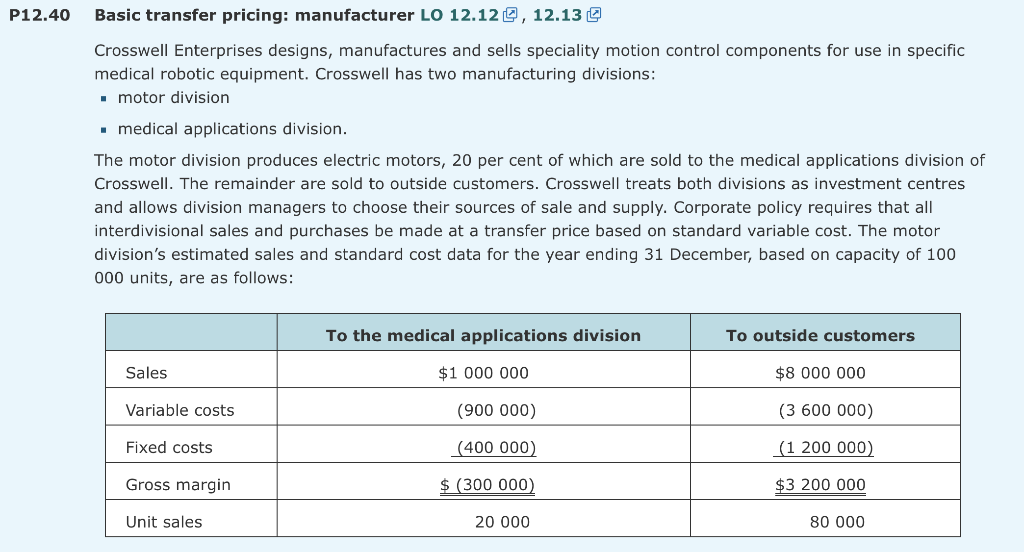

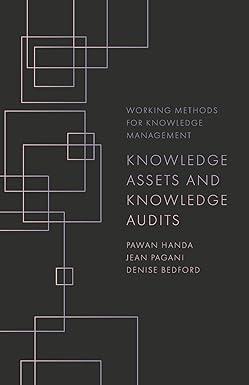

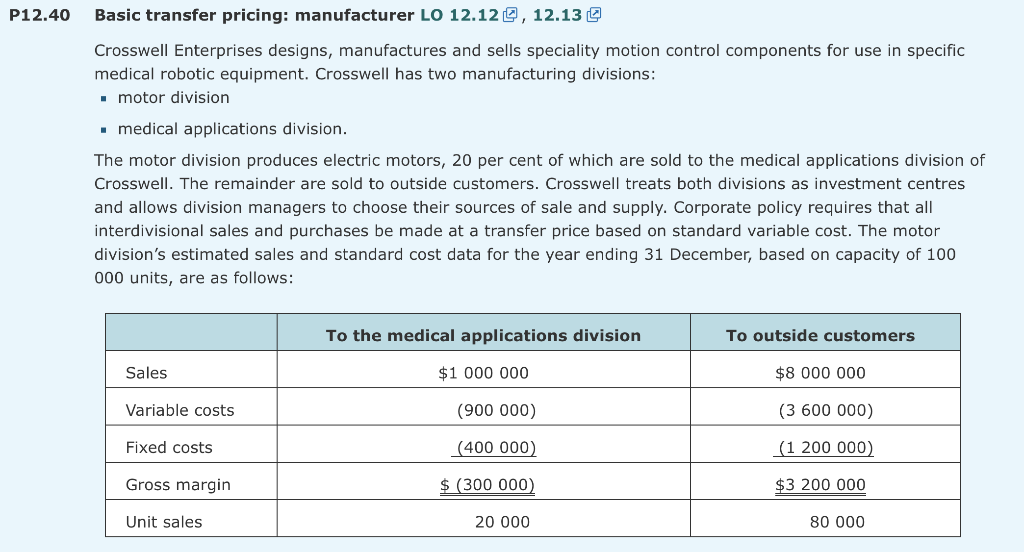

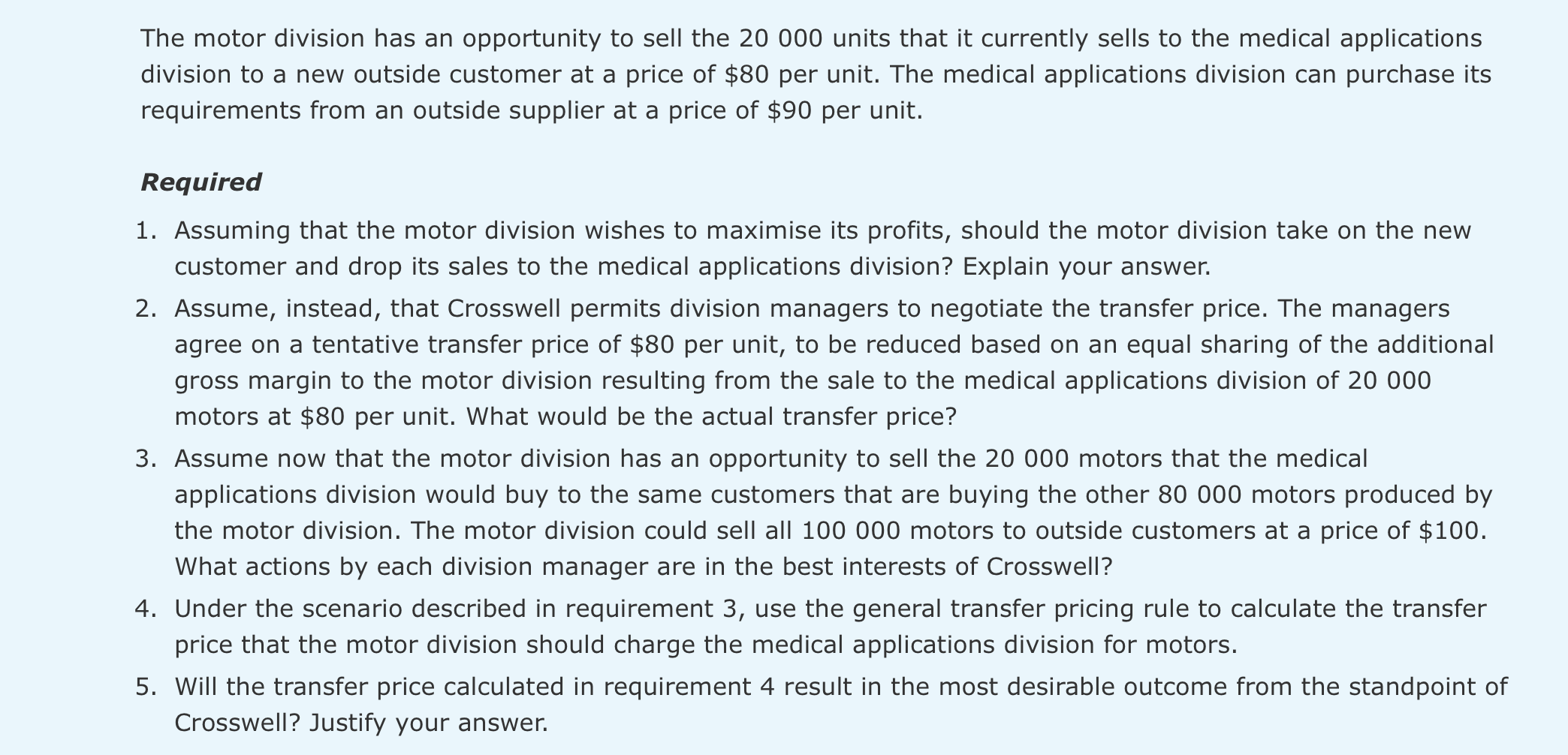

P12.40 Basic transfer pricing: manufacturer LO 12.120, 12.13 @ Crosswell Enterprises designs, manufactures and sells speciality motion control components for use in specific medical robotic equipment. Crosswell has two manufacturing divisions: . motor division medical applications division. The motor division produces electric motors, 20 per cent of which are sold to the medical applications division of Crosswell. The remainder are sold to outside customers. Crosswell treats both divisions as investment centres and allows division managers to choose their sources of sale and supply. Corporate policy requires that all interdivisional sales and purchases be made at a transfer price based on standard variable cost. The motor division's estimated sales and standard cost data for the year ending 31 December, based on capacity of 100 000 units, are as follows: To the medical applications division To outside customers Sales $1 000 000 $8 000 000 Variable costs (900 000) (3 600 000) Fixed costs (400 000) (1 200 000) Gross margin $ (300 000 $3 200 000 Unit sales 20 000 80 000 The motor division has an opportunity to sell the 20 000 units that it currently sells to the medical applications division to a new outside customer at a price of $80 per unit. The medical applications division can purchase its requirements from an outside supplier at a price of $90 per unit. Required 1. Assuming that the motor division wishes to maximise its profits, should the motor division take on the new customer and drop its sales to the medical applications division? Explain your answer. 2. Assume, instead, that Crosswell permits division managers to negotiate the transfer price. The managers agree on a tentative transfer price of $80 per unit, to be reduced based on an equal sharing of the additional gross margin to the motor division resulting from the sale to the medical applications division of 20 000 motors at $80 per unit. What would be the actual transfer price? 3. Assume now that the motor division has an opportunity to sell the 20 000 motors that the medical applications division would buy to the same customers that are buying the other 80 000 motors produced by the motor division. The motor division could sell all 100 000 motors to outside customers at a price of $100. What actions by each division manager are in the best interests of Crosswell? 4. Under the scenario described in requirement 3, use the general transfer pricing rule to calculate the transfer price that the motor division should charge the medical applications division for motors. 5. Will the transfer price calculated in requirement 4 result in the most desirable outcome from the standpoint of Crosswell? Justify your