Answered step by step

Verified Expert Solution

Question

1 Approved Answer

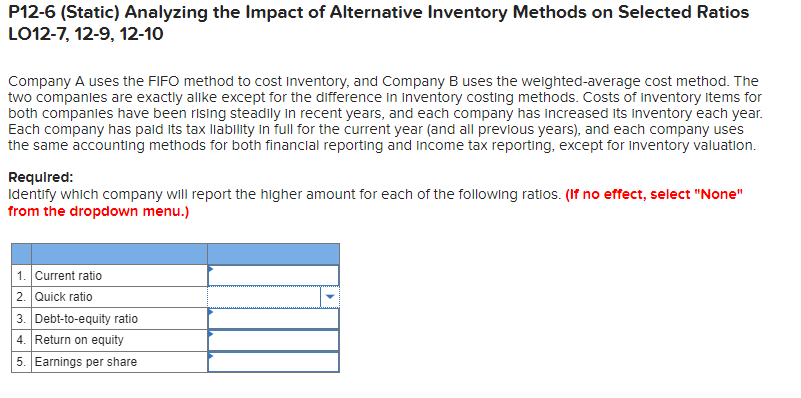

P12-6 (Static) Analyzing the Impact of Alternative Inventory Methods on Selected Ratios LO12-7, 12-9, 12-10 Company A uses the FIFO method to cost Inventory, and

P12-6 (Static) Analyzing the Impact of Alternative Inventory Methods on Selected Ratios LO12-7, 12-9, 12-10 Company A uses the FIFO method to cost Inventory, and Company B uses the weighted-average cost method. The two companles are exactly alike except for the difference in inventory costing methods. Costs of inventory items for both companles have been rising steadily in recent years, and each company has increased its inventory each year. Each company has paid its tax liability in full for the current year (and all previous years), and each company uses the same accounting methods for both financial reporting and Income tax reporting, except for inventory valuation. Required: Identify which company will report the higher amount for each of the following ratios. (If no effect, select "None" from the dropdown menu.) Company A Company B None

P12-6 (Static) Analyzing the Impact of Alternative Inventory Methods on Selected Ratios LO12-7, 12-9, 12-10 Company A uses the FIFO method to cost Inventory, and Company B uses the weighted-average cost method. The two companles are exactly alike except for the difference in inventory costing methods. Costs of inventory items for both companles have been rising steadily in recent years, and each company has increased its inventory each year. Each company has paid its tax liability in full for the current year (and all previous years), and each company uses the same accounting methods for both financial reporting and Income tax reporting, except for inventory valuation. Required: Identify which company will report the higher amount for each of the following ratios. (If no effect, select "None" from the dropdown menu.) Company A Company B None Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started