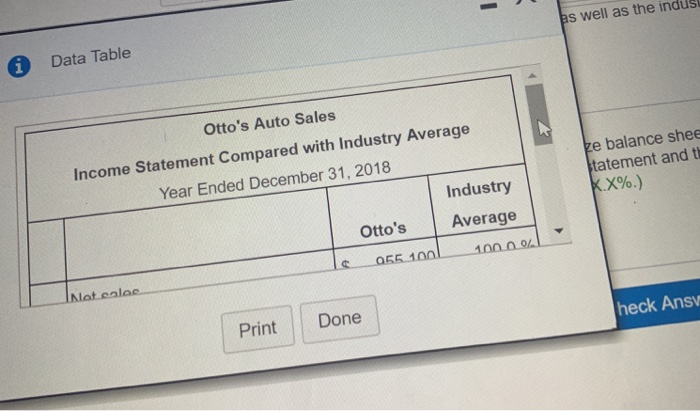

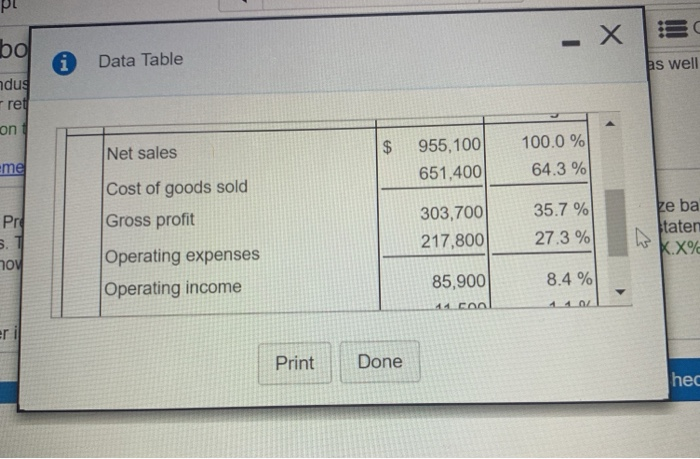

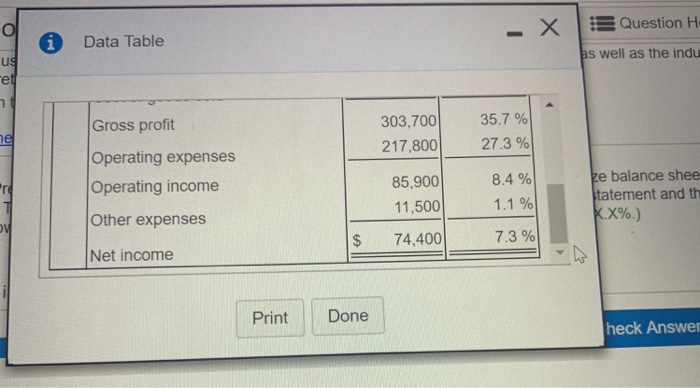

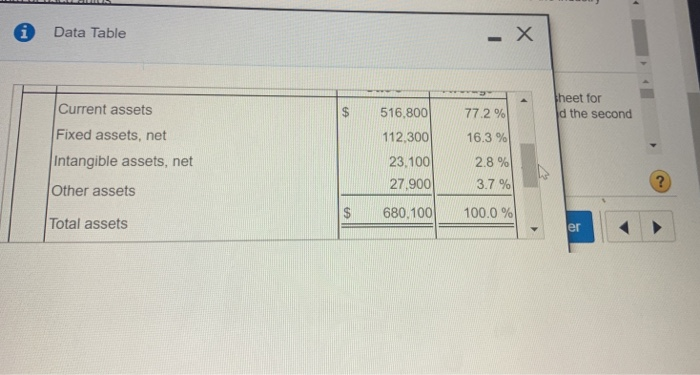

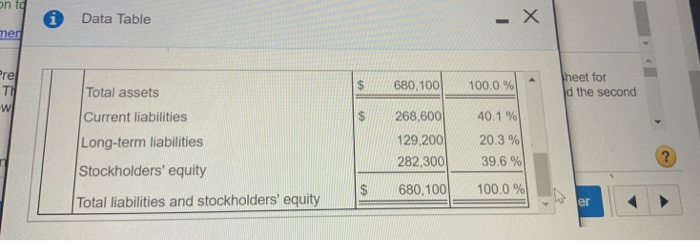

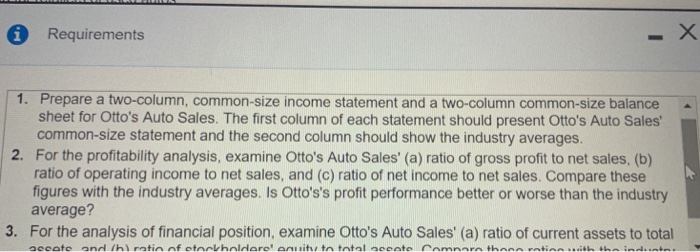

P12-32A (book/static) Question Help a o's Auto Sales asked for your help in comparing the company's profit performance and financial postion with the average for the auto average data for retailers of used autos sales industry The owner has given you the company's income statement and balance sheet as well as the industry EB (Click the icon to view the income statement) EB(Click the icon to view the balance sheet.) Requirement 1. Prepare a two-column, common-size income statement and a two-column common-size balance sheet for Otto's Auto Sales. The first column of each statement should present Otto's Auto Sales' common-size statement and the second column should show the industry averages. (Round the percentages to the nearest one-tenth percent. XX%) i Data Table s well as the indus Otto's Auto Sales Income Statement Compared with Industry Average Year Ended December 31, 2018 ze balance shee tatement and t KX%.) Industry Otto'sAverage Alat colec Print Done heck Ansv Data Table s well du re on 9551001 651,400 100.0 % 64.3 % Net sales Cost of goods sold Gross proft Operating expenses Operating income me | 357 % 27.3 % e ba taten Pr 303,700 217,800| n0 85,900 8.4 % Print Done hec 1 Data Table X Question H s well as the indu Gross profit Operating expenses Operating income Other expenses Net income 303,700 35.7 % 217,800| 27.3 % 85,900| e balance shee tatement and th 84% 11,500 1.1 % $ 74,400 7.3% PrintDone heck Answer of 1o(T complete HW Score: 0%, 0 of 10 pts 32A (book/static) to sales industry. The owner has given you the company's income statement and balance sheet as weil as the industry ge data for retailers of used autos lick the icon t Question Help * Data Table he requiremen heet for d the second ement 1. Pre Sales. Th should show Otto's Auto Sales Balance Sheet Compared with Industry Average December 31,2018 Auto Industry Otto'sAverage 72.9 y number in er 616 900 i Data Table heet for Current assets Fixed assets, net Intangible assets, net Other assets Total assets 516,800| 112.300| 23,100| 27,900 77.2% 163% 2.8 % 3.7 % d the second $ 680.1001 100.0 % er Data Table heet for d the second 680, 1001 268,600| 1292001 282.300 680,100| 100 0 %-1 40.1 %| 20.3 % 39.6 % $ Total assets Current liabilities Long-term liabilities Stockholders' equity Total liabilities and stockholders' equity $ 100,0%) er Requirements 1. Prepare a two-column, common-size income statement and a two-column common-size balance sheet for Otto's Auto Sales. The first column of each statement should present Otto's Auto Sales common-size statement and the second column should show the industry averages. For the profitability analysis, examine Otto's Auto Sales' (a) ratio of gross profit to net sales, (b) ratio of operating income to net sales, and (c) ratio of net income to net sales. Compare these figures with the industry averages. Is Otto's's profit performance better or worse than the industry average? For the analysis of financial position, examine Otto's Auto Sales' (a) ratio of current assets to total 2. 3. Conmpal y statement s Incom ge lic and balance sheet as well as the industry Requirements he common-size statement and the second column should show the industry averages. 2. For the profitability analysis, examine Otto's Auto Sales (a) ratio of gross profit to net sales, (b) . Compare these ratio of operating income to net sales, and (c) ratio of net income to net sales figures with the industry averages. Is Otto's's profit performance better or worse than the industny average? 3. For the analysis of financial position, examine Otto's Auto Sales' (a) ratio of current assets to total assets, and (b) ratio of stockholders' equity to total assets. Compare these ratios with the industry averages. Is Otto's Auto Sales' financial position better or worse than the industry average