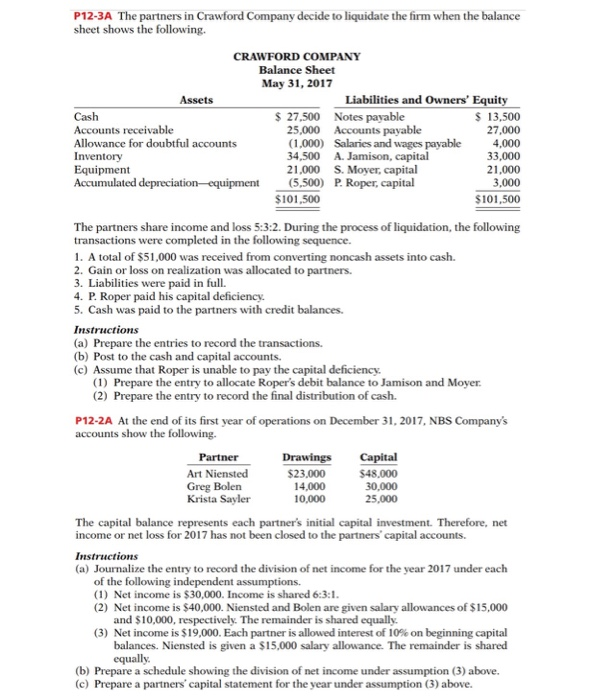

P12-3A The partners in Crawford Company decide to liquidate the firm when the balance sheet shows the following. CRAWFORD COMPANY Balance Sheet May 31, 2017 Assets Liabilities and Owners' Equity Cash Accounts receivable Allowance for doubtful accounts 27,500 Notes payable 25,000 Accounts payable (1,000) 34,500 21,000 (5,500) Salaries and wages payable A. Jamison, capital S. Moyer, capital P. Roper, capital 13,500 27,000 4,000 33,000 21,000 3,000 $101,500 Equipment Accumulated depreciation-equipment $101,500 The partners share income and loss 5:3:2. During the process of liquidation, the following transactions were completed in the following sequence. 1. A total of $51,000 was received from converting noncash assets into cash. 2. Gain or loss on realization was allocated to partners. 3. Liabilities were paid in full. 4. P. Roper paid his capital deficiency. 5. Cash was paid to the partners with credit balances. Instructions (a) Prepare the entries to record the transactions (b) Post to the cash and capital accounts. (c) Assume that Roper is unable to pay the capital deficiency (1) Prepare the entry to allocate Roper's debit balance to Jamison and Moyer (2) Prepare the entry to record the final distribution of cash. P12-2A At the end of its first year of operations on December 31, 2017, NBS Company's accounts show the following. Partner Art Niensted Greg Bolen Krista Sayler Drawings Capital $48,000 30,000 25,000 $23,000 14,000 10,000 The capital balance represents each partners initial capital investment. Therefore, net income or net loss for 2017 has not been closed to the partners' capital accounts. (a) Journalize the entry to record the division of net income for the year 2017 under each (1) Net income is $30,000. Income is shared 6:3:1 (2) Net income is $40,000. Niensted and Bolen are given salary allowances of $15,000 and $10,000, respectively. The remainder is shared equally. Net income is $19,000. Each partner is allowed interest of 10% on beginning capital balances. Niensted is given a $15,000 salary allowance. The remainder is shared equally. (3) (b) Prepare a schedule showing the division of net income under assumption (3) above. (c) Prepare a partners' capital statement for the year under assumption (3) above