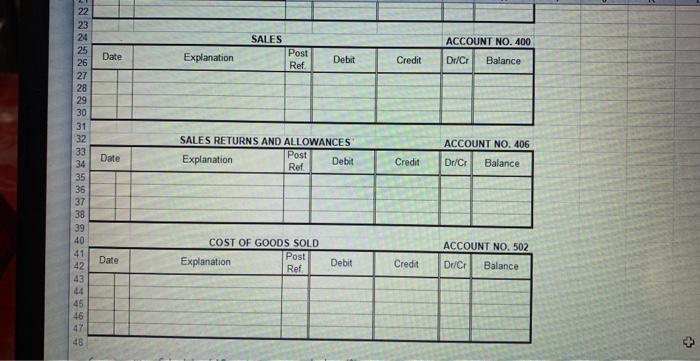

2023 Aug. 1 Royce Lamoureux invested $32,000 in Royce's Communication Sales Co. from his personal account. 2 From the cash register tapes, cellular cash sales were $5,400 plus taxes. 6 From the cash register tapes, radio cash sales were $8,150 plus taxes. 7 Sold cellular equipment on account to Kelly's Real Estate Ca. $4,260, sales invoice No. 1201, plus taxes. 9 Sold radio equipment on account to Well's Hotshot Service Ca, $3,100, sales invoice No. 1202, plus taxes. 13 Issued credit memonandum Na. 1 to Kelly's Real Estate Ca for cellular equipment returned, $800. (Be sure to reduce taxes payable.) Merchandise was damaged and was not returned to inventory. 16 Wells Hotshot Service Co. paid half the amount owed from sales invoice No. 1202, dated August 9. 20 Sold cellular equipment on account to Mountain Explorations Co., $5,770, sales invoice Na. 1203 , plus taxes. 20. Received proceeds of loan from the Business Development Bank of Canada, $50,000. 22 Sold radio equipment on account to Walkin's Safcty Supply Co, 55,820. Sales invoice Na1204, plus taxes. 23 Issued credit memorandum No. 2 to Mountain Explorations Co. for $1,420 for equipment returned from sales invoice No. 1203, dated August 20. (Remember to include taxes!) This was defective merchandise and was not returned to inventory. 26 Received payment of net amount due from Kelly's Real Estate Co. on sales invoice No. 1201 , less the credit allowed. 27 Cash sales taken from the cash register tape showed: 1. Cellular- $8,400+ taxes 2. Radio $7,600+ taxes 30 Sold cellular equipment on account to Well's Hotshot Service Co., $5,150 sales invoice, No. 1205 , plus taxes. 31 Received balance from Well's Hotshot Service Co. for sales invoice No. 1202, dated August 9. CASH RECEIPTS JOURNAL ACCOUNTS RECEIVABLE SUBSIDIARY LEDGER NAME: KELLYS REAL ESTATE CO. ADDRESS: 245 CHATIERFORTH RD.. WINNIPEG. MB R2T 4R5 NAME: MOUNTAIN EXPLORATIONS CO. ADDRESS: 66 ROYAL ROAD. STONY MOUNTAIN. MB R0C 3Cn NAME: WELLS HOTSHOT SERVICE CO ADDRESS: 23 PITIS AVE PORTAGF IA PRAIRIF MR R1N 782 SCHEDULE OF ACCOUNTS RECEIVABLE AUGUST 31,2023 GENERAL LEDGER \begin{tabular}{|l|l|l|l|l|l|l|l|} \hline 44 & \multicolumn{3}{c}{ GST PAYABL } & \multicolumn{3}{c|}{ ACCOUNT NO. 220 } \\ \cline { 2 - 8 } \\ \hline 46 & Date & Explanation & PostRef & Debit & Credit & DriCr & Balance \\ \hline 47 & & & & & & & \\ 48 & & & & & & & \\ 49 & & & & & & & \\ 50 & & & & & & & \\ 51 & & & & & & \\ \hline \end{tabular} GENERAL LEDGER cAI Ee netinae cost ne ranne cnu

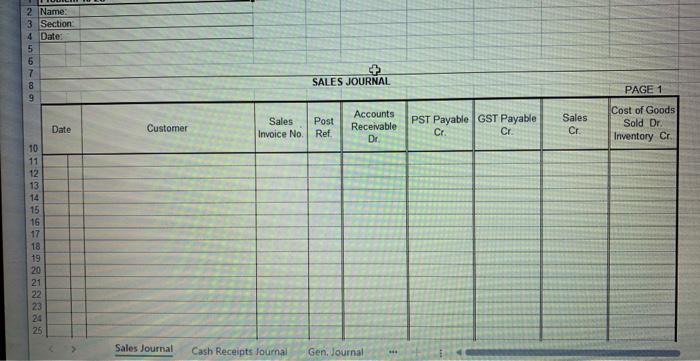

Comprehensive problem:using sales taxes in recording transactions into sales,cash receipts,and general journals,recording in the accountsreceivable sub-ledger and posting to the general ledger; and preparing a schedule of accounts receivable

Check figure schedules of accounts Receivable $17,311.60

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started