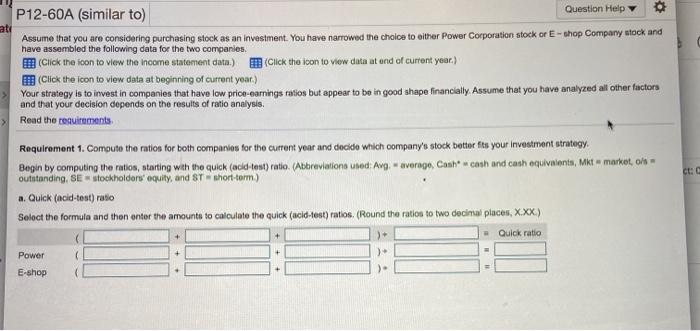

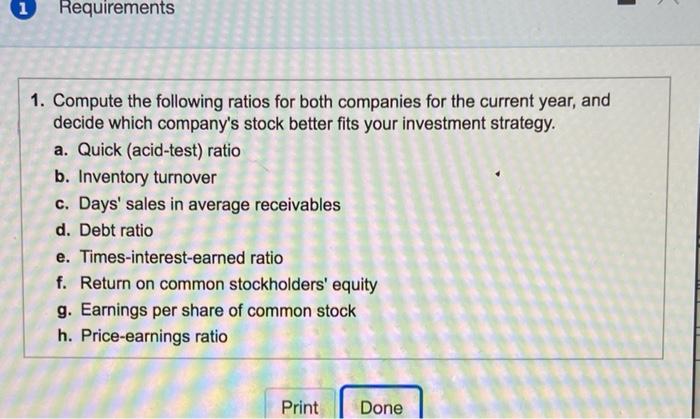

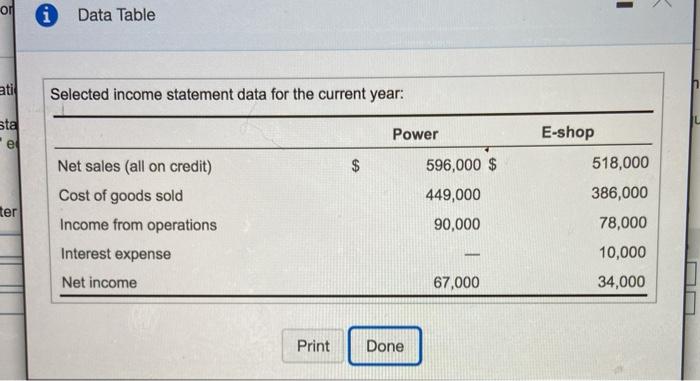

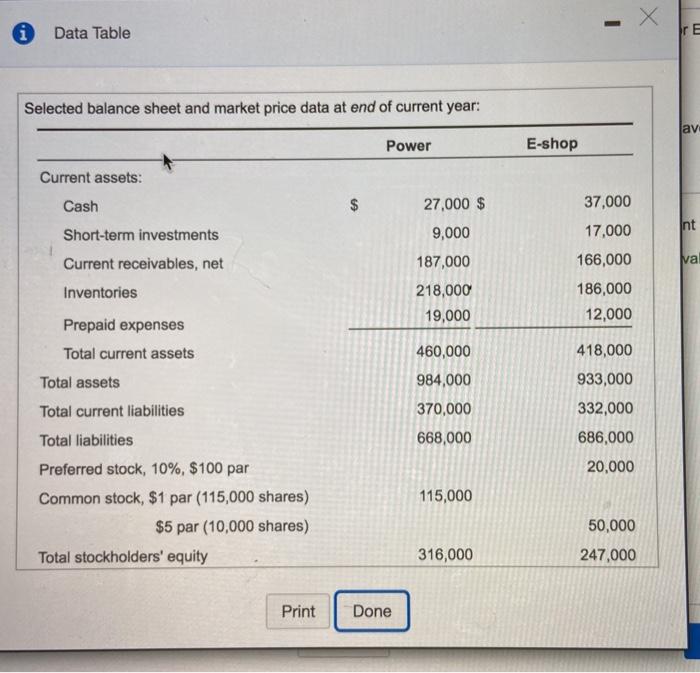

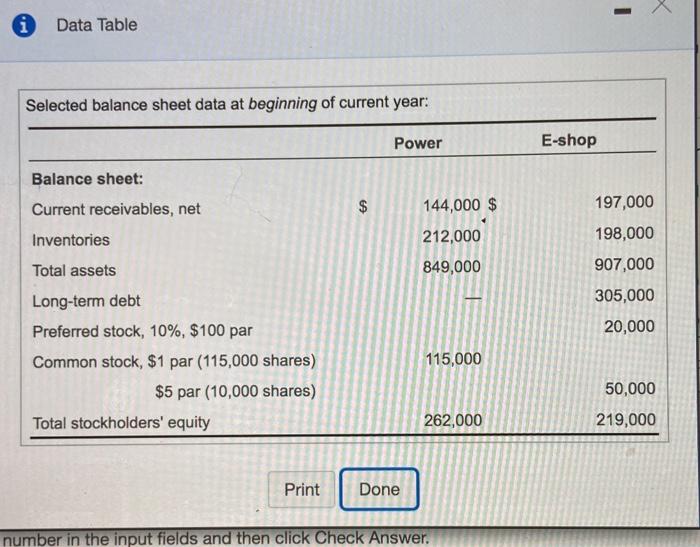

P12-60A (similar to) Question Help aty Assume that you are considering purchasing stock as an investment. You have narrowed the choice to other Power Corporation stock or E-shop Company stock and have assembled the following data for the two companies. Click the foon to view the income statement data.) Click the loon to view data at and of current year) Click the icon to view data at beginning of current year.) Your strategy is to invest in companies that have low price earnings ratios but appear to be in good shape financially. Assume that you have analyzed all other factors and that your decision depends on the results of ratio analysis. Read the requirements Requirement 1. Computo the ration for both companion for the current year and decide which company's stock betur fts your investment strategy Begin by computing the ratios, starting with the quick (acid test) ratio. Abbreviations used Avg. - average, Cash cash and cash equivalents, Mkt market, os outstanding, SE stockholders' equity, and ST short-term) a. Quick (acid-test) ratio Select the formula and then enter the amounts to calculate the quick (acid-test) ratios (Round the ration to two decimal places, X.XX) - Quick ratio CE: + ) Power + ) + ) E-shop 1 Requirements 1. Compute the following ratios for both companies for the current year, and decide which company's stock better fits your investment strategy. a. Quick (acid-test) ratio b. Inventory turnover c. Days' sales in average receivables d. Debt ratio e. Times-interest-earned ratio f. Return on common stockholders' equity g. Earnings per share of common stock h. Price-earnings ratio Print Done oll i Data Table ati Selected income statement data for the current year: sta Power e E-shop 518,000 $ Net sales (all on credit) Cost of goods sold Income from operations 596,000 $ 449,000 90,000 386,000 ter 78,000 Interest expense 10,000 34,000 Net income 67,000 Print Done i Data Table re Selected balance sheet and market price data at end of current year: lav Power E-shop Current assets: Cash $ 27,000 $ 37,000 Int Short-term investments 17,000 Current receivables, net va 9,000 187,000 218,000 19,000 Inventories 166,000 186,000 12,000 Prepaid expenses Total current assets 460,000 Total assets 418,000 933,000 332,000 686,000 984,000 370,000 668,000 Total current liabilities Total liabilities 20,000 115,000 Preferred stock, 10%, $100 par Common stock, $1 par (115,000 shares) $5 par (10,000 shares) Total stockholders' equity 50,000 247,000 316,000 Print Done 1 Data Table Selected balance sheet data at beginning of current year: Power E-shop Balance sheet: Current receivables, net $ 144,000 $ Inventories 212,000 849,000 197,000 198,000 907,000 305,000 20,000 Total assets Long-term debt Preferred stock, 10%, $100 par Common stock, $1 par (115,000 shares) $5 par (10,000 shares) Total stockholders' equity 115,000 50,000 219,000 262,000 Print Done number in the input fields and then click Check