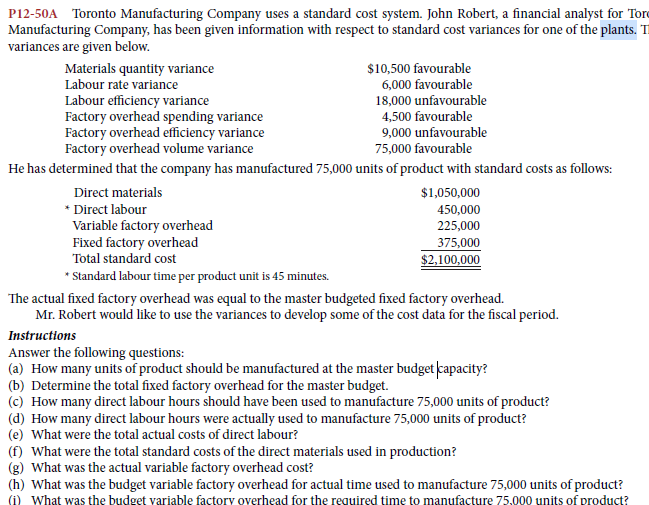

P12-50A Toronto Manufacturing Company uses a standard cost system. John Robert, a financial analyst for Tor Manufacturing Company, has been given information with respect to standard cost variances for one of the plants. T variances are given below. Materials quantity variance $10,500 favourable Labour rate variance 6,000 favourable Labour efficiency variance 18,000 unfavourable Factory overhead spending variance 4,500 favourable Factory overhead efficiency variance 9,000 unfavourable Factory overhead volume variance 75,000 favourable He has determined that the company has manufactured 75,000 units of product with standard costs as follows: Direct materials $1,050,000 * Direct labour 450,000 Variable factory overhead 225,000 Fixed factory overhead 375,000 Total standard cost $2,100,000 * Standard labour time per product unit is 45 minutes. The actual fixed factory overhead was equal to the master budgeted fixed factory overhead. Mr. Robert would like to use the variances to develop some of the cost data for the fiscal period. Instructions Answer the following questions: (a) How many units of product should be manufactured at the master budget capacity? (b) Determine the total fixed factory overhead for the master budget. (c) How many direct labour hours should have been used to manufacture 75,000 units of product? (d) How many direct labour hours were actually used to manufacture 75,000 units of product? (e) What were the total actual costs of direct labour? (f) What were the total standard costs of the direct materials used in production? (g) What was the actual variable factory overhead cost? (h) What was the budget variable factory overhead for actual time used to manufacture 75,000 units of product? (i) What was the budget variable factory overhead for the required time to manufacture 75,000 units of product? P12-50A Toronto Manufacturing Company uses a standard cost system. John Robert, a financial analyst for Tor Manufacturing Company, has been given information with respect to standard cost variances for one of the plants. T variances are given below. Materials quantity variance $10,500 favourable Labour rate variance 6,000 favourable Labour efficiency variance 18,000 unfavourable Factory overhead spending variance 4,500 favourable Factory overhead efficiency variance 9,000 unfavourable Factory overhead volume variance 75,000 favourable He has determined that the company has manufactured 75,000 units of product with standard costs as follows: Direct materials $1,050,000 * Direct labour 450,000 Variable factory overhead 225,000 Fixed factory overhead 375,000 Total standard cost $2,100,000 * Standard labour time per product unit is 45 minutes. The actual fixed factory overhead was equal to the master budgeted fixed factory overhead. Mr. Robert would like to use the variances to develop some of the cost data for the fiscal period. Instructions Answer the following questions: (a) How many units of product should be manufactured at the master budget capacity? (b) Determine the total fixed factory overhead for the master budget. (c) How many direct labour hours should have been used to manufacture 75,000 units of product? (d) How many direct labour hours were actually used to manufacture 75,000 units of product? (e) What were the total actual costs of direct labour? (f) What were the total standard costs of the direct materials used in production? (g) What was the actual variable factory overhead cost? (h) What was the budget variable factory overhead for actual time used to manufacture 75,000 units of product? (i) What was the budget variable factory overhead for the required time to manufacture 75,000 units of product