P13.7

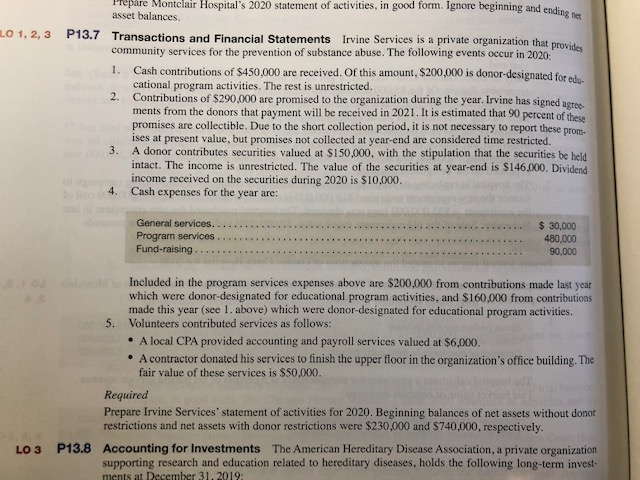

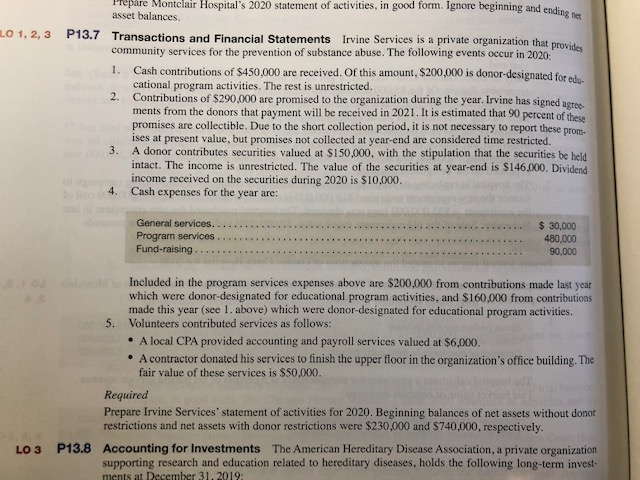

LO 1. 2. 3 P13.7 Prepare Montclair Hospital's 2020 statement of activities, in good form. Ignore beginning and endin asset balances. Transactions and Financial Statements Irvine Services is a private organization that provide community services for the prevention of substance abuse. The following events occur in 2020 1. Cash contributions of $450,000 are received. Of this amount, $200,000 is donor-designated for a cational program activities. The rest is unrestricted. 2. Contributions of $290,000 are promised to the organization during the year. Irvine has signed aer ments from the donors that payment will be received in 2021. It is estimated that 90 percent of these promises are collectible. Due to the short collection period, it is not necessary to report these prom. ises at present value, but promises not collected at year-end are considered time restricted. 3. A donor contributes securities valued at $150,000, with the stipulation that the securities be held intact. The income is unrestricted. The value of the securities at year-end is $146.000. Dividend income received on the securities during 2020 is $10.000. Cash expenses for the year are: . General services........ Program services. Fund-raising ... 480,000 90.000 Included in the program services expenses above are $200.000 from contributions made last yea which were donor-designated for educational program activities, and $160.000 from contributions made this year (see 1. above) which were donor-designated for educational program activities. 5. Volunteers contributed services as follows: A local CPA provided accounting and payroll services valued at $6,000. A contractor donated his services to finish the upper floor in the organization's office building. The fair value of these services is $50,000. Required Prepare Irvine Services' statement of activities for 2020. Beginning balances of net assets without donor restrictions and net assets with donor restrictions were $230,000 and $740,000, respectively. Accounting for Investments The American Hereditary Disease Association, a private organization supporting research and education related to hereditary diseases, holds the following long-term invest- ments at December 31, 2019 LO 3 P13.8 LO 1. 2. 3 P13.7 Prepare Montclair Hospital's 2020 statement of activities, in good form. Ignore beginning and endin asset balances. Transactions and Financial Statements Irvine Services is a private organization that provide community services for the prevention of substance abuse. The following events occur in 2020 1. Cash contributions of $450,000 are received. Of this amount, $200,000 is donor-designated for a cational program activities. The rest is unrestricted. 2. Contributions of $290,000 are promised to the organization during the year. Irvine has signed aer ments from the donors that payment will be received in 2021. It is estimated that 90 percent of these promises are collectible. Due to the short collection period, it is not necessary to report these prom. ises at present value, but promises not collected at year-end are considered time restricted. 3. A donor contributes securities valued at $150,000, with the stipulation that the securities be held intact. The income is unrestricted. The value of the securities at year-end is $146.000. Dividend income received on the securities during 2020 is $10.000. Cash expenses for the year are: . General services........ Program services. Fund-raising ... 480,000 90.000 Included in the program services expenses above are $200.000 from contributions made last yea which were donor-designated for educational program activities, and $160.000 from contributions made this year (see 1. above) which were donor-designated for educational program activities. 5. Volunteers contributed services as follows: A local CPA provided accounting and payroll services valued at $6,000. A contractor donated his services to finish the upper floor in the organization's office building. The fair value of these services is $50,000. Required Prepare Irvine Services' statement of activities for 2020. Beginning balances of net assets without donor restrictions and net assets with donor restrictions were $230,000 and $740,000, respectively. Accounting for Investments The American Hereditary Disease Association, a private organization supporting research and education related to hereditary diseases, holds the following long-term invest- ments at December 31, 2019 LO 3 P13.8