P13-42A - Accounting Homework

From: Horngren's Financial & Managerial Accounting - Sixth Edition

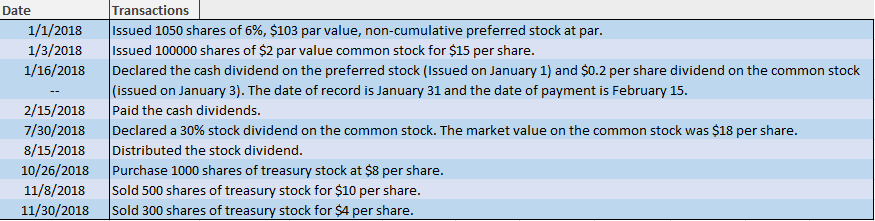

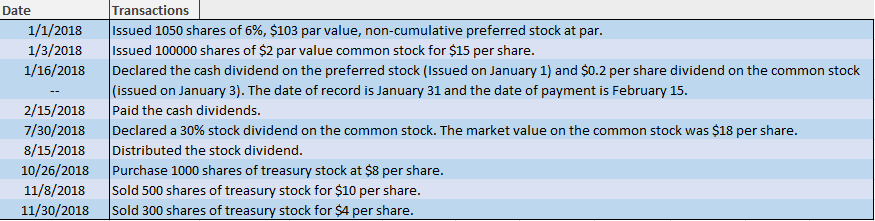

Random Manufacturing Co. completed the transactions related to stockholders equity listed in the transactions section below.

Assignment: Journalize each transaction.

I would appreciate clear and succinct calculations -- showing exactly how to calculate each figure.

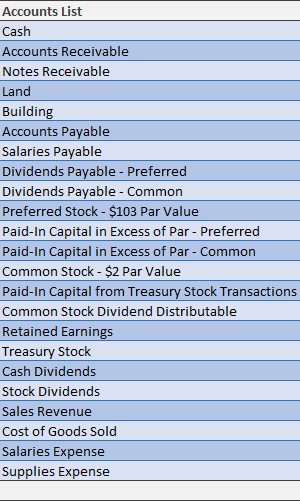

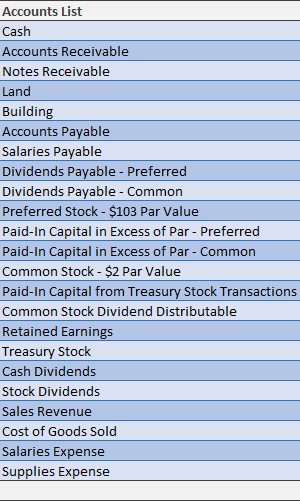

Accounts List :: Please use only the listed accounts

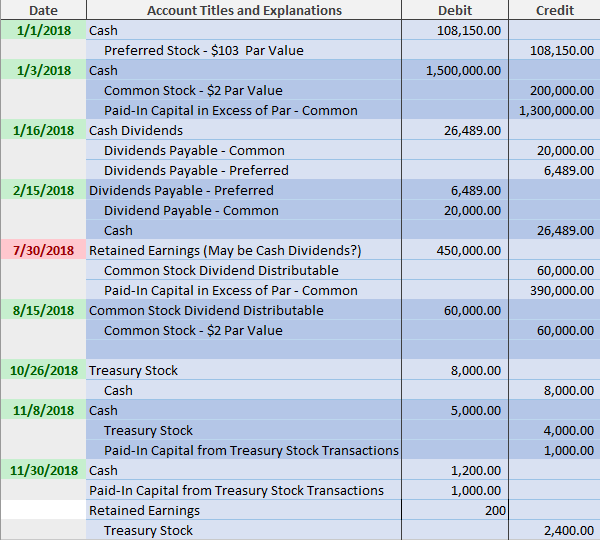

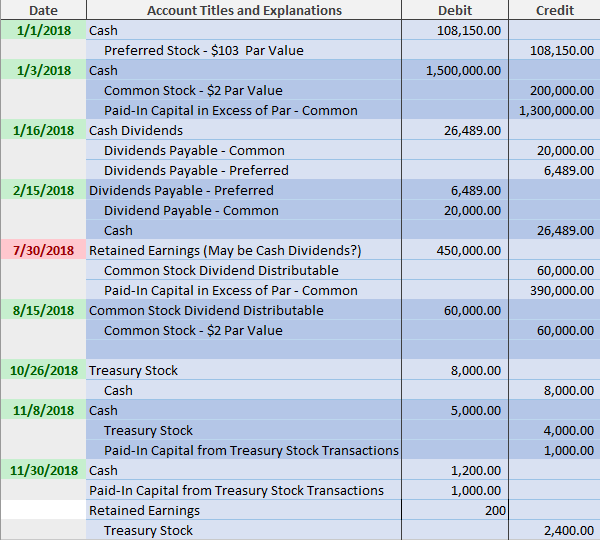

Here is what I have done so far. The items in green are good to go. The one item in red is what I need help with.

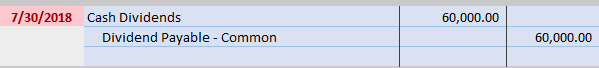

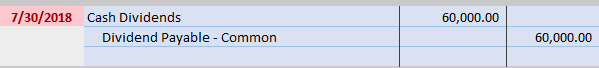

It's the July 30th transaction

Here's what I tried:

Date 1/1/2018 1/3/2018 1/16/2018 2/15/2018 7/30/2018 8/15/2018 10/26/2018 11/8/2018 11/30/2018 Transactions Issued 1050 shares of 6%, $103 par value, non-cumulative preferred stock at par. Issued 100000 shares of $2 par value common stock for $15 per share. Declared the cash dividend on the preferred stock (Issued on January 1) and $0.2 per share dividend on the common stock (issued on January 3). The date of record is January 31 and the date of payment is February 15. Paid the cash dividends. Declared a 30% stock dividend on the common stock. The market value on the common stock was $18 per share. Distributed the stock dividend. Purchase 1000 shares of treasury stock at $8 per share. sold 500 shares of treasury stock for $10 per share. Sold 300 shares of treasury stock for $4 per share. Accounts List Cash Accounts Receivable Notes Receivable Land Building Accounts Payable Salaries Payable Dividends Payable - Preferred Dividends Payable - Common Preferred Stock - $103 Par Value Paid-In Capital in Excess of Par - Preferred Paid-In Capital in Excess of Par - Common Common Stock - $2 Par Value Paid-In Capital from Treasury Stock Transactions Common Stock Dividend Distributable Retained Earnings Treasury Stock Cash Dividends Stock Dividends Sales Revenue Cost of Goods Sold Salaries Expense Supplies Expense Credit Debit 108,150.00 108,150.00 1,500,000.00 200,000.00 1,300,000.00 26,489.00 Date Account Titles and Explanations 1/1/2018 Cash Preferred Stock - $103 Par Value 1/3/2018 Cash Common Stock - $2 Par Value Paid-In Capital in Excess of Par - Common 1/16/2018 Cash Dividends Dividends Payable - Common Dividends Payable - Preferred 2/15/2018 Dividends Payable - Preferred Dividend Payable - Common Cash 7/30/2018 Retained Earnings (May be Cash Dividends?) Common Stock Dividend Distributable Paid-In Capital in Excess of Par - Common 8/15/2018 Common Stock Dividend Distributable Common Stock - $2 Par Value 20,000.00 6,489.00 6,489.00 20,000.00 26,489.00 450,000.00 60,000.00 390,000.00 60,000.00 60,000.00 8,000.00 8,000.00 5,000.00 10/26/2018 Treasury Stock Cash 11/8/2018 Cash Treasury Stock Paid-In Capital from Treasury Stock Transactions 11/30/2018 Cash Paid-In Capital from Treasury Stock Transactions Retained Earnings Treasury Stock 4,000.00 1,000.00 1,200.00 1,000.00 200 2,400.00 7/30/2018 60,000.00 Cash Dividends Dividend Payable - Common 60,000.00