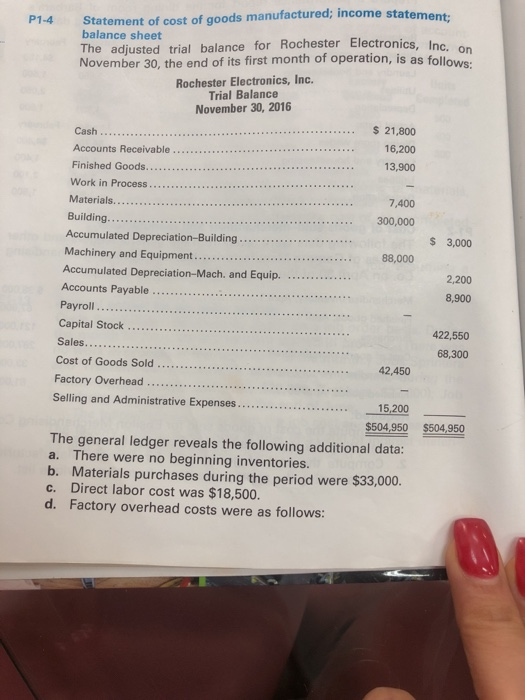

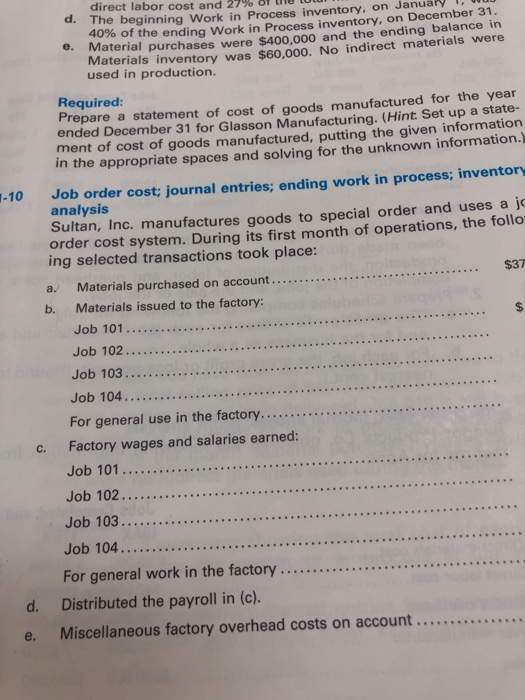

P1-4 balance sheet Statement of cost of goods manufactured; income statement; The adjusted trial balance for Rochester Electronics, Inc. on November 30, the end of its first month of operation, is as follows: Rochester Electronics, Inc. Trial Balance November 30, 2016 $ 21,800 16,200 13,900 7,400 300,000 $ 3,000 88,000 Cash Accounts Receivable Finished Goods. Work in Process Materials. Building. Accumulated Depreciation-Building Machinery and Equipment... Accumulated Depreciation-Mach and Equip. Accounts Payable .. Payroll... Capital Stock Sales.. Cost of Goods Sold Factory Overhead Selling and Administrative Expenses. 2,200 8,900 422,550 68,300 42,450 15,200 $504,950 $504,950 The general ledger reveals the following additional data: a. There were no beginning inventories. b. Materials purchases during the period were $33,000. c. Direct labor cost was $18,500. d. Factory overhead costs were as follows: e. 7-10 $37 a. $ direct labor cost and d. The beginning Work in Process inventory, on Janu 40% of the ending Work in Process inventory, on December 31. Material purchases were $400,000 and the ending balance in Materials inventory was $60,000. No indirect materials were used in production. Required: Prepare a statement of cost of goods manufactured for the year ended December 31 for Glasson Manufacturing. (Hint: Set up a state- ment of cost of goods manufactured, putting the given information in the appropriate spaces and solving for the unknown information. Job order cost; journal entries; ending work in process; inventory analysis Sultan, Inc. manufactures goods to special order and uses a jo order cost system. During its first month of operations, the follo ing selected transactions took place: Materials purchased on account.. b. Materials issued to the factory: Job 101 Job 102 Job 103 Job 104.. For general use in the factory.. Factory wages and salaries earned: Job 101. Job 102.... Job 103..... Job 104..... For general work in the factory .. Distributed the payroll in (c). Miscellaneous factory overhead costs on account.... C. d. e. P1-4 balance sheet Statement of cost of goods manufactured; income statement; The adjusted trial balance for Rochester Electronics, Inc. on November 30, the end of its first month of operation, is as follows: Rochester Electronics, Inc. Trial Balance November 30, 2016 $ 21,800 16,200 13,900 7,400 300,000 $ 3,000 88,000 Cash Accounts Receivable Finished Goods. Work in Process Materials. Building. Accumulated Depreciation-Building Machinery and Equipment... Accumulated Depreciation-Mach and Equip. Accounts Payable .. Payroll... Capital Stock Sales.. Cost of Goods Sold Factory Overhead Selling and Administrative Expenses. 2,200 8,900 422,550 68,300 42,450 15,200 $504,950 $504,950 The general ledger reveals the following additional data: a. There were no beginning inventories. b. Materials purchases during the period were $33,000. c. Direct labor cost was $18,500. d. Factory overhead costs were as follows: e. 7-10 $37 a. $ direct labor cost and d. The beginning Work in Process inventory, on Janu 40% of the ending Work in Process inventory, on December 31. Material purchases were $400,000 and the ending balance in Materials inventory was $60,000. No indirect materials were used in production. Required: Prepare a statement of cost of goods manufactured for the year ended December 31 for Glasson Manufacturing. (Hint: Set up a state- ment of cost of goods manufactured, putting the given information in the appropriate spaces and solving for the unknown information. Job order cost; journal entries; ending work in process; inventory analysis Sultan, Inc. manufactures goods to special order and uses a jo order cost system. During its first month of operations, the follo ing selected transactions took place: Materials purchased on account.. b. Materials issued to the factory: Job 101 Job 102 Job 103 Job 104.. For general use in the factory.. Factory wages and salaries earned: Job 101. Job 102.... Job 103..... Job 104..... For general work in the factory .. Distributed the payroll in (c). Miscellaneous factory overhead costs on account.... C. d. e